Did The President Of Robinhood Dump All His AMC Stock Right Before They Restricted Trading?

It may seem like ancient history now, but back in January the great WallStreetBets short squeeze was all the rage, having sent heavily shorted meme stocks like GME and AMC to unprecedented heights as millions of retail daytraders used their Robinhood account to pile on and buy in wave after seemingly endless wave in the process crushing reputable hedge funds such as Melvin Capital which needed multi-billion capital infusions to avoid being margin called to death. That wave, however, came to an abrupt end on January 28 when Robinhood took the unprecedented action to “render the financial system inaccessible” to millions of customers and investors, as a recently filed class-action lawsuit claims, when it went into sell-only made as the retail brokerage found itself short on regulatory capital as a result of the unprecedented buying tsunami, and imposed temporary bans on purchases of 13 heavily shorted stocks in the process ending the epic momentum wave and allowing a fresh round of short sellers – which the lawsuit claims included such financial scions such as Citadel – to generate material profits.

The fact that Citadel also happens to be Robinhood’s biggest customer and pays the retail brokerage hundreds of millions to frontrun retail orders placed on the Robinhood brokerage in the form of Payment for Orderflow, only added to the complexity and reflexivity of the situation.

We discussed this episode in great detail back in February in “Exposing The Robinhood Scam: Here’s How Much Citadel Paid To Robinhood To Buy Your Orders“ in which we said “Frankly, we’ve had it with the constant stream of lies from Robinhood and neverending bullshit from the company’s CEO, Vlad Tenev.” And while we laid out all the lies we had observed from both Robinhood’s CEO and Citadel, including Citadel’s threats to sue us into oblivion for alleging they frontrun their own customers only for FINRA to accuse Citadel of doing just that (resulting blessed silence from Citadel’s lawyers as far as we are concerned), the best summary of the entire January farce belonged to Michael Burry who on February said in a since deleted tweet that “The #mainstreetrevolution is a myth. Zero commissions and gamified apps were designed to feed flows to the two most influential WS trading houses. A few HFs got hurt, but if retail is moving toward more trading and away from fundamentals, WS owns that game. #Stonks by design.” Jeffrey Gundlach also piled on.

To be clear, the name change would reflect Robinhood robbing the little guy, nothing else.

— Jeffrey Gundlach (@TruthGundlach) February 10, 2021

Still, memories fade, and Robinhood’s dismal abdication of its fiduciary responsibilities was mostly forgotten especially after the company – which for a brief moment in late January was insolvent and urgently needed billions in rescue funding – went public and now has a market cap of over $37 billion.

Yet not everybody forgot and a recent filing in a class action lawsuit filed in April in the Southern District of Florida (case 21-md-02989), revealed that a lot of what Robinhood and Citadel called conspiracy theories, was in fact true, culminating earlier this week when the top trending hashtag on twitter was #KenGriffenLied.

#1 Trending on Twitter is #KenGriffinLied pic.twitter.com/0SMlyjwfya

— Wolf of My Street🏡 (@Ryan__Rigg) September 27, 2021

Remarkably, the latest populist uprising against Citadel and Robinhood (incidentally, the same venue where most of those who slam Robinhood on social media also trade), prompted the two financial firm to respond to the renewed criticism of their actions during January’s meme-stock frenzy. As we reported on Monday, Citadel – whose founder Ken Griffin testified about the episode during a February congressional hearing and claimed there was no back and forth between his firm and Robinhood – fired off a series of tweets late Monday denying allegations that it pressured Robinhood to restrict trading. Apparently having gotten under Citadel’s skin, the defensive tweets continued late on Tuesday when the HFT-heavy internalizer first mocked conspiracy theorists saying that “there are those who still refuse to believe an American landed on the moon. Internet conspiracies and Twitter mobs try to ignore the facts, but the fact is that Citadel Securities was the pre-eminent market maker to the retail brokerage community in January 2021” before stating that “Citadel Securities never requested, intimated, agreed or otherwise sought to limit or to restrict the trading of such securities. On January 27th, we executed an astonishing 7.4 billion shares on behalf of retail investors.”

On January 27th, numerous retail brokerage firms imposed restrictions on the trading of certain “meme stocks” due to capital constraints, liquidity concerns and other commercial reasons.

— Citadel Securities (@citsecurities) September 28, 2021

We’re proud of the important role we have long played in making US financial markets fair, transparent, resilient, and the envy of the world.

