Buffett Sells Stock For Third Quarter In A Row, Slows Buyback With Market At All Time High

Over a decade into the biggest metaphorical massacre of value investors by the Federal Reserve (which sadly was also literal in the case of Charles de Vaulx, a renowned value investor and co-founder of International Value Advisors, who in April jumped to his death from a Manhattan skyscraper), people still seem to care what the biggest value investor of them all, Warren Buffett, does. Or at least some people.

To satisfy their curiosity – even as an entire generation of traders no longer cares, or has heard, about the Oracle of Omaha – who turns 91 next month – and instead wants to know which meme stock to short squeeze to generate overnight tendies – this is what Berkshire Hathaway reported earlier this morning when it filed its second quarter 10Q:

- Q2 revenue jumped 22% to $69.1 billion.

- Q2 operating profit – which excludes investment results – rose 21% to $6.69 billion, or about $4,424 per Class A share, from $5.51 billion, or about $3,463 per share, a year earlier; profit declined modestly from the $7.02 billion recorded in Q1, 2021. Profits increased within the company’s railroad, utilities and energy divisions but declined at the company’s vast insurance operations, to wit:

- Railroad, utilities & energy businesses operating earnings $2.26 billion, +28% y/y

- Insurance underwriting operating profit $376 million, -53% y/y

- Insurance float $142 billion, +8.4% y/y

- Q2 net income rose 7% to $28.1 billion, or $18,488 per Class A share, from $26.3 billion, or $16,314 per share.Net income was bolstered by unrealized gains in Apple, Bank of America and American Express Corp, where Berkshire’s investments ended June at $124.3 billion, $42.6 billion and $25.1 billion, respectively. Accounting rules require Berkshire to report the unrealized gains with net results, causing huge swings that Buffett considers meaningless.

The company said that earnings for most of its manufacturing, service and retailing businesses suffered last year as economic activity plunged, job losses soared and shoppers stayed home thanks to the coronavirus pandemic. But over the second half of 2020 and into 2021, many of its businesses have recovered and in some cases, now exceed pre-pandemic levels. As a result, Berkshire said businesses such as the BNSF railroad, NetJets luxury planes and its namesake auto dealerships are posting “significant” recoveries despite supply chain disruptions and higher costs, with earnings and revenue sometimes topping pre-pandemic levels. Another sign of improvement was Berkshire’s decision not to repeat a caution from its previous quarterly report that other operating units still faced adverse effects from the pandemic.

Courtesy of Reuters, here is a more details look at Berkshire’s vast business empire:

- BNSF’s profit surged 34% to $1.52 billion, as retailers replenished inventories to satisfy consumer demand, and demand grew for building products, grain and coal.

- Profit soared 43% at Clayton Homes mobile homes and 129% at Berkshire’s namesake real estate brokerage as more people bought homes in what many have called a new housing bubble. The brokerage is part of Berkshire Hathaway Energy, where tax credits for wind power were among factors that boosted profit 17% to $740 million.

Some other results were less rosy:

- Geico’s pretax underwriting profit fell 70% as people drove more as drivers returned to the road as the U.S. opened up in recent months and crashed more often, with claims frequencies for collisions rising more than 21%.

- At another unit, Berkshire had to shell out $160 million to help contain and respond to a fire at one of chemical maker Lubrizol’s facilities in Rockton, Illinois in June.

- A sore spot remained Precision Castparts, the aircraft and industrial parts maker that in 2020 cut 13,400 jobs and was written down by $9.8 billion as airlines slashed plane orders. Precision’s revenue fell another 9%, and Berkshire said a big rebound is not likely soon because customers have enough parts.

Like many other consumer-facing companies – most notably Clorox which imploded this week after issuing an unprecedented profit margin warning due to a “generational inflation” surge- the conglomerate wasn’t immune to the effects of inflation. Berkshire was confronted with higher costs for some materials hitting businesses such as its operations that deal with home building.

