“It’s Magical Thinking” – Most Law Degrees Are No Longer Worth The Tuition

A few weeks ago, the Wall Street Journal published a report about overpriced masters’ degree programs offered by Ivy League Universities and other top-ranked private colleges that often left graduates “financially hobbled for life”. The story appeared to resonate, and was one of the most popular stories on the WSJ website for days after its publication, while sparking discussion on social media, as many chimed in with similar personal experiences.

Schools like Columbia (one of the worst offenders, according to WSJ) have been churning out MFAs and Masters in Fine Arts degrees at a surprisingly rapid pace given the paucity of well-paying jobs in those fields. Ultimately, the story showed the government was partly culpable, as no-limit loans for masters’ degrees helped create the incentives for schools to make useless masters’ degrees part of the higher education boom.

One student, who earned a Masters in Fine Arts from Columbia in 2018, described having “2 a.m. panic attacks where you’re thinking, ‘How the hell am I going to pay this off?'” While we sympathize with the student, we can’t help but wonder what was going through his mind when he signed up for the program. In many cases, the classes are stocked with the children of wealthy parents, who happily foot their rent and tuition (while letting them carrying around daddy’s credit card).

Of course, it’s one think to go broke after taking out a quarter of a million dollars in loans for your MFA. It’s quite another when the ‘worthless degree’ you shelled out for is a law degree, or an MBA. At least the students who enrolled in those programs had a reasonable expectation that they might find work in their chosen field after graduation.

But as the old saying goes, “lawyers are a dime a dozen”, and for students of non-target law schools, the time has come to ask: was this degree really worth it?

As WSJ begins, “law school was once considered a surefire ticket to a comfortable life. Years of tuition increases have made it a fast way to get buried in debt.” One professor quoted in the story said law schools “foster this kind of cruel optimism” in students, letting them think six figure salaries are attainable when in reality, those high-paying jobs are largely reserved for students at only the top-ranked law schools. Law schools encourage a kind of ‘magical thinking’ to keep the lights on.”

We suspect the situation is probably similar for students who graduate from non-target MBA programs: stories abound of students shelling out a quarter of a million dollars to get degrees at Fordham, or even NYU, and coming out making less than many graduates of top ranked schools who have only undergraduate degrees.

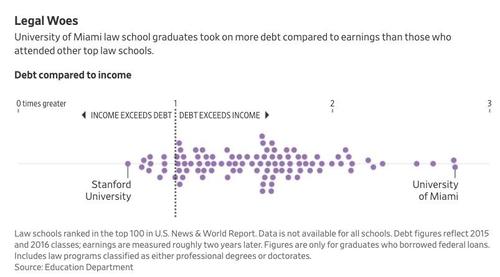

One of the schools featured in the WSJ report was the Unversity of Miami Law School, once of the most expensive in the country. Federal data show the value of law degrees from non-elite schools has fallen substantially. Salaries haven’t kept pace with inflation over the past 20 years, while tuition has soared. A thre-year JD program including living expenses, costs more than $250K now.

Source: WSJ

Meanwhile, law school graduates earn a median $72.5K the year after graduation, according to the National Association for Law Placement. That means half of them earn less than that.

The end result of all this is that ‘graduate degree debt’ has emerged as a trouble spot in the modern economy.

In fact, the only way to practically guarantee that law school will pay off is by attending one of the country’s top law schools. Out of roughly 200 law programs, only a dozen of the country’s top schools leave students earning salaries two years after graduation.

At UMiami’s law school, tuition and fees have risen by 43%, to $57K for the coming school year, according to the ABA. That’s more than double the rate of inflation. The result is that students graduate and can only afford the minimum payment on their loans (unless they have help from parents). For those who don’t, they’re essentially condemned to decades of having their income garnished by a debt that will have swollen by more than 100% over the duration of the loan.

Laura Cordell, a 2019 graduate, said she chose Miami for the prestige, particularly within Florida. “You go to any courthouse in Miami and the judge went to UM, the judge is a teacher at UM, there’s some sort of connection to UM,” she said.

“When I was looking for law schools, I wasn’t looking at price as much as what would be good for my career,” said Ms. Cordell, 30 years old, who said she turned down another school that offered her a large scholarship. “I didn’t have an understanding of the gravity of the amount I was borrowing.”

Ms. Cordell owes $334,000 in federal loans for her time at Miami. She now makes an $80,000 base salary, with a bonus of about $12,000, working at a firm that specializes in insurance. Because her debt load is so high, she said, she can’t afford more than the minimum payment on an income-driven plan, which sets her monthly payments according to her income.

Why is that UMiami can get away with raising tuition, even though wages for its graduates are stagnating? The answer is government-backed loans: Schools know graduates can tap the government’s Grad Plus loan program, which permits borrowing for whatever the cost of tuition, fees plus living expenses. It’s still the fastest growing federal student loan program, even as law school enrollment dropped substantially after the financial crisis.

Tyler Durden

Fri, 08/06/2021 – 23:20

via ZeroHedge News https://ift.tt/3jMXhsT Tyler Durden