Key Events This Busy Week: Core PCE, ISM, Fed Speakers Galore And Government Shutdown

With 10Y yields briefly spiking above 1.50% this morning, Deutsche Bank’s Jim Reid writes that one factor that will greatly influence yields over the week ahead is the ongoing US debt ceiling / government shutdown / infrastructure bill saga that is coming to a head as we hit October on Friday – the day that there could be a partial government shutdown without action by the close on Thursday. Needless to say, it’s a fluid situation. So far the the House of Representatives has passed a measure that would keep the government funded through December 3, but it also includes a debt ceiling suspension, so Republicans are expected to block this in the Senate if it still includes that.

The coming week could also see the House of Representatives vote on the bipartisan infrastructure bill (c.$550bn) that’s already gone through the Senate, since Speaker Pelosi had previously committed to moderate House Democrats that there’d be a vote on the measure by today. She reaffirmed that yesterday although the timing may slip. However, there remain divisions among House Democrats, with some progressives not willing to support it unless the reconciliation bill also passes.

In short it remains unclear how this get resolved but most think some compromise will be reached before Friday. Pelosi yesterday said it “seems self-evident” that the reconciliation bill won’t reach the $3.5 trillion hoped for by the administration which hints at some compromise. Overall the sentiment has seemingly shifted a little more positively on there being some progress over the weekend.

From politics to central banks and following a busy week of policy meetings, there are an array of speakers over the week ahead. One of the biggest highlights will be the ECB’s Forum on Central Banking, which is taking place as an online event on Tuesday and Wednesday, and the final policy panel on Wednesday will include Fed Chair Powell, ECB President Lagarde, BoE Governor Bailey and BoJ Governor Kuroda. Otherwise, Fed Chair Powell will also be testifying before the Senate Banking Committee on Tuesday, alongside Treasury Secretary Yellen, and on Monday, ECB President Lagarde will be appearing before the European Parliament’s Committee on Economic and Monetary Affairs as part of the regular Monetary Dialogue. There are lots of other Fed speakers this week and they can add nuances to the taper and dot plot debates.

Finally on the data front, there’ll be further clues about the state of inflation across the key economies, as the Euro Area flash CPI estimate for September is coming out on Friday. Last month’s reading showed that Euro Area inflation rose to +3.0% in August, which was its highest level in nearly a decade. Otherwise, there’s also the manufacturing PMIs from around the world on Friday given it’s the start of the month, along with the ISM reading from the US, and Tuesday will see the release of the Conference Board’s consumer confidence reading for the US as well. For the rest of the week ahead see the day-by-day calendar of events at the end.

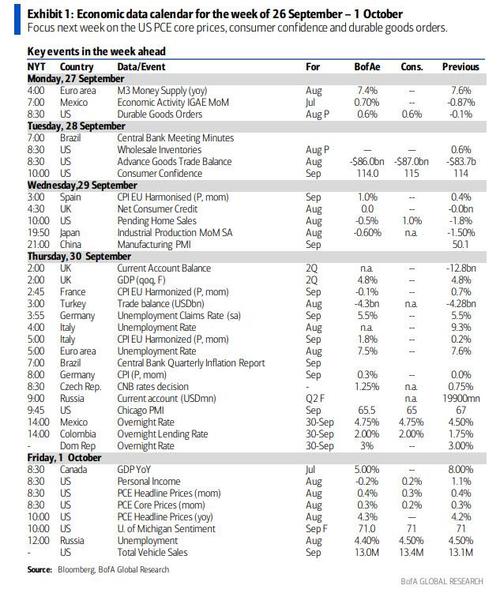

Here is a day-by-day calendar of events, courtesy of Deutsche Bank:

Monday September 27

- Data: Euro Area August M3 money supply, US preliminary August durable goods orders, core capital goods orders, September Dallas Fed manufacturing activity

- Central Banks: ECB President Lagarde, BoE Governor Bailey, and Fed’s Williams, Brainard and Evans speak

Tuesday September 28

- Data: China August industrial profits, Germany October GfK consumer confidence, France September consumer confidence, US preliminary August wholesale inventories, July FHFA house price index, September Conference Board consumer confidence, Richmond Fed manufacturing index

- Central Banks: ECB President Lagarde, Vice President de Guindos, ECB’s Schnabel and Panetta, Fed’s Evans, Bostic and BoE’s Mann speak, Fed Chair Powell appears alongside Treasury Secretary Yellen before Senate Banking Committee

Wednesday September 29

- Data: UK August mortgage approvals, Euro Area final September consumer confidence, US August pending home sales

- Central Banks: Fed Chair Powell, ECB President Lagarde, BoJ Governor Kuroda and BoE Governor Bailey speak on policy panel at ECB Forum on Central Banking, Fed’s Bostic, ECB Vice President de Guindos, ECB’s Elderso, Lane and Visco speak, Fed’s Bullard speaks (00:00 London time)

