Dems Propose Subsidized 20-Year Mortgages For First-Generation Homebuyers

In a world where the biggest asset bubble in history means home prices are now rising at a never before seen 20% pace, dooming tens of millions of of potential homeowners to a life of renting, Democrats have had another glorious solution how to “fix” the problem of unaffordable housing, which may help in the short run only to lead to an even greater crisis a few years down the line. It is, of course, even more market-warping subsidies.

As part of the raft of new legislation designed to spur first-time homeownership in America, a remarkable bill has joined the fray: its sponsors propose creating a new subsdizied 20-year-fixed-rate mortgage program through Ginnie Mae, HousingWire reports.

According to the bill, Ginnie Mae in tandem with the Department of the Treasury would subsidize the interest rate and origination fees associated with these 20-year mortgages, so that the monthly payment would be in line with a new 30-year FHA-insured mortgage. The move – which is an explicit subsidy of one share of the population by another – could, in theory, “allow qualified homebuyers to build equity-and wealth- at twice the rate of a conventional 30-year mortgage.” Instead, what it will do is lead to is an even bigger housing bubble.

The legislation, dubbed the “Low-income First Time Homebuyer (LIFT) Act,” would create a program through the Department of Housing and Urban Development that would sponsor low fixed-rate 20-year mortgages. The bill is sponsored by Sens. Mark Warner (D-VA), Tim Kaine (D-VA), Chris Van Hollen (D-MD), Raphael Warnock (D-GA), and Jon Ossoff (D-GA).

To qualify, one would have to be a first-time, first-generation homebuyer, with an income equal to or less than 120% of the area median income.

An example of how the subsidized mortgage would work:

- Today, a first-time homebuyer of modest means purchasing a property for $210,000 is likely to put down $10,000 and take out a $200,000 mortgage. In today’s market, a lender would offer this borrower a 2.75% 30-year FHA-insured mortgage, for which the borrower would pay an annual 0.85% FHA insurance fee and a 1.75% up-front insurance fee, which would be folded into the mortgage. The borrower would have a monthly payment of $970.

- Under the LIFT program, the lender would instead offer this homebuyer a 1.50% 20-year FHA insured mortgage, which would include a 4.00% up-front FHA fee that would be folded into the loan and no annual FHA premium. The borrower would have a monthly payment of $1,004.

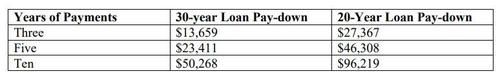

- By paying roughly the equivalent monthly payment, a borrower with a LIFT loan would build equity twice as fast.

- Furthermore, because LIFT rates are tied to the FHA 30-year, even if mortgage rates rise, a LIFT loan would continue to pay down – and build wealth – at about twice the rate of the 30-year mortgage.

“The number one way that middle class Americans build wealth is through homeownership, an opportunity that due to racism and structural inequality has been denied to too many families of color,” Warner said in a statement. “Today, Black families in this country have an average net worth just one-tenth the size of their white counterparts.”

In the past couple of months two versions of the $15,000 first-time homebuyer tax credit and Rep. Maxine Waters’ (D-CA) Down Payment Towards Equity Act of 2021 were introduced as alternatives for addressing housing inequity.

The response from some fair housing advocates to the LIFT Act has been lukewarm so far. Some sources expressed worry that if significant money is allocated to this program, funding for Rep. Maxine Waters’ down payment assistance bill – a favorite among fair housing advocates – might not come.

Former FHA commissioner, Dave Stevens, said that Warner’s bill has the potential of getting traction in Congress. This first-time homebuyer bill has a “unique combination of Republicans and Democrats that have aligned on how this thing can work,” Stevens said.

Additionally, the legislation is “very limited” and specifically geared towards first-generation homebuyers, addressing worries of a bill being too broad, resulting in minority homebuyers getting pushed out of purchasing a home.

“In Congress right now, and I would guess the White House, they would like to see both Maxine Waters down payment assistance bill and this one make its way to the reconciliation process,” added Stevens. “If you could get a modest amount of dollars for both Chairwoman Waters’ piece of legislation as well as for the LIFT bill, you get some really good dollars targeted for first time homebuyers.”

Dave Dworkin, CEO of the National Housing Conference, said that down payment assistance is still the number one option for increasing homeownership: “[The LIFT Act and Waters’ down payment assistance] have to go together,” he said. “Our first priority is creating homeowners and our second priority is to accelerate wealth building.”

Dworkin added that NHC “would like to see at least $20 billion to $50 billion go to down payment assistance.”

Meanwhile, Mark Zandi, chief economist at Moody’s Analytics, commented that there are upsides to the bill, mainly that it “preserves affordability and supports homeownership” while also allowing homeowners to rapidly accumulate equity.

“LIFT is among the most effective ways policymakers have to address the nation’s pernicious problem of large and widening economic disparities,” he said. The only troubling language with the LIFT Act, said Stevens, may be the attestation clause.

“I mean, the real question is how do you prove that you’re a first-generation buyer,” said Stevens. “As long as a borrower attests to the fact that they’re first generation, they technically are able to apply.” As a reminder, the 2007 housing crisis was in large part the result of tens of millions of Americans lying about their income and their net worth on (multiple) mortgage applications. Everyone knows how that ended.

“That’s the only area where I think there could be some moral hazard,” Stevens concluded as if that wasn’t enough. .

Tyler Durden

Wed, 09/29/2021 – 19:40

via ZeroHedge News https://ift.tt/2ZDgQ05 Tyler Durden