Key Events This Week: Payrolls, PMIs, Earnings And More Stimmies

As we enter August and what is set to be a period of higher than normal holiday taking (as traders scramble to hit the beach ahead of the next round of lockdowns), we’ll have to wait until Friday for the main event, which is the July payrolls report but before that we’ll see the release of the July PMIs from around the world (mostly today and Wednesday), a further 150 earnings reports from S&P 500 companies, and 4 monetary policy decisions from G20 central banks, including the Bank of England (Thursday). And, as DB’s Jim Reid reminds us, don’t forget the US infrastructure bill which seems to be making progress in the background after senators agreed text to a bipartisan bill that they hope to vote on this week.

Going through the main highlights of the week ahead in more details, the next few days will be dominated by the build up to Friday’s US employment report. Fed Chair Powell said in his press conference after last week’s Fed meeting that “the labor market has a ways to go”, and that the unemployment rate of 5.9% “understates the shortfall in employment, particularly as participation in the labor market has not moved up from the low rates that have prevailed for most of the past year.” This is actually the last jobs report ahead of Powell’s speech at Jackson Hole later in August, so could be an important one in terms of providing clues on a potential timeline for the Fed’s tapering of asset purchases. In terms of what to expect, DB’s economists are forecasting that nonfarm payrolls will have risen by +1m in July (consensus at 900k), which would be the fastest pace of jobs growth since last August. And in turn, they see that bringing the unemployment rate down to a post-pandemic low of 5.6%. That said, July is a seasonally weak month for hiring so the seasonal adjustment is strong. In a year as unusual as this there is high uncertainty as to what impact the seasonals will actually have. So it’s clear that the margin for error could be high.

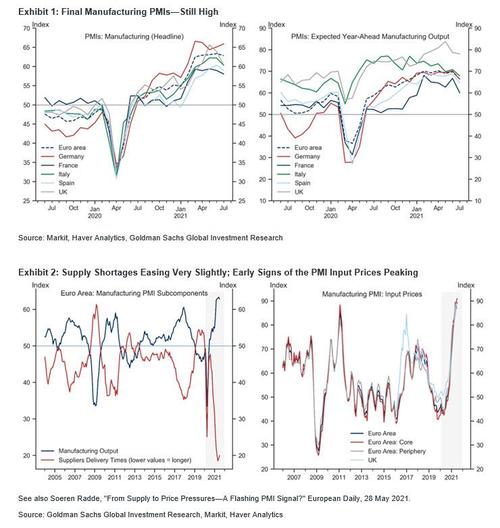

The other main data highlight this week will be the release of the July PMIs from around the world mostly today (manufacturing) and Wednesday (services and composite). The flash numbers we already have showed significant strength, with the Euro Area composite PMI up to a 21-year high of 60.6, whilst the US reading still showed a decent performance at 59.7, even though it’s down somewhat from its recent high.

The Euro area manufacturing PMI for July was revised up by 0.2pt to 62.8, a level moderately below June’s all-time high. The Italian and Spanish manufacturing PMIs both softened by more than expected from last month’s multi-decade highs. In the UK, the manufacturing PMI for July was unrevised at 60.4 in the final release, remaining around 5pt below the May all-time high.

Key numbers:

- Euro Area Manufacturing PMI (Final, July): 62.8, flash 62.6, previous 63.4

- Germany Manufacturing PMI (Final, July): 65.9, flash 65.6, previous 65.1

- France Manufacturing PMI (Final, July): 58.0, flash 58.1, previous 59.0

- Italy Manufacturing PMI (July): 60.3, GS 61.0, consensus 61.5, previous 62.2

- Spain Manufacturing PMI (July): 59.0, GS 59.2, consensus 59.5, previous 60.4

- UK Manufacturing PMI (Final, July): 60.4, flash 60.4, previous 63.9

On the central bank side, the main highlight this week will be the Bank of England’s monetary policy decision on Thursday. DB economists write that they expect there to be no change in the Bank’s policy settings, with Bank rate kept at 0.1% and the QE target maintained at £895bn. With CPI inflation now running at 2.5% and above the BoE’s target, they see the MPC preaching a patient message with regards to the outlook for now, before a more hawkish pivot occurs later this year once there’s further clarity on the state of the economy coming out of the pandemic.

