Why 4430 Is A Crucial Line In The Sand For The S&P 500 This Week

After a strong overnight session, S&P has slumped since the European open, back in the red and hovering at a critical technical level for the week…

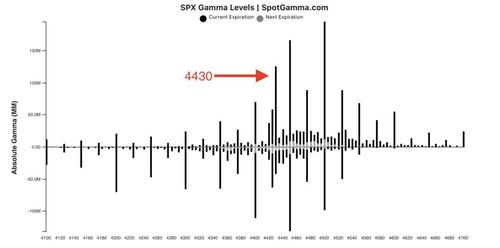

4430 seems like a magnet, here’s why…

As SpotGamma details, a big point of conversation this week will be the quarterly JPM collar roll, which currently holds short calls at 4430 (more here). These calls expire and are likely rolled on 9/30 (Thursday) – an expiration which currently holds >20% of total SPX gamma. The size of this expiration likely invokes some volatility (i.e. gamma “unclenching”) in/around Thursday.

As you can see above the gamma tied to this 4430 strike is still less than that of 4400/4450, and we think this overall position provides decent support on any drawdown.

SpotGamma notes that the 4500 Call Wall remains our upside target for this week.

For the downside it would take a pretty decent punch to break 4400. If 4400 is breached we think volatility expands drastically due to negative gamma. We anticipate 4400 being the critical support line into Thursdays expiration.

Tyler Durden

Mon, 09/27/2021 – 09:41

via ZeroHedge News https://ift.tt/2Y1bwTK Tyler Durden