Stocks End Seven Straight Months Of Gains With A Whimper

On the last day of a stellar August for stocks, a month which saw 12 all time highs in a year where stocks have already hit new records no less than 53 times, investors were wondering if we would see a lucky 13 on the last day of the month, and while stocks pushed sharply higher overnight, they failed to maintain the momentum into the close, which saw the Emini close just fractionally in the red – despite a another ramp in the last minute of trading – as the now traditional leadership from the Nasdaq was missing following lackluster performance from the FAAMGs.

In a day that may have seen up to $13 billion in pension month-end selling, the broader market suffered from weakness across bank shares after Bloomberg reported that Wells Fargo would face fresh regulatory action over the pace of “restitution” did not help, with Wells stock tumbling more than 5% and dragging the broader bank sector lower…

… after banks were the best performing sector early in the day thanks to the rise in yields. In fact, by the close, most sectors were in the red with the exception of the Russell/small caps…

… which benefited from the move higher in yields.

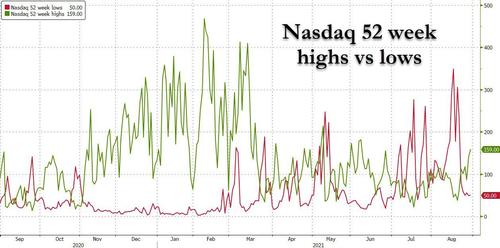

Breadth was, as usual horrible, with just 159 new highs on the Nasdaq which however was a modest improvement to recent weeks when just the 5 FAAMGs did all the heavy lifting. This was offset by 50 new lows, a drop from the 300+ observed just a week earlier.

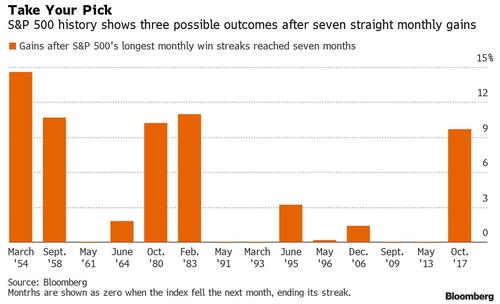

Despite today’s flat move, US stocks still headed toward their seventh straight monthly advance – the longest winning streak since January 2018 which ended with the infamous Volmageddon that sent the VIX explosively higher – thanks to a tidal wave of central bank liquidity.

But while stocks had a great month, nothing compares to the rally enjoyed by cryptoswhich have soared higher blowing away returns of all other asset classes.

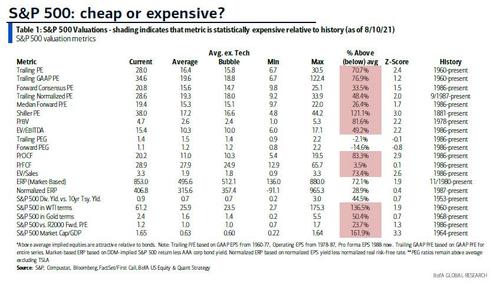

Meanwhile, as the tapering debate heats up at a time when a coronavirus resurgence is delaying reopenings in some parts of the world, there’s been concern about an overstretched stock market – as Bloomberg notes, and as regular readers know too well, the S&P 500 is currently trading near its highest valuation levels since 2000, in fact according to BofA, stocks are now overvalued according to 18 of 20 metrics.

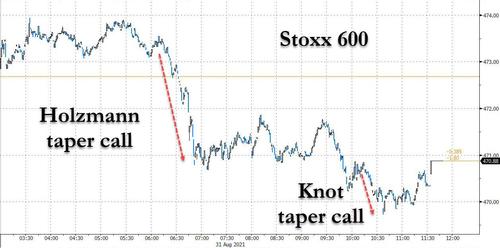

While US stocks were flat, Europe closed near session lows after not one but two ECB officials said it’s time to start discussing the ECB’s own taper…

… a development which sent both Bund and Treasury yields sharply higher.

“Markets are taking a little bit of a breather,” said Cliff Hodge, chief investment officer at Cornerstone Wealth. After making it through strong economic data and stellar corporate earnings, “markets are now trying to grapple with: well, what’s next?”

What does happen next? According to Bloomberg, fourteen streaks of seven months or longer for the S&P 500 have occurred during the past 60 years, with history pointing to three outcomes for the gauge after reaching such milestones: five of them ended in the next month as the index fell. Another four were followed by gains of no more than 3.2% before the streaks ended. The other five delivered advances of 9.7% or more before they concluded — including the most recent streak, which lasted 10 months and ran through January 2018 and ended quite painfully for holders of inverse VIX ETFs.

Paradoxically, while one would expect record highs in the market to bring out insider sllers, corporate insiders, whose buying correctly signaled the bear-market bottom in March 2020, are chasing the record-setting rally with more than 1,000 executives and officers have snapped up shares of their own firms this month — the most since May of last year.

In short, with the S&P at all time highs, everyone is now all in.

Tyler Durden

Tue, 08/31/2021 – 16:06

via ZeroHedge News https://ift.tt/3yy3zld Tyler Durden