In terms of central bank decisions elsewhere, the Reserve Bank of India is expected to maintain its accommodative monetary policy stance, but the forward guidance is likely to put more emphasis on pipeline inflation risks compared to past policies. Meanwhile at the Reserve Bank of Australia’s meeting the lockdown in Sydney (at significant short-term economic cost) means that they’ll suspend their tapering of bond purchases until November.

On the earnings front, it’s another busy week ahead, with 150 companies in the S&P 500 reporting, along with a further 82 from the STOXX 600, among others. In terms of the highlights to look out for, today we’ll hear from HSBC and Ferrari. Then tomorrow, reports include Eli Lilly, Amgen, FIS, BP, BMW, Alibaba, and Societe Generale. Wednesday sees releases from CVS Health, Booking Holdings, General Motors, Uber and Toyota. Then on Thursday, there’s Novo Nordisk, Expedia, Moderna, Siemens, Zoetis, Merck, Deutsche Post, Adidas, Regeneron, Bayer, Credit Agricole and AIG. Finally on Friday, Allianz will be reporting.

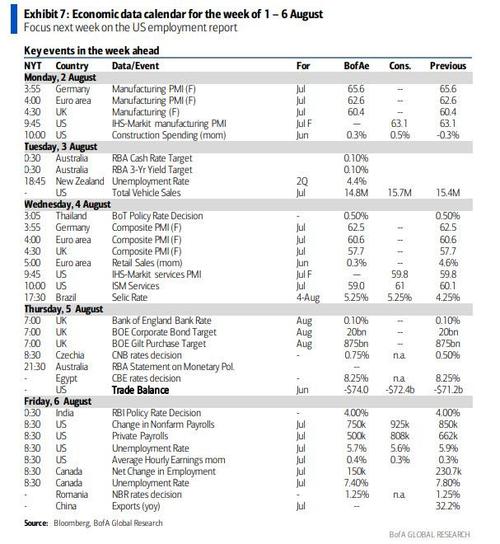

A day-by-day calendar of events, courtesy of DB:

Monday August 2

- Data: July manufacturing PMIs from Australia, South Korea, Indonesia, Japan, China, India, Russia, Turkey, Italy, France, Germany, Euro Area, UK, South Africa, Brazil, US and Mexico, US July ISM manufacturing, June construction spending, Japan July vehicle sales, Germany June retail sales

- Earnings: HSBC, Ferrari

Tuesday August 3

- Data: Japan July monetary base, Euro Area June PPI, Canada July manufacturing PMI, US June factory orders, final June durable goods orders

- Central Banks: Reserve Bank of Australia monetary policy decision, Fed’s Bowman speaks

- Earnings: Eli Lilly, Amgen, FIS, BP, BMW, Alibaba, Societe Generale

Wednesday August 4

- Data: July services and composite PMIs from Australia, Japan, China, India, Russia, Italy, France, Germany, Euro Area, UK, Brazil and US, Euro Area June retail sales, Italy June retail sales, US July ISM services index, ADP employment change

- Central Banks: Central Bank of Brazil monetary policy decision, Fed Vice Chair Clarida speaks

- Earnings: CVS Health, Booking Holdings, General Motors, Uber, Toyota

Thursday August 5

- Data: Germany June factory orders, France June industrial production, July construction PMI from Germany and UK, US June trade balance, weekly initial jobless claims

- Central Banks: Bank of England monetary policy decision, ECB publishes Economic Bulletin, Fed’s Waller speaks

- Earnings: Novo Nordisk, Expedia, Moderna, Siemens, Zoetis, Merck, Deutsche Post, Adidas, Regeneron, Bayer, Credit Agricole, AIG

Friday August 6

- Data: Japan preliminary June leading index, Germany June industrial production, France June trade balance, Italy June industrial production, US July change in nonfarm payrolls, unemployment rate, average hourly earnings, final June wholesale inventories, June consumer credit

- Central Banks: Reserve Bank of India monetary policy decision

- Earnings: Allianz

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing index on Monday, the ISM services index on Wednesday, and the employment report on Friday. There are a few scheduled speaking engagements from Fed officials this week, including a speech on monetary policy by Vice Chair Clarida on Wednesday.

Monday, August 2

- 09:45 AM Markit manufacturing PMI, July final (consensus 63.1, last 63.1)

- 10:00 AM Construction spending, June (GS +1.0%, consensus +0.5%, last -0.3%): We estimate a 1.0% increase in construction spending in June.

