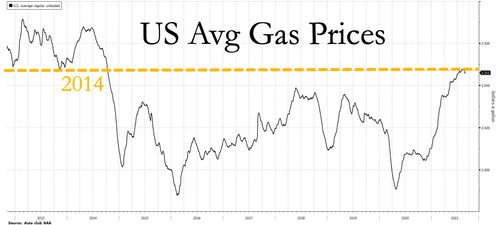

Traveling By Car For Labor Day? Expect To Pay Highest Prices In Seven Years

It’s the end of summer, and millions of Americans are about to pay the highest gas prices since 2014, thanks to Hurricane Ida’s blow to the oil industry in Louisiana.

Patrick De Haan, head of petroleum analysis for GasBuddy, a fuel-savings app, warned in a tweet that “many refineries in Louisiana all citing the same thing- extended downtime possible, power being the biggest burden at this time.”

Haan said some refiners are down due to widespread power outages or the lack of nitrogen supply which is crucial for the refining process.

To help with developing fuel shortages, the Environmental Protection Agency (EPA) issued emergency fuel waivers for Louisiana and Mississippi. Reid Vapor Pressure (RVP) waivers help increase the fuel supply by allowing other types of fuels with different standards in affected areas. These temporary waivers help guarantee that an adequate supply of fuel is available.

… and maybe shortages have already begun, according to Haan?

Sources indicate that $XOM in Baton Rouge is out of diesel completely and that allocations are ongoing for gasoline. I really hope that the region sees some diesel incoming.

— Patrick De Haan ⛽️📊 (@GasBuddyGuy) August 31, 2021

What’s essential is that Colonial Pipeline, the largest U.S. fuel pipeline, has been working to return gasoline and diesel to its lines that stretch from Texas to the Northeast.

Regional gasoline prices have soared, the American Automotive Association said. Also, national prices will be 90 cents higher per gallon than they were for Labor Day last year.

“To close out a summer driving season that will inevitably have had the highest average gas prices since the summer of 2014, Labor Day weekend prices at the pump are expected to be the highest in seven years at $3.11 per gallon,” according to GasBuddy.

So at what price point will demand destruction be reached when consumers can’t afford to travel?

Ontop of elevated fuel prices, consumer are paying much higher prices at the supermarket.

The point here is that inflation is becoming sticky, and the Federal Reserve’s narrative of “transitory” is beginning to lose credibility.

Tyler Durden

Tue, 08/31/2021 – 09:55

via ZeroHedge News https://ift.tt/3zB3cIa Tyler Durden