Empowering Investors To Short The Market Can Help End The Keynesian Fantasy

Submitted by Quoth the Raven at QTR’s Fringe Finance,

In an interview I did last week with one of my favorite podcasts, Palisades Gold Radio, I talked about the rigged Keynesian system the Fed runs to help prop up capital markets by any means necessary.

In addition to frontrunning monetary policy moves in their own portfolios, which appears to be standard operating procedure at the FOMC (and Congress) nowadays, Fed governors are also subject to the constant psychological reminder that keeping the country’s citizens comfortable by keeping the appearance of order makes for a much nicer Tuesday at the office than shocking the system and its participants by announcing that today will be the day that the Fed plans on raising rates.

I often propose critiques of the system without pragmatic, real-world ways to help bring balance to this expectation of comfort. Today, I want to propose one idea for helping solve this problem: empowering retail investors to get short the market, if they want.

Teaching the every day investor how to gain exposure to market downside could be a crucial first step to bringing much-needed balance back to Central Banking, and by default, to markets.

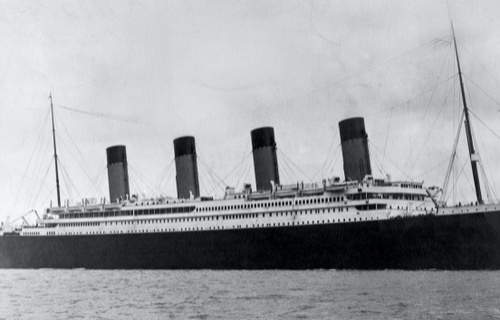

While I often nitpick by suggesting individual reforms and pointing out all types of gripes I have with the Fed, the fact is that affecting change at a Central Bank is like attempting to pull a 180° turn in the Titanic. That is to say, it would need to be done extremely slowly and with the buy-in of a majority of the country, its politicians, its elites and its citizens – all at once.

While I’m not going to pretend that I have all of the answers on how to bring homeostasis and balance to the markets by undoing all of the damage the Fed has already done, I do think we can take a positive collective step forward by empowering retail investors to understand how to profit from individual equities and markets moving lower. Put simply, it would help make the populace far less scared of what should be normal, run-of-the-mill market corrections and much needed rebalancing.

And that’s a good first step.

Aside from the fact that it has been burned into everybody’s brains that the price of equities and markets moving higher is a profound positive and all-out daily certainty, it is realistically the only way that many people know how to invest. Buying and holding a stock and then hoping it rises, is about as American as apple pie. 401(k) plans and employee stock options are just two of the many financial instruments that your average American citizen comes across during their careers and, like many other instruments, these are set up to benefit the owner by holding securities and waiting for appreciation.

But the one thing that market skeptics, Austrian economists and short sellers all have in common is that they all know how to position themselves for moves lower in the market. They have the wherewithal and the financial sophistication (i.e. a first grade education on markets) to play in instruments like options and execute trades like short sales, or even long purchases of inverse ETFs, that can allow them to hedge their portfolios of risk or even bet on companies or markets to fall outright.

In the world of sports betting, you have the over/under when it comes to total points or runs in a game. While the over remains more popular, especially with unsophisticated bettors, the under is as easily available for people to bet. Most notably, it doesn’t take any expertise that betting the over does require.

Not unlike how the majority often bets the over, if betting against markets or stocks was just as easy as going long, the majority might still have the tendency to position themselves on the “over”, or long, side.

That is to be expected, but the introduction of how to benefit from markets moving lower may jar some things loose in the heads of retail investors who otherwise might not have noticed how “rigged” the markets truly are – constantly coming in “over”.

It is only through painful loss of capital on the short side that many market skeptics start to come to terms with exactly how skewed the playing field truly is. Emboldening retail investors to be able to position themselves short would not only make these types of trades available to them, allowing them to learn in the (sometimes painful) same way, but it would also result in an increased likelihood of having a better fluency of how our markets work and how our markets are affected by central banks.

Not unlike the Fed pushing out the bubble even further, a lack of understanding of the short side will also make the next coming recession that much more painful for individual investors. Introducing more retail investors to positioning themselves short would rein in some of this excess, introduce much needed balance to the markets when they rip higher, and help ease the tension for the Fed to do the right thing.

I believe that a collective effort to make exposure to the short side just as easy as exposure to the long side for retail would not only result in a new generation of investors with a more complex understanding of markets, it would also make the Fed’s job of being objective, easier.

Every person that “wakes up” to exactly how central banks are manipulating markets is one less person the Fed has to worry about being uncomfortable when they do consider doing the right thing and quelling access to the euphoric upside in markets. Whether it be from tapering or raising rates, it doesn’t matter: removing even the slightest amount of psychological worry that likely encourages the Fed to continue confirming their Keynesian biases would be a step toward order in monetary policy. It would also offer a true emboldening of investors; something that brokerages like Robinhood have tried to promise.

In addition to making it easier for the Fed to be objective, being able to easily short the system would also put retail investors on more of a level playing field with Wall Street. This is due to the fact that many of the esoteric instruments that Wall Street “fat cats” have access to that Main Street doesn’t are simply various complex instruments set up to benefit from both upside and downside in markets.

Finally, the mass scale at which this type of financial education could be deployed may be enough to influence government and central banking decisions in a way that nitpicking individual ideas never could.

Not unlike what makes Wikipedia so efficient and effective: the more people you add to the collective effort, the more likely it has of being a success and helping a usher in change that would otherwise seem insurmountable to catalyze.

Photo: Britannica

* * *

Zerohedge readers get 10% off an annual subscription to my blog by using this special link here.

Tyler Durden

Thu, 09/30/2021 – 08:07

via ZeroHedge News https://ift.tt/2Wrf5BX Tyler Durden