China Exports, Imports Fall Sequentially, Adding To Slowdown Fears

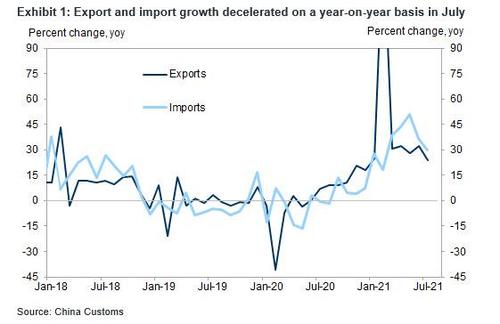

China’s exports rose 19.3% y/y in July, missing the median consensus expectation of 20% (ranging from 15.4% to 30.7%), and declining sequentially -0.3% in July after rising +5.7% in June. Imports also rose less than expected, up 28.1% Y/Y in July, below the 33.3% median expectation, and fell 6.4% sequentially after surging +11.3% M/M in June.

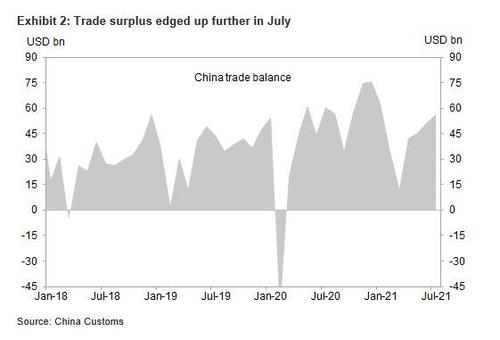

As a result this disproportional slowdown in imports vs exports, China’s monthly trade surplus actually rose to $56.6bn in July, slightly better than the $53.3BN consensus, and up from $51.5BN in June due to the bigger miss in imports.

ASEAN was China’s biggest trading partner in July, followed by the Europe Union and the U.S., customs data showed. China’s exports to the US grew 13.4% in July from a year ago, while imports from America rose 25.6%, leaving a trade surplus of $35.4 billion in the month.

Some more details:

- By geography: Export growth slowed across major export destinations, and exports to major DMs continued to be a drag. Exports to the US decelerated further to 13.4% Y/Y in July vs. 17.8% Y/Y in June, and growth of exports to EU moderated to 17.2% yoy from 27.2% Y/Y in June. Exports to Japan slowed to 12.6% Y/Y from 26.0% Y/Y in June. Among major EMs, export growth to Korea decelerated to 27.9% Y/Y in July vs. 36.4% in June. Exports to ASEAN rose 14.5% Y/Y vs. 33.1% in June. Exports to India also moderated to 31.2% Y/Y n July from 44.3% yoy in June.

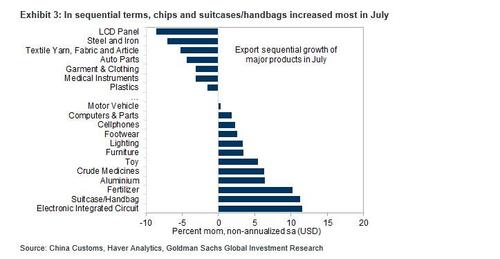

- By major export category: Household appliances exports continued to outpace other major categories and rose 25.8% yoy (vs. 47.3% yoy in June), although growth in furniture exports moderated to +9.3% yoy (vs. 25.3% in June) and lightings rose 11.4% yoy (vs. +22.4% in June). On tech-related products, exports in electronic integrated circuits remained relatively solid and rose 25.5% yoy (vs. 32.1% yoy in June), and LCD panels rose 30.8% yoy in July. In contrast, among consumer electronic products, computers exports rose only 11.5% yoy in July (vs. +13.5% yoy in June) and cellphone exports fell 9.3% yoy, reversing from +11.3% yoy in June. Exports of personal protection related products continued to be a drag in July as global vaccination pace picked up. Export growth of textile & fabric goods contracted 26.8% yoy on a high base and exports of plastic articles fell 1.4% yoy (vs. +11.7% yoy in June).

