Natgas Drops 7% On Warmer Forecasts, Largest One-Day Decline Since January

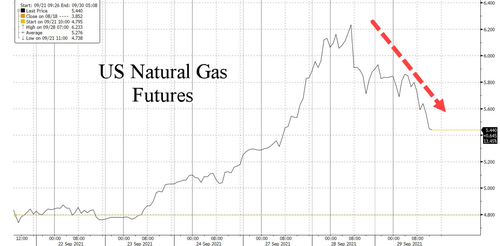

U.S. natural gas futures plunged more than 7% Wednesday from a seven-year-high on warmer weather forecasts for the next few weeks, which indicates lower demand for powerplant and heating fuel, according to Bloomberg.

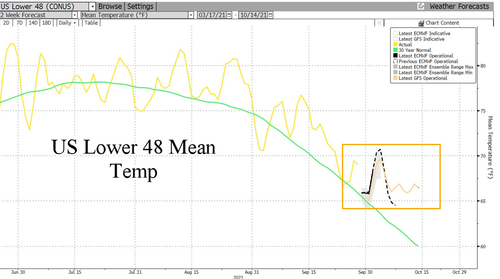

Above-normal temperatures for the East Coast while below-normal temperatures for the West Coast are expected to last through Oct. 13. Shown below is the U.S. Lower 48 mean temperature positively diverging from the 30-year norm.

“October is supposed to be warmer than normal. If that’s the case, natgas is going to find some stability,” said Phil Flynn, senior market analyst, Price Futures Group.

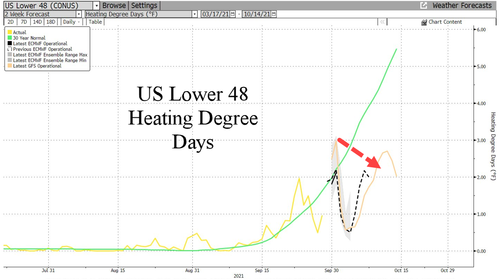

Heating degree days (HDD), the measure of demand for energy needed to heat a building when the average temperature is below 65F, began to slightly increase from 1 HDD to nearly 3 HDD from Sept. 15-30 but has since negatively diverged the 30-year trend and estimated to do so through Oct. 13.

Natgas futures have been on a tear, reaching seven-year highs above the $6 handle on shortage fears in Europe. Futures have plunged almost 12.5% in the last two trading sessions, with today’s 7% drop the largest daily slump since Jan. 19.

The largest decline since Jan. 19.

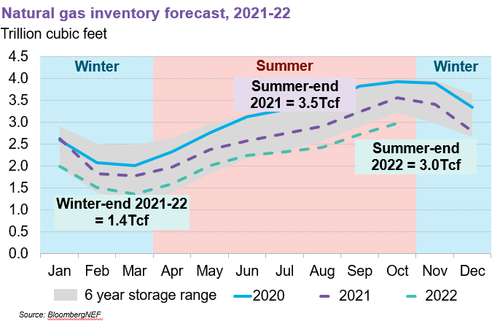

BloombergNEF estimates that “even mild weather in coming months” will keep U.S. stockpiles below historical averages because of increasing demand and will put a bid under prices.

“There’s a 64% chance that inventories will finish below the five-year average level at the end of winter 2021-22,” BNEF noted in its latest U.S. Gas Monthly report.

The problem with soaring natgas prices, especially prices in Europe, is that it may threaten economic recoveries as consumers and businesses cannot afford gas to power homes and businesses.

Tyler Durden

Wed, 09/29/2021 – 14:52

via ZeroHedge News https://ift.tt/2Y2EeDl Tyler Durden