UK Energy Crisis Shows Danger Of Net-Zero Emissions Policies: Aussie Senator

Authored by Daniel Khmelev via The Epoch Times,

The push for Australia to legislate a net zero emissions target has spurred discord from some government officials who firmly believe the climate policy could harm Australia’s energy security and industry amid the UK’s own unravelling energy crisis.

Australia has faced criticism for not setting a 2050 net zero target—a goal already undertaken by many of the world’s developed countries, including the United States and the United Kingdom.

But Nationals Senator Matt Canavan suggested that the UK’s unfolding energy crisis is a direct consequence of its “net zero” emissions plans via a shift to so-called renewables and banning coal power.

“The UK has been trying to reach net zero. They’ve passed legislation to do that,” Canavan told 2GB radio.

“They’re not there yet, but they’re on the path. And already down that path, they are seeing a situation where industry is being asked to shut down just to keep the lights on.”

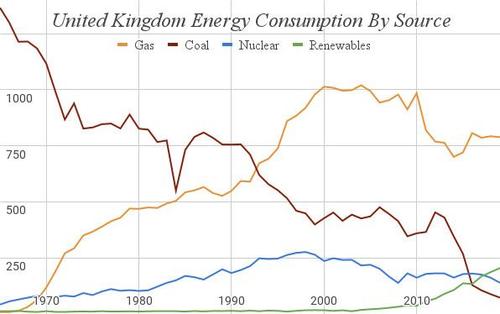

Over the last 50 years, the UK has weaned itself of coal generation and become more dependent on gas as its primary source of electricity generation – much of which is imported from Europe.

Further, heavy investment into renewables over the last decade has also boosted wind output, contributing to 24 percent of total generation in 2020.

The United Kingdom’s coal, gas, nuclear and renewable energy consumption from 1965 to 2019. Source: Our World in Data. (The Epoch Times)

However, the UK has recently experienced a 400 percent spike in gas prices, and a 250 percent price rise for electricity after a confluence of unforeseen factors throttled the country’s supply—including record low wind levels, a fire at a major France-UK electricity interconnector, nuclear plant outages, and a gas shortfall sweeping Europe.

This has already led to the collapse of some energy providers while forcing other industries—such as steelmaking and manufacturing—to opt to shut down during peak hours to avoid paying exorbitant energy fees.

Canavan cautioned against a repeat of the policies that have led to the UK crisis, saying he disagreed with the current “net zero” approach, which does not include nuclear, as the legislation could undermine Australia’s critical infrastructure.

“We should maintain the energy independence—we are lucky to have and grow our coal and gas production,” Canavan told The Epoch Times.

Nationals Senator Matthew Canavan at a press conference at Parliament House in Canberra, Australia on Jun. 22, 2021. (AAP Image/Mick Tsikas)

Canavan also said that Australia could not afford to lose its energy independence amid concern of growing hostilities from Beijing.

“I just don’t think this is the right decision for our country, especially at a time when our leaders and defence officials are very worried about the risk of conflict in our region, potentially being dragged into a risk of conflict with China. This is not the right priority,” Canavan told 2GB radio.

“The right priority right now, surely, is to get more things [that are made in Australia]. That’s what we’ve got to do.

“If you do not have a strong industrial economy, you will not defend yourself. If you cannot be energy independent, you will not defend yourself,” he said.

“And so why would we seek to shut down our coal and gas industries which create an energy independence for us as a nation?”

Deputy Prime Minister of Australia and leader of the National Party, Barnaby Joyce, has not explicitly spoken against a net zero target, but has said that Australia should also consider the economic impact caused by a shutdown of the nation’s coal industry.

On the other hand, Treasurer Josh Frydenberg said that a lack of a concrete net zero deadline could undermine investments flowing into Australia.

“Markets are moving as governments, regulators, central banks, and investors are preparing for a lower emissions future,” Frydenberg said in an address to the Australian Industry Group.

“Increasingly, institutional investors are themselves committing to the net zero goal, like BlackRock, Fidelity and Vanguard, three of the biggest fund managers in the world.”

Australian Treasurer Josh Frydenberg speaks in Melbourne, Australia, on June 28, 2021. (Photo by WILLIAM WEST/AFP via Getty Images)

Frydenberg said Australia’s economy relied heavily on imported capital to stimulate growth across the economy—including foreign investment stock worth $4 trillion (US$2.9 trillion).

“Australia has a lot at stake,” Frydenberg said. “We cannot run the risk that markets falsely assume we are not transitioning in line with the rest of the world.”

Environmental groups have also pressed Australia to fast track its emissions reduction efforts to address their concerns around ecological damage and global warming.

Climate change advocacy organisation, the Climate Council, has urged Australia to commit to a net zero deadline ahead of the 26th United Nations Climate Change conference in Glasgow, Scotland.

“Australia is refusing to increase its 2030 emissions reduction target, or commit to net zero emissions,” said Climate Council spokesperson and Emeritus Professor at Australian National University, Will Steffen. “The science is clear that the world urgently needs to reduce emissions this decade, but none of Australia’s commitments are a meaningful contribution to this goal.”

Tyler Durden

Thu, 09/30/2021 – 02:00

via ZeroHedge News https://ift.tt/3CV90xe Tyler Durden