Tech Wreck: “Secular Growth” Slammed By Soaring Rates, Negative Gamma

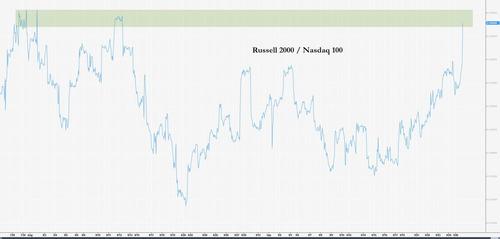

‘Growth-heavy’ Nasdaq has been underperforming significantly in recent days, especially relative to value-heavy Small Caps…

And that trend is accelerating this morning as the pressure on yields continues to lean-on the heavyweight “Secular Growth” Tech contingent (weighing down S&P and Nasdaq relative to Dow and Small Caps). On the day, Russell 2000 is up 1% and Nasdaq 100 down 1%…

As Nomura’s Charlie McEligott noted this morning, real yields have been marching higher recently (5Y and 10Y TIPS yields least negative in 3 months), as it continues to look more like the broad Rates selloff has been a risk-premium trade (due to increased uncertainty in holding the front- and belly- of USTs thanks to recent Fed policy updates w/ guidance faster taper + more hikes in the dot plot), as opposed to a view on heightened or accelerating growth- or inflation- expectations—particularly with the latter going nowhere but sideways since start June.

Juxtapose this then with the long-end, which relatively-speaking, has held in much firmer despite this broad UST sell-off, as the indicated Fed policy evolution has market participants pivoting back towards a longer-term resumption of a “secular stagnation” worldview, with slowing growth from tighter financial conditions increasingly priced-into even lower terminal rate pricing.

There is then an important message here with regard to the move higher in nominal yields being more about real yields and “tight” Fed policy down the pipe (as well as the tactical drivers of +++ supply and seasonality), versus some potentially misinterpreting the higher nominal yields as a pure read on “reflation” trade dynamics or that sentiment for “above trend growth” is picking back up again.

Regardless of the “true” catalyst vs narratives, it’s bearish for Bonds either way, and that is driving a thematic trade in Equities which has many nervous – because most have legged-back into the duration-proxy “Growth” Equities vs reducing “Cyclical Value” over the course this past Quarter.

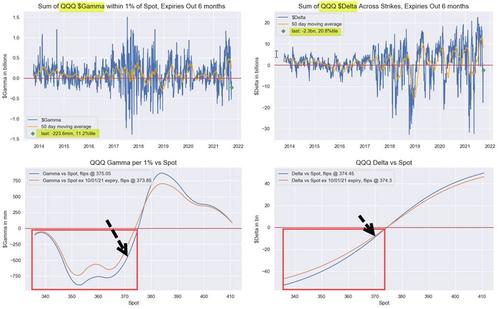

Making matters worse for big-tech, the “nervous around Nasdaq / Secular Growth / Bond Proxies” is exaggerated by the larger Index Vol picture, QQQs (Nasdaq) is in “negative Gamma” territory vs “spot” for Dealers and acting accordingly “jumpy” (-$223.6mm, just 11.2%ile—flips positive back above $375.05 today in QQQ), while also “negative Delta” vs spot (-$2.3B, 20.8%Ile, flips positive back above $374.45).

In other words, brace.

However, there is still hope broader US equity indices. McElligott notes that IF the Rates breakdown slows, the S&P is currently “stable,” (not beaucoup, but ho-hum) back “long Gamma” vs spot (+$3.6B, 39.7%ile, flips below 4374) as an insulating dynamic, while similarly lukewarm “long Delta” ($62.2B, 36.7%ile, flips negative below 4423).

Tyler Durden

Mon, 09/27/2021 – 10:08

via ZeroHedge News https://ift.tt/3oaQWuU Tyler Durden