Don’t Look Now, But Cathie Wood Just Sold Another $270 Million In Tesla Shares

As we’ve noted in a previous piece about ARK’s Cathie Wood selling $266 million worth of Tesla earlier this month, selling any shares at this point while maintaining a firm $3,000 price target on a $790 stock doesn’t seem to make much sense.

But what do we know? We’re hardly the visionaries Wood is, which is why she has $50 billion under management, right? Right?

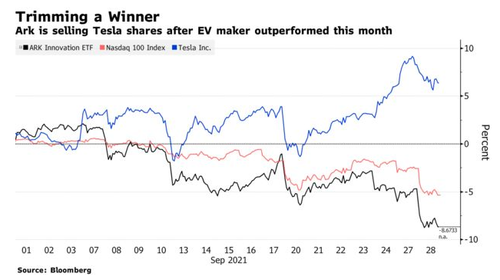

Regardless, Wood was back to her old tricks again this week, smashing the bid on Tesla shares yesterday, selling nearly $270 million in her favorite name as her flagship ARKK fund dipped 4.18% on the day.

The sales of the more than 340,000 shares were to “spur outflows from her growth focused funds,” according to Bloomberg. Tesla remains about an 11% weighting in Wood’s ARK Innovation ETF, the report noted. Wood has a habit of trimming the stake when it rises above 10%, it said.

Overnight data showed that $297 million was withdrawn from the ARKK fund on Monday, marking its largest outflow since March of this year.

Over the last four days, more than $660 million has been pulled from the fund.

“Our estimate for Tesla’s success has gone up. The main reason for that is their market share. Instead of going down from year-end 2017 to today, it has actually gone up fairly dramatically,” Wood said just days ago to Yahoo Finance.

$3,000 marked the target for her “base case” for Tesla, the Yahoo report said.

When asked about selling some Tesla last year, Wood told CNBC that it was “wise portfolio management” to trim some of your winners to invest in other companies.

Tesla is still Wood’s largest holding.

Tyler Durden

Wed, 09/29/2021 – 09:30

via ZeroHedge News https://ift.tt/3AT8M9k Tyler Durden