Crypto & Tech Stocks Soar As ‘Soft’ Data Slumps To 18-Month Lows

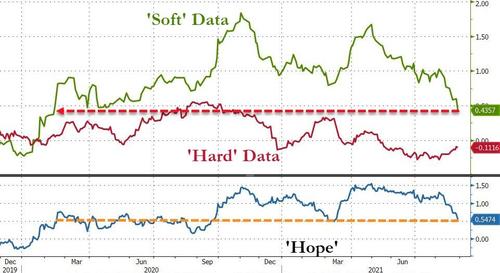

‘Hope’ – as measured by the spread between ‘soft’ survey data and ‘hard’ real economic data – has slumped to its lowest since Feb 2020 as today’s Dallas Fed survey’s collapse confirming the recent trend of ‘soft’ survey data puking as the stimmies run dry…

Source: Bloomberg

Or put another way…

But, it appears that big-tech investors “Can handle the truth…” while Small Cap buyers can’t… The Dow ended marginally lower and S&P was weaker into the close but managed gains…

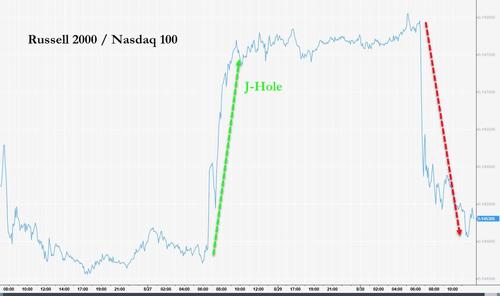

NOTE – once again all the ignition occurred at the cash open.

Small Caps reversed all their J-Hole-driven gains from Friday relative to Nasdaq…

Growth stocks dramatically outperformed Value today…

Source: Bloomberg

Big drop in MRNA today after a series of ugly headlines over contaminants…

And HOOD (and Schwab etc) was monkeyhammered on PayPal brokerage chatter and SEC ‘Payment for Order Flow’ headlines…

VIX was hammered back down to a 15 handle again today…

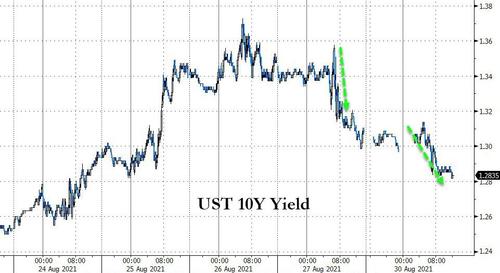

Bonds were bid (down around 2-3bps across the curve today) alongside big-tech with yields extending their drop from Friday’s J-Hole speech…

Source: Bloomberg

The dollar trod water after getting clubbed like a baby seal on Friday…

Source: Bloomberg

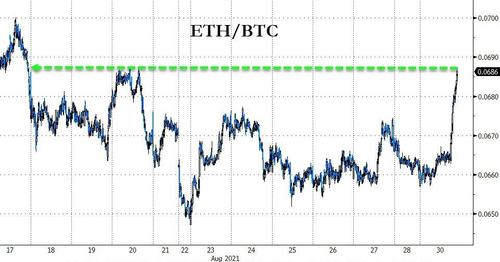

Crypto rallied back today from some weakness with ETH significantly outperforming…

Source: Bloomberg

…breaking out to two-week highs relative to BTC today…

Source: Bloomberg

Gold gave back some of Friday’s gains, but remained above $1800…

Oil traders bought the f**king dip today as WTI managed a v-shaped recovery from overnight losses…

Finally, The Hindenburg Omen remains in play…

Source: Bloomberg

“Valuations” ain’t cheap…

Source: Bloomberg

And the ghost of 1987 is looming…

Source: Bloomberg

Tyler Durden

Mon, 08/30/2021 – 16:00

via ZeroHedge News https://ift.tt/2WHNtIO Tyler Durden