- Politics: Japan’s Liberal Democratic Party leadership election

Thursday September 30

- Data: Japan August retail sales, preliminary August industrial production, China September non-manufacturing PMI, manufacturing PMI, composite PMI, UK final Q2 GDP, preliminary September CPI from France, Germany and Italy, Germany September unemployment change, Italy August unemployment rate, Euro Area August unemployment rate, US weekly initial jobless claims, third estimate Q2 GDP, September MNI Chicago PMI

- Central Banks: Fed’s Williams, Bostic, Evans, Bullard and Harker speak, Central Bank of Mexico monetary policy decision

- Politics: US Government funding runs out (at time of writing)

Friday October 1

- Data: September manufacturing PMIs from Australia, South Korea, Indonesia, Japan, India, Russia, Turkey, Italy, France, Germany, Euro Area, UK, South Africa, Brazil, Canada, US and Mexico, US September ISM manufacturing, August personal income, personal spending, final September University of Michigan consumer sentiment index, Japan August jobless rate, Euro Area September CPI flash estimate, Canada July GDP

- Central Banks: Fed’s Harker and Mester, and ECB’s Schnabel speak

* * *

Turning to just the US, Goldman writes that the key economic data releases this week are the durable goods report on Monday and the core PCE inflation and ISM manufacturing reports on Friday. There are many speaking engagements from Fed officials this week, including congressional testimony by Chair Powell on Tuesday and possibly on Thursday.

Monday, September 27

- 08:00 AM Chicago Fed President Evans (FOMC voter) speaks; Chicago Fed President Charles Evans will speak at the NABE annual meeting.

- 8:30 AM Durable goods orders, August preliminary (GS +1.5%, consensus +0.6%, last -0.1%); Durable goods orders ex-transportation, August preliminary (GS +0.3%, consensus +0.5%, last +0.8%); Core capital goods orders, August preliminary (GS +0.3%, consensus +0.4%, last +0.1%); Core capital goods shipments, August preliminary (GS +0.3%, consensus +0.5%, last +0.9%): We estimate durable goods rose 1.5% in the preliminary August report, reflecting a rebound in commercial aircraft orders. We estimate more modest increases in core capital goods orders (+0.3%) and core capital goods shipments (+0.3%), reflecting supply chain disruptions and a drag from the covid resurgence abroad.

- 09:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will make opening and closing remarks at a conference on culture hosted by his bank.

- 12:00 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will discuss the economic outlook before the Economic Club of New York. Prepared text and Moderated Q&A are expected.

- 12:50 PM Fed Governor Brainard (FOMC voter) speaks: Fed Governor Lael Brainard will discuss the economic outlook at the annual NABE meeting. Prepared text and Moderated Q&A are expected.

Tuesday, September 28

- 08:30 AM Advance goods trade balance, August (GS -$89.0bn, consensus -$87.3bn, last -$86.4bn); We estimate that the goods trade deficit increased by $2.6bn to $89.0bn in August compared to the final July report, reflecting strengthening imports.

- 08:30 AM Wholesale inventories, August preliminary (consensus +0.8%, last +0.6%); Retail inventories, August (consensus +0.4%, last +0.4%)

- 09:00 AM FHFA house price index, July (consensus +1.5%, last +1.6%)

- 09:00 AM S&P/Case-Shiller 20-city home price index, July (GS +1.7%, consensus +1.6%, last +1.77%); We estimate the S&P/Case-Shiller 20-city home price index rose by 1.7% in July, following a 1.77% increase in June.

- 09:00 AM Chicago Fed President Evans (FOMC voter) speaks: Chicago Fed President Charles Evans will give welcoming remarks at a payments system conference hosted by his bank.

- 10:00 AM Conference Board consumer confidence, September (GS 115.5 consensus 115.0, last 113.8): We estimate that the Conference Board consumer confidence index increased by 1.7pt to 115.5 in September. Our forecast reflects mixed signals from other consumer confidence measures and modest improvements in the virus situation.

- 10:00 AM Richmond Fed manufacturing index, September (consensus 10, last 9)

- 10:00 AM Fed Chair Powell (FOMC voter) speaks: Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen will appear before a Senate Banking Committee CARES Act oversight hearing. Prepared text and Q&A are expected.

- 01:40 PM Fed Governor Bowman (FOMC voter) speaks: Fed Governor Michelle Bowman will discuss community banking during a virtual event. Prepared text is expected.

- 03:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will discuss the economic outlook during a virtual banking conference. Audience Q&A is expected.

- 07:00 PM St. Louis Fed President Bullard (FOMC non-voter) speaks: St. Louis Fed President James Bullard will take part in a virtual moderated panel discussion on the U.S. economy and monetary policy hosted by the Central Bank of the Philippines. Prepared text is expected.