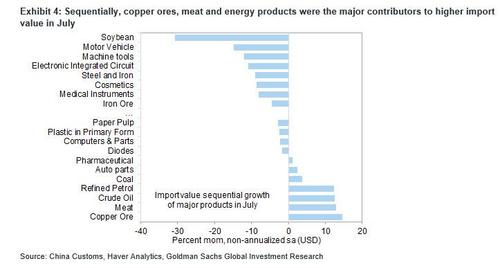

- By major import category: Crude oil imports grew 51.5% yoy, moderating from 62.8% in June, and iron ore imports rose 63.8% yoy in July (vs. 83.3% in June). Import growth of integrated circuits decelerated to 21.0% yoy in July (vs. +31.4% yoy in June). In volume terms, the decline in crude oil imports narrowed slightly to -19.6% yoy from -24.5% yoy in June while iron ore imports fell more sharply by 21.4% yoy (vs. -12.1% yoy in June).

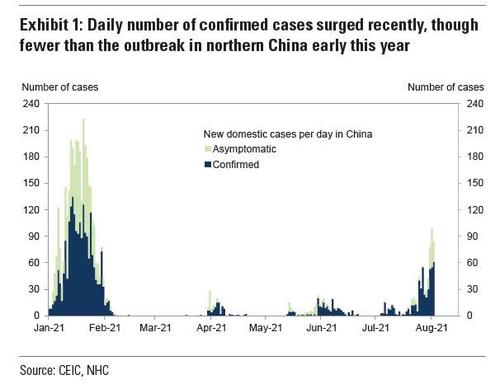

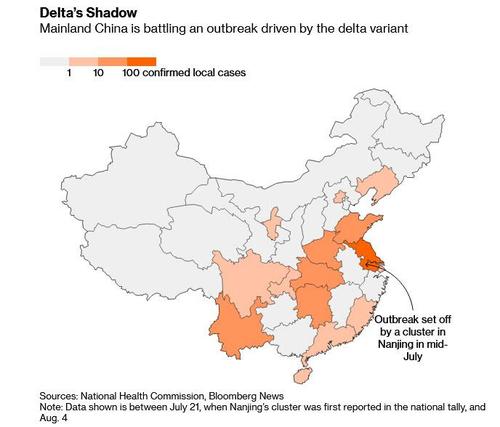

While China’s exports had remained resilient in the first half, as gradual easing of lockdown measures around the world helped to support global demand, trade risks have increased in recent months as the delta variant has spread across China…

… threatening to snarl supply chains across the region and disrupting production and shipping in parts of China, leading to record-high freight costs which have squeezed exporters’ profits. As the map below shows, recent cases have been identified in heavily commercial regions which if left uncontained could lead to even more shipping chaos.

It’s not just covid: according to Goldman, exports and imports both fell sequentially in July partially due to typhoon-related disruptions to the operation of major ports around Yangtze River Delta in late July. While the operations of major ports haven’t been affected by the ongoing local outbreaks so far as Shenzhen ports during the outbreak in June, it’s worth watching out whether intercity traffic restrictions may disrupt exports in August.

Furthermore, surging commodity prices prompted authorities to suspend some exports and consider imposing more tariffs to ensure domestic supplies.

Meanwhile, growth in imports has remained robust, supported by the ongoing recovery in domestic demand and high commodity prices. Imports of commodities including iron ore, crude oil and steel grew in value in the first seven months of the year, but dropped in volume during the same period. Purchases of 25 aircraft in July also helped to support import growth.

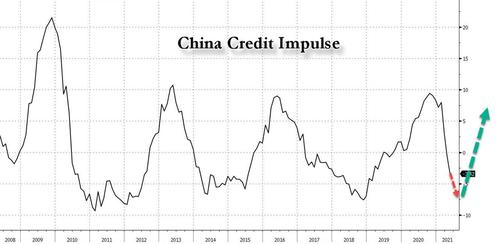

In any case, the slowdown in trade has added to growing concerns about a Chinese slowdown in the second half which has also led to a bottoming in China’s credit impulse as Beijing seeks to inject another substantial dose of credit into the economy.

The latest purchasing managers surveys also showed a contraction in manufacturers’ export orders for a third consecutive month in July. Officials have also warned of a slowdown in trade growth in the second half, with a higher base of comparison from a year ago also a likely factor.

“Leading indicators suggest export may weaken in coming months,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management. “Exports and the Covid outbreak are the main sources of uncertainty in China for the next few months.”

In the face of rising growth risks, China’s top leaders have signaled more targeted support for the economy. According to Bloomberg, authorities will likely take more steps to help struggling small businesses, boost fiscal spending and possibly reduce the reserve requirement ratio for banks again, economists said after a meeting of the Chinese Communist Party’s elite Politburo chaired by President Xi Jinpinglast month.

Tyler Durden

Sat, 08/07/2021 – 10:41

via ZeroHedge News https://ift.tt/2X0Hsa1 Tyler Durden