Proxy Advisory Firm To Tesla Shareholders: Time To Ditch Kimbal Musk And James Murdoch

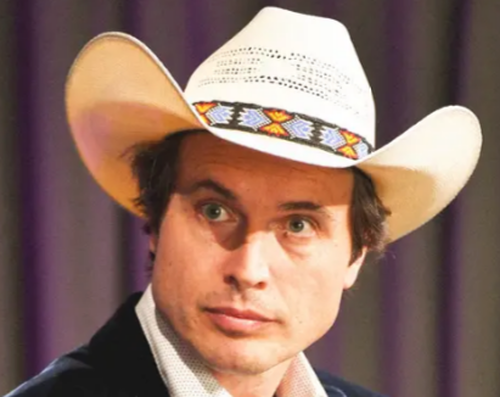

Tesla investors are being told to reject board members James Murdoch and Kimbal Musk heading into Tesla’s annual general meeting.

The recommendation is being made by the largest proxy advisory firm, Institutional Shareholder Services, Bloomberg reported. They made the recommendation in a September 24 report to clients.

Tesla currently has 9 directors and its annual general meeting is slated for October 7th. The meeting will take place at Tesla’s new factory in Austin, Texas.

Out of the company’s board, Murdoch and Musk are the two names standing for re-election. Murdoch was previously CEO of 21st Century Fox from 2015 to 2019. Kimbal Musk is a self-described “entrepreneur” who showcased his true business acumen during the recent trial over the Solar City acquisition, where analysis of his testimony seemed to reveal he knew little about disclosure requirements or how mergers and acquisitions work.

Antonio Gracias will not stand for re-election and will not be replaced, according to the report.

The ISS report said Tesla directors have gotten “outlier levels of pay without a compelling rationale” and that there’s no good reason current directors’ options were “so much larger than director compensation at peer companies.”

The report continued: “Tesla’s non-employee directors are highly compensated as compared to directors at companies in the same GICS sector and index or indeed as compared to directors of even the largest U.S. public companies.”

“Directors Robyn Denholm and Hiromichi Mizuno received total compensation of $5.76 million and $9.23 million, respectively, while outgoing director Antonio Gracias received compensation of $1.19 million,” it said.

“In each case, the vast majority of this compensation came in the form of stock option grants valued by the company at $5.63 million for Denholm, $9.21 million for Mizuno and $1.16 million for Gracias.”

We can’t help but think that ISS does, in fact raise a great question. We’ve seen companies with questionable financials pay extra in audit fees before. So, what does it mean when a company’s directors are compensated so much higher than peers? What might be the motive behind such exorbitant payments?

Tyler Durden

Mon, 09/27/2021 – 16:40

via ZeroHedge News https://ift.tt/2WhQNud Tyler Durden