Wednesday, September 29

- 10:00 AM Pending home sales, August (GS +2.0%, consensus +1.0%, last -1.8%); We estimate that pending home sales increased 2.0% in August.

- 11:45 AM Fed Chair Powell (FOMC voter) speaks: Federal Reserve Chair Jerome Powell will take part in a virtual panel discussion on central banking hosted by the European Central bank. Moderated Q&A is expected.

- 02:30 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will give a virtual speech at an event hosted by UCLA Anderson. Prepared text and Q&A are expected.

- 02:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will discuss the topic of inclusive payments at a virtual conference hosted by the Chicago Fed. Audience Q&A is expected.

Thursday, September 30

- 08:30 AM Initial jobless claims, week ended September 25 (GS 330k, consensus 330k, last 351k); Continuing jobless claims, week ended September 18 (consensus 2,815k, last 2,845k): We estimate initial jobless claims decreased to 330k in the week ended September 25.

- 08:30 AM GDP (third), Q2 (GS +6.6%, consensus +6.6%, last +6.6%); Personal consumption, Q2 (GS +11.9%, consensus +11.9%, last +11.9%): We estimate no revision on net in the third vintage of the Q2 GDP report (previously reported at +6.6% qoq saar).

- 09:45 AM Chicago PMI, September (GS 62.0, consensus 65.0, last 66.8): We estimate that the Chicago PMI pulled back further, falling 4.8 points to 62.0 in September. Our forecast reflects the still-elevated level relative to other business surveys and weaker industrial data abroad.

- 10:00 AM Fed Chair Powell (FOMC voter) speaks: Although the witness list has not yet been published, Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen may appear before a House Financial Services Committee hearing on the Federal Reserve and Treasury Department’s pandemic response. If so, prepared text and Q&A are expected.

- 10:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will make opening remarks at a webinar on the Fed’s pandemic response.

- 11:00 AM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will discuss economic mobility as a tool for sustainability at a virtual event hosted by Georgia Tech. Audience Q&A is expected.

- 12:30 PM Chicago Fed President Evans (FOMC voter) speaks: Chicago Fed President Charles Evans will discuss the economic outlook at an event hosted by the Bendheim Center for Finance. Audience Q&A is expected.

- 01:05 PM St. Louis Fed President Bullard (FOMC non-voter) speaks: St. Louis Fed President James Bullard will make opening remarks at a book launch on the future of building wealth.

- 02:30 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will speak virtually to the 2021 Idaho Women and Leadership conference hosted by Boise State University.

- 03:30 PM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will take part in a discussion on regulations, sustainable assets and financial markets hosted by the Official Monetary and Financial Institutions Forum.

Friday, October 1

- Personal income, August (GS +0.3%, consensus +0.2%, last +1.1%); Personal spending, August (GS +0.4%, consensus +0.6%, last +0.3%); PCE price index, August (GS +0.32%, consensus +0.3%, last +0.41%); Core PCE price index, August (GS +0.25%, consensus +0.2%, last +0.34%); PCE price index (yoy), August (GS +4.19%, consensus +4.2%, last +4.17%); Core PCE price index (yoy), August (GS +3.54%, consensus +3.5%, last +3.62%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose by 0.25% month-over-month in August, corresponding to a 3.54% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.32% in August, corresponding to a 4.19% increase from a year earlier. We expect a 0.3% increase in personal income and a 0.4% increase in personal spending in August.

- 09:45 AM Markit US manufacturing PMI, September final (consensus 60.5, last 60.5)

- 10:00 AM University of Michigan consumer sentiment, September final (GS 71.2, consensus 71.0, last 71.0): We expect the University of Michigan consumer sentiment index increased by 0.2pt to 71.2 in the final September reading.

- 10:00 AM Construction spending, August (GS +0.2%, consensus +0.3%, last +0.3%); We estimate a 0.2% increase in construction spending in August.

- 10:00 AM ISM manufacturing index, September (GS 58.9, consensus 59.5, last 59.9); We estimate that the ISM manufacturing index declined 1pt to 58.9, reflecting weaker industrial data abroad, supply constraints, and a related pullback in auto production.

- 11:00 AM Philadelphia Fed President Harker (FOMC non-voter) speaks; Philadelphia Fed President Patrick Harker will take part in a virtual discussion on the economic outlook hosted by the New Castle County Chamber of Commerce. Prepared text and audience Q&A are expected.

- 01:00 PM Cleveland Fed President Mester (FOMC non-voter) speaks; Cleveland Fed President Loretta Mester will take part in a virtual moderated discussion on inflation and employment hosted by the Shadow Open Market Committee. Audience Q&A is expected.

- 5:00 PM Wards Total Vehicle Sales, September (GS 12.5m, consensus 13.3m, last 13.06m)

Source: DB, Goldman, BofA

Tyler Durden

Mon, 09/27/2021 – 09:15

via ZeroHedge News https://ift.tt/2XWO89S Tyler Durden