— Citadel Securities (@citsecurities) September 28, 2021

At the same time, Robinhood said in an emailed statement Tuesday that the lawsuit paints “a false narrative of collusion” with Citadel Securities.

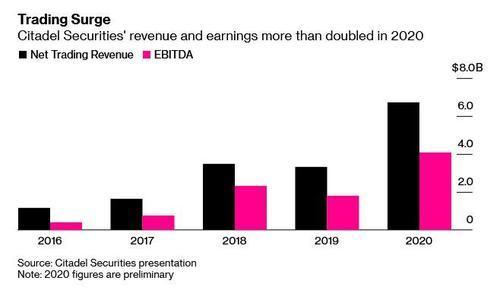

Ken Griffin added a statement of his own on Tuesday: “It must frustrate the conspiracy theorists to no end that Vlad and I have never texted, called or met each other. But I must say, kudos to Vlad and his team at Robinhood for their remarkable success story.” Of course Griffin will be delighted by Robinhood’s success in enticing tens of millions of Gen-Z Americans to daytrade: after all frontrunning their orderflow (for which it generously paid Robinhood) is what allowed Citadel Securites to record its best year ever in 2020.

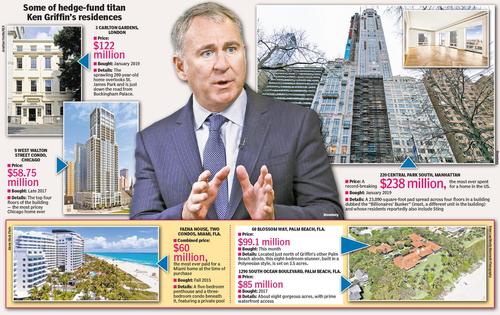

In fact, when Griffin was congratulating Robinhood, he was really toasting to the success of Citadel Securities – which is perhaps best known for being the biggest buyers of Robinhood stock and option orderflow (which remains a perfectly legal strategy for Wall Street exchanges) with the intent of “price improvement” – in a year that was defined by economic pain and despair for many, but will go down as the most profitable for Wall Street firms in history. It will also allow Ken to add several more massive mansions to his already staggering collection.

In any case, while we would love to take Ken Griffin on his word that nothing illegal took place, we will leave that to the discovery process. In the latest lawsuit, plaintiffs allege that Citadel Securities amassed a substantial short position in GameStop and other stocks that exploded in value, and that the market-maker pressured Robinhood to stop customers from purchasing those shares, which the online brokerage did on Jan. 28.

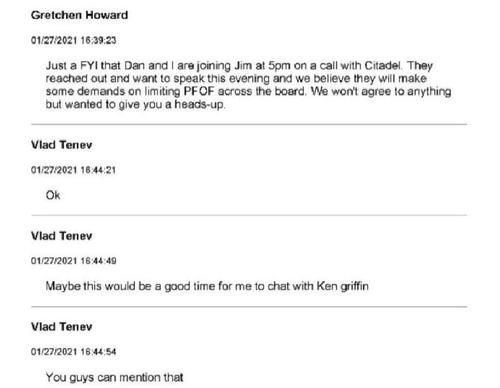

In fact, it appears we already know that Griffin lied: according to the complaint filed Sept. 22 in federal court in Miami, senior executives at both Citadel Securities and Robinhood had “numerous communications with each other that indicate that Citadel applied pressure on Robinhood.”

BREAKING (2/3) 🚨

See the following images for better context of what is going on.

The link to the actual document is in the 3rd part of this thread. pic.twitter.com/FtnyhVBXws

— Antonio Martinez (@AntonioTheMexi) September 25, 2021

According to the plantiffs who managed to obtain internal chat transcripts, on January 27 the day before the restrictions were implemented, high level employees of Citadel and Robinhood had numerous communications with each other, contrary to what Ken Griffin told Congress. Furthermore, the plaintiffs allege that Citadel applied pressure on Robinhood to throttle (and eventually block) purchases in the heavily shorted names.

