$14 Billion In Quarter-End Pension Buying: Goldman

With month- and quarter-end on deck, Goldman’s theoretical, “model-based” estimates are for a net $14 billion of US equities to buy from US pensions given the moves in equities and bonds over the month and quarter.

How does this stack up vs history? According to Goldman’s Gillian Hood, this ranks in the 36th percentile amongst all buy and sell estimates in absolute dollar value over the past three years. In absolute terms, this falls below the three year average absolute dollar value of $26bn worth of equities to be rebalanced.

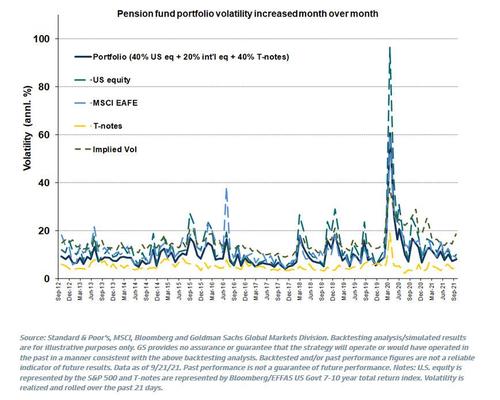

Next, a chart showing that over the month, the indicative pension fund volatility increase month over month.

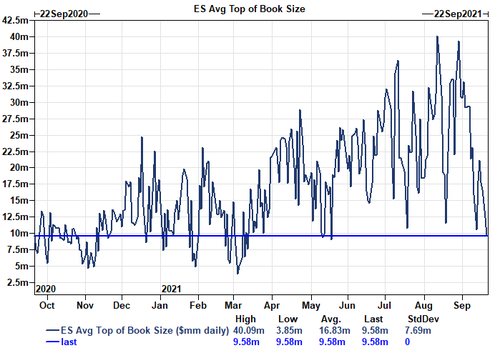

And while it is tangential to the topic of pension rebal, Goldman makes an interesting observation: ES liquidity…

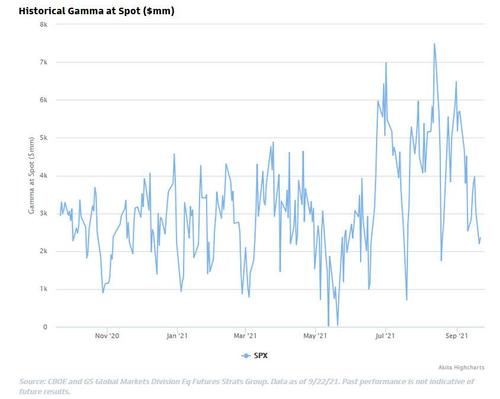

… is now directly correlated to gamma…

… which makes intuitive sense: since a gamma drop is usually indicative of lower upside buffers and higher put buying, which in turn is a function of anticipated volatility, HFTs such as virtu and citadel are now looking at gamma as a leading indicator of when to withdraw liquidity. And since gamma is often self-reinforcing, a good time to buy VIX and bet on vol spikes is when gamma tumbles and when overall market liquidity collapses.

Tyler Durden

Wed, 09/29/2021 – 11:00

via ZeroHedge News https://ift.tt/3D1dGBV Tyler Durden