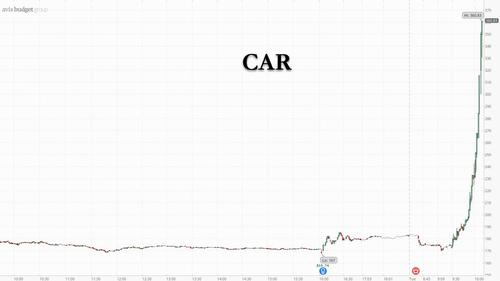

Avis Shares Halted Multiple Times After Soaring As Much As 100% In Minutes

Our first reaction when seeing the exponential move higher in shares of rental car operator Avid Budget Group (whose ticker is CAR yet the company is hardly a “car company”) was whether they, too, had ordered a few hundred thousand Teslas in the latest cross-marketing gimmick.

*AVIS BUDGET TRADING PAUSED AFTER SHARES SPIKE 36%

How many teslas are they ordering?

— zerohedge (@zerohedge) November 2, 2021

Turns out this time the reason was somewhat more fundamental, coupled with a solid dose of technicals: Avis shares soared over 100% to a record high on Tuesday, triggering at least two trading halts, after the car-rental company’s third-quarter results topped expectations, helped by strong demand.

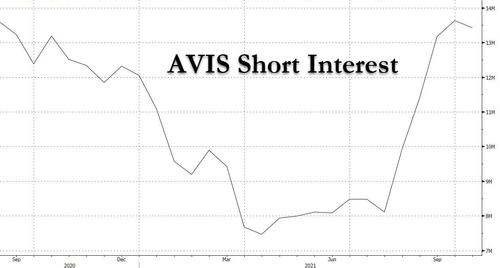

The fact that CAR had the most shorts (as a % of float) in over a year certainly did not slow the exponential surge higher.

Still, analysts were split over their future performance with Morgan Stanley saying high margins cannot be maintained longer term while JPMorgan noted that the strong conditions in the rental car industry can be expected to last for some time.

Morgan Stanley analyst Billy Kovanis (underweight, PT $140 from $110) said Avis delivered against very high expectations in 3Q, hitting a record high Ebitda margin; that said, the analyst continues to believe that 2021/2022 will mark the cyclical peak and doesn’t see Avis maintaining the current margin profile in the long term.

On the other hand, JPMorgan analyst Ryan Brinkman (overweight) said the record results came as revenue rose, driven by both surging Revenue per Day (RPD), which reached record highs in both the Americas and International segments, as well as steadily recovering transaction days. He noted that Avis shares fell sharply after reporting a similar size beat to 2Q expectations, prompting an investor concern of peaking performance.

According to Brinkman, while the 3Q beat may feel similar, JPMorgan estimates it is different, as a great deal of evidence has piled up in the time since 2Q results to suggest that above average normal conditions in the rental car industry are likely to persist for some time

FInally, Deutsche Bank analyst Chris Woronka (hold) said that if any weakness ultimately unfolds in the shares, would view it as likely profit taking from investors with a “this is as good as it gets” point of view.

Despite their opinions, none of the analysts could explain today’s move which likely was precipitated by a solid burst in short covering, as CAR was the stock that many traders used as a pair trade to HTZ, and which is now being unwound.

Tyler Durden

Tue, 11/02/2021 – 10:32

via ZeroHedge News https://ift.tt/31pQrnu Tyler Durden