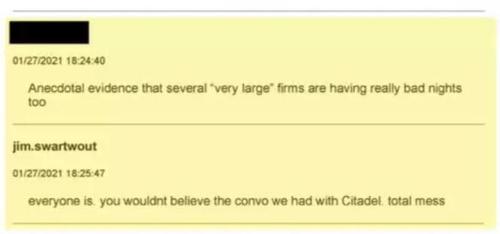

The plaintiffs also argue that Citadel Securities stood to gain from stopping the short squeeze by purchasing new shorts positions at the peak of the squeeze and then profiting from the decrease in share prices as the buying momentum fizzled. As the next chat session between an unnamed Robinhood employee and Jim Swartwout, President and COO of Robinhood, indicates, on Jan 27 – after being told that several “very large” firms are having really bad nights, he had just had a conversation with Citadel which was “unbelievable” and revealed a “total mess.”

Perhaps Swartwout can testify for the record just what this “unbelievable” conversation he had just had with Citadel was all about.

So on to the infamous January 28 when shortly before Robinhood announced it would implement the dreaded PCO or “position closing only” policy which the plaintiffs allege was designed to artificially suppress the prices of Suspended Stocks – despite indicating that “we are too big for them to actually shut us down” referring to Tenev’s allegation that the NSCC was the one seeking the trading halt – we read from yet another internal chat that at least one Robinhood employee correctly predicted that “we are going to get crucified… for pco’ing.”

Curiously, someone else had a similar bad feeling about the PCO: Citadel. According to the lawsuit, “former Citadel Securities Senior Vice President, in an internal chat with Citadel Securities Head of Execution Services, on January 28, 2021, at 1:48pm UTC, ““Robinhood moving the following EQUITY positions to CLOSING ONLY: AMC, GME, NOK, BB, NAKD, KOSS, EXPR, BBBY all PCO.” Citadel acknowledged, “this may cause some big moves.” (Emphasis added.) When asked about options at 1:55 p.m. UTC, Citadel stated, “options moving too . . . closing only in all symbols.”

But while the nuances of who knew in advance, or who demanded, or who profited from the “code red” the PCO, and whether Citadel pressured and stood to profit from said PCO, will eventually be decided upon by the judge, one thing is a flashing red light that Gary Gensler and the SEC should immediately follow up on.

On page 4 of the MDL amended complaint (docket 21-2989) we read that ahead of the PCO, “Robinhood knew at the highest levels of the company that its risk management system was strained to the breaking point during the week of January 25th. Robinhood Securities President and COO, James (Jim) Swartwout, who Tenev points to as making the ultimate call to PCO, says in an internal chat on January 26, 2021, “I sold my AMC today. FYI – tomorrow morning we are moving GME to 100% – so you are aware.”

Now, while the “we are moving GME to 100%” may refer to Robinhood demanding 100% margin on GME stock as of Jan 27 as the firm realized it didn’t have nearly enough client margin to satisfy regulatory requirements, the preceding fragment, “I sold my AMC today” can mean just one thing: Swartwout sold all his AMC stock on January 26, two days before the firm blocked tens of millions of clients from being able to buy it, in the process triggering a price collapse.

It wasn’t until February 5, or one week later, that Robinhood would remove all restrictions in the trading of the meme stocks.

Which brings us to the question posed by Dave Portnoy, whose long-running feud with Vlad Tenev is well-known: did “The President of Robinhood sold all his AMC right before they restricted trading.“

Is this real? The President of Robinhood sold all his AMC right before they restricted trading. Where is this from? @vladtenev ? https://t.co/EtI9Xc0Z9x

— Dave Portnoy (@stoolpresidente) September 29, 2021

We conclude with one tangent: every time Citadel is cornered and asked if they are frontrunning retail orderflow, they immediately change the subject and explain how they are making the market more efficient and saving investors so much money in commissions. Of course, what they don’t explain is how and why they end up making far more than the money they kick back to the brokerage for lost commissions. Here’s the answer:

This, for lack of a better word, is frontrunning pure and simple. But because frontrunning is illegal if only when peasants do it, and sounds so much more sophisticated and noble when it is framed as “high frequently trading” and “payment for oderflow”, the market will remain broken because the corrupt, bought and paid for SEC will never dare to explain to ordinary Americans what a giant crime scene our markets have become. It’s also why nothing will ever change, and after all these lawsuits are settled, Citadel and Robinhood will be order to pay a few million dollars in settlement fees and life in the corrupt world of capital markets will go on as usual.

Tyler Durden

Wed, 09/29/2021 – 22:40

via ZeroHedge News https://ift.tt/3F6aRRV Tyler Durden