Despite a reputation for often either purchasing companies outright or making direct loans during these types of times in markets, Buffett’s firm has been largely silent for much of the pandemic as the billionaire has lamented the lack of underpriced investment opportunities amid what his fellow iconic investor, Howard Marks has dubbed an “everything bubble.” Berkshire’s biggest deal came in the middle of last year when Berkshire announced an agreement to buy Dominion Energy’s midstream energy business for $9.7 billion including debt. The purchase is typical for Buffett in that Dominion’s stock was in decline and he knows the sector well.

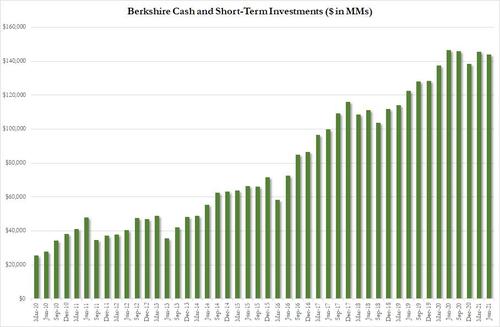

In the latest warning sign of just how overvalued assets are, despite having more than $144 billion of cash at his disposal at June 30, down fractionally from $145.4 billion in cash at the end of the first quarter and not too far off the company’s record has pile hit one year ago, the Berkshire Hathaway CEO ended up taking a step back with his capital deployment during the second quarter.

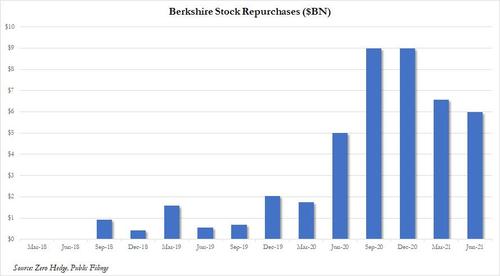

It’s not just other stocks that are overvalued: it appears that Berkshire itself is getting expensive as Buffett repurchased just $6 billion of Berkshire stock, the lowest amount of buybacks since the middle of 2020 (if still the fourth-biggest quarter since Berkshire began buying back more stock in 2018 after previously shunned buybacks in favor of other ways of deploying capital)…

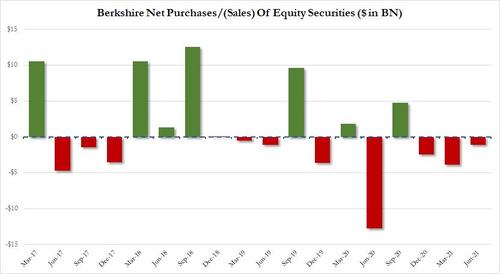

… and was a net seller of other stocks for the third quarter in a row, according to the company’s 10Q.

As Bloomberg notes, Buffett’s been faced with a high-class problem in recent years: Too much cash, and too few opportunities. He’s been under pressure to do a large deal to help supercharge the company’s growth, but has come up short with well-priced and attractive options, leading Berkshire to spend even more funds buying back its stock. But now, he’s in more of a bind. Berkshire stock, already a challenge because of its lack of liquidity, has rallied in recent months and the broader stock market has also become more pricey with the S&P 500 Index climbing to new highs.

“They’re kind of between a rock and a hard place,” Cathy Seifert, an analyst at CFRA Research, told Bloomberg in a phone interview. “Against that backdrop, I think the level of buybacks was prudent and appropriate.”

That said, Berkshire net sales of just $1.1 billion in other stocks was the lowest amount in the past three quarters. Those sales appear to have largely come from a decrease in its group of commercial, industrial and other stocks, according to a regulatory filing Saturday. Berkshire is set to report its specific stock changes in a filing later this month. Berkshire shareholder Tom Russo deemed the move as smart given the overall level of the stock market.

“It’s housekeeping,” Russo, who oversees $10 billion including investments in Berkshire shares at Gardner Russo & Quinn LLC, told Bloomberg. “He’s been willing to do that a lot more. He came in and out of airlines, he’s come in and out of other holdings.”

Still, despite its investing “challenges”, markets rewarded the conglomerate with Berkshire Class A stock up 8.5% during the second quarter, following a nearly 11% gain in the first three months of the year.

Tyler Durden

Sat, 08/07/2021 – 12:34

via ZeroHedge News https://ift.tt/2VpQ9dL Tyler Durden