Solid 5Y Auction Stops Through After Ugly, Tailing 2Y Sale Earlier

In the aftermath of the ugly 2Y auction at 1130am, moments ago the Treasury followed up with its second coupon auction of the day when it sold $61 billion in 5Y notes. And unlike the “gruesome” tailing 2Y sale, this time demand was far more solid.

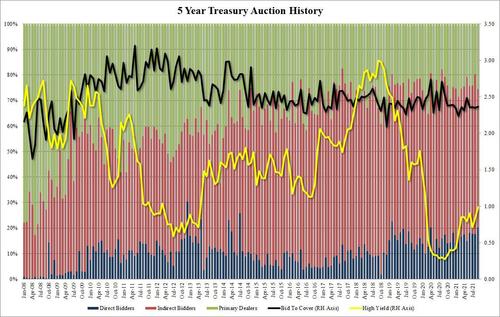

Printing at a high yield of 0.990%, the auction stopped through the When Issued 0.994% by 0.4bps, even if it too was the highest yield since February 2020 and decidedly above last month’s 0.831% now that the Fed’s tapering is officially in play.

The Bid to Cover came in at 2.37, which unlike the near record plunge in the 2Y BTC was actually a modest improvement to last month’s 2.35, and also printed right on top of the six-auction average.

The Internals were soggier, with Indirects taking down just 54.3%, below the recent average of 59.8%, and the lowest since March 2020 when foreign buyers took down just 52.1%. And with Directs taking down 20.2% higher than the 17.1% recent average, Dealers were left holding 25.5%, or the most since February.

Overall, compared to today’s 2Y debacle, the 5Y auction was a decidedly stronger appearance, if leaving a bit to be desired.

Tyler Durden

Mon, 09/27/2021 – 13:13

via ZeroHedge News https://ift.tt/2XQ1FzN Tyler Durden