WTI Dips After Surprise Crude Build, Production Rebounds From Ida

Oil prices see-sawed overnight, with WTI sliding back to a $73 handle after API’s reported across the board inventory builds, but found support and has rallied back to almost unchanged ahead of this morning’s official data.

“The oil rally is taking a bit of a pause…as there is a perception that the market has gone up too fast and the fact that we saw builds in the American Petroleum Institute (API) supply report,” said Phil Flynn, senior market analyst at The Price Futures Group.

Traders are anxious for the official data to prove API right… or wrong.

API

-

Crude +4.127mm (-2.5mm exp)

-

Cushing +359k

-

Gasoline +3.555mm

-

Distillates +2.483mm

DOE

-

Crude +4.578mm (-2.5mm exp)

-

Cushing +131k

-

Gasoline +193k

-

Distillates +384k

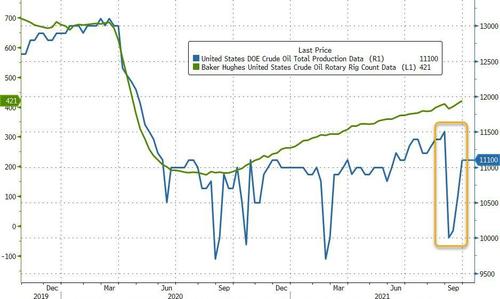

The official EIA data confirmed API’s, with a 4.578mm crude build, ending a 7-week streak of draws. Also confirming the API data, inventories rose for products and at Cushing…

Source: Bloomberg

Despite over 500k bb/d in output increase last week, recovery from Hurricane Ida continues to lag as US crude production remains Down 400k bb/d…

Source: Bloomberg

WTI was hovering around $75 – just about where it was pre-API – before the official data hit and faded lower after…

“The overall fundamentals for oil and products are extremely bullish as supplies of almost everything energy has tight supplies around the globe,” said Flynn in a daily report.

“Demand for products and energy [are] rising as recent lockdowns around the globe due to the delta variant of the COVID-19 plague are being lifted.”

Tyler Durden

Wed, 09/29/2021 – 10:35

via ZeroHedge News https://ift.tt/3kQOgk4 Tyler Durden