- 10:00 AM ISM manufacturing index, June (GS 60.5, consensus 60.9, last 60.6): We estimate that the ISM manufacturing index edged down to 60.5, as the measure is elevated relative to our manufacturing tracker (+1.7 to 59.4 in July).

Tuesday, August 3

- 10:00 AM Factory orders, June (GS +1.0%, consensus +1.0%, last +1.7%); Durable goods orders, June final (consensus +0.8%, last +0.8%); Durable goods orders ex-transportation, June final (last +0.3%); Core capital goods orders, June final (last +0.5%); Core capital goods shipments, June final (last +0.6%): We estimate that factory orders increased by 1.0% in June following a 1.7% increase in May. Durable goods orders increased by 0.8% in the June advance report and core capital goods orders increased by 0.5%.

- 02:00 PM Fed Governor Bowman (FOMC voter) speaks: Fed Governor Michelle Bowman will present opening remarks at a Fed conference on low-income and marginalized workers. Prepared text is expected.

- 05:00 PM Lightweight motor vehicle sales, July (GS 15.2mn, consensus 15.3m, last 15.4m)

Wednesday, August 4

- 08:15 AM ADP employment report, July (GS +550k, consensus +650k, last +692k): We expect a 550k rise in ADP payroll employment for the month of July, following the 692k rise in June. Our forecast reflects strong underlying job gains but a drag from the inputs to the ADP model.

- 09:45 AM Markit services PMI, July final (consensus 59.8, last 59.8)

- 10:00 AM ISM services index, July (GS 59.6, consensus 60.5, last 60.1): We estimate that the ISM services index declined by 0.5pt to 59.6, reflecting a waning demand boost from reopening and its already-elevated level relative to other surveys (GS services tracker +0.6 to 54.9 in July).

- 10:00 AM Fed Vice Chair Clarida (FOMC voter) speaks: Fed Vice Chair Richard Clarida will give a speech on “Outlooks, Outcomes, and Prospects for U.S. Monetary Policy” at a virtual event hosted by the Peterson Institute for International Economics. Prepared text and moderated Q&A are expected.

Thursday, August 5

- 08:30 AM Initial jobless claims, week ended July 31 (GS 385k, consensus 382k, last 400k); Continuing jobless claims, week ended July 24 (consensus 3,260k, last 3,269k); We estimate initial jobless claims declined to 385k in the week ended July 31.

- 08:30 AM Trade Balance, June (GS -$75.6bn, consensus -$74.0bn, last -$71.2bn): We estimate that the trade deficit increased by $4.4bn to $75.6bn in June, reflecting a stronger increase in imports than in exports in the advance goods report.

- 10:00 AM Fed Governor Waller (FOMC voter) speaks: Fed Governor Christopher Waller will discuss central bank digital currencies at a virtual event hosted by the American Enterprise Institute. Prepared text and moderated Q&A are expected.

Friday, August 6

- 08:30 AM Nonfarm payroll employment, July (GS +1,150k, consensus +900k, last +850k), Private payroll employment, July (GS +1,000k, consensus +750k, last +662k), Average hourly earnings (mom), July (GS +0.3%, consensus +0.3%, last +0.3%), Average hourly earnings (yoy), July (GS +3.8%, consensus +3.9%, last +3.6%), Unemployment rate, July (GS 5.5%, consensus 5.7%, last 5.9%): We estimate nonfarm payrolls rose 1,150k in July (mom sa). We believe labor supply constraints eased further due to the wind-down of federal unemployment top-ups in some states and the addition of over 2mn youth job seekers in June and July. Coupled with very strong labor demand and continued progress on vaccinations and reopening, we believe job growth picked up further in the month. We also note little impact on dining activity in response to the Delta variant, including in highly-impacted states. While Big Data employment measures were mixed, continuing jobless claims declined significantly in states that are ending UI top-ups early. We also expect a roughly 150k boost from fewer end-of-year layoffs in the education sector.

- We estimate a four-tenths drop in the unemployment rate to 5.5%, reflecting a strong household employment gain offset by a sizable rise in the participation rate. We estimate a 0.3% rise in average hourly earnings (mom sa, and +3.8% yoy), reflecting some continued wage pressures but mixed calendar effects.

- 10:00 AM Wholesale inventories, June final (consensus +0.8%, last +0.8%)

Source: DB, GS, BofA

Tyler Durden

Mon, 08/02/2021 – 09:54

via ZeroHedge News https://ift.tt/3zSRckW Tyler Durden