Biden’s Unusually Late Fed Chair Decision Reportedly Expected As Soon As Today

After months of speculation, President Biden is finally expected to announce his pick for who will lead the Fed for its next term as soon as this week, according to a WSJ report published Sunday evening, while Punchbowl News reported Monday morning that the decision could arrive before the end of Monday’s session.

>@PunchbowlNews scoop: FED ANNOUNCEMENT COMING TODAY

The White House will announce whether it will nominate Jerome Powell to a second term today, according to multiple sources with knowledge of the move.

— Jake Sherman (@JakeSherman) November 22, 2021

And as we have been signaling for months now, it looks like the decision will come down to between whether to renominate Jay Powell for a second four-year term, or to instead elevate Democrat Lael Brainard. WSJ says Biden is ultimately looking for “continuity” when it comes to Fed policy.

Some have described the decision over who will next lead the Fed as the most important move left to make on Biden’s near-term agenda (which is saying a lot considering looming battles over polishing off his ‘BBB’ agenda, as well as raising the debt ceiling, all while the US economy sees an inflationary supernova).

One River Asset Management CIO Eric Peters pointed out over the weekend that Fed Chairman Jay Powell’s greatest political value to President Biden is as a political scapegoat should inflation continue to soar during and after the holidays.

“I need to decide,” whispered Biden to himself, struggling, unsure.

“Lael is just terrific, no doubt, and her Fed wouldn’t dare cut off my funding,” thought the President, old enough to remember bond vigilantes.

“But you can’t help but like Jay, a fine gentleman, a decent human being, and face it, he’s still buying over $100bln of bonds a month with CPI humming hotter than 6%,” thought Joe, having lived through the 1970s inflation. Heck, he was born during WWII and grew up during the post-war financial repression.

“Hard to say we need someone more dovish than Powell,” whispered Biden. But of course, all such considerations were beside the point and Joe knew it deep down.

The only thing that mattered now, was whether it would be better to fire Powell before or after the Democrats lose mid-terms. Because at this point in the cycle, Jay’s greatest political value is in being a scapegoat.

Even the WSJ acknowledged that the decision on the Fed chair position will be “largely political” – despite the fact that the Fed is supposed to be an apolitical institution – after the WSJ editorial board said last week that Biden had recently met with both candidates. Then again, the market has had plenty of time to digest this fact ever since Sen. Elizabeth Warren demanded that Powell – whom she described as “dangerous – resign during a Congressional hearing earlier this fall. Senior WH officials have reportedly confirmed that the decision will come before Thanksgiving. As for whether Biden will continue President Trump’s “tradition” of replacing the Fed chair with a member of his own party, doing so would, in Biden’s case, mean replacing Powell with Brainard, like Trump replaced Janet Yellen with Powell.

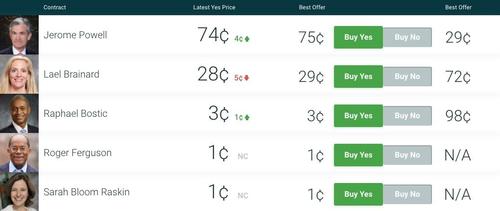

As for betting markets, curiously, PredictIt betting markets have continued to price in much higher odds of Biden sticking with Powell over Brainard.

Source: PredictIt

And when it comes to why Powell has left his decision on the Fed chair to so late in the year, anonymous sources told WSJ that he and his advisers see little upside in a decision that will inevitably be controversial. The thinking is why rush a ‘no-win’ situation, which isn’t technically due until early next year.

President Biden has left the decision to much later in the year than his recent predecessors, Additionally, Biden has one vacancy to fill on the seven-seat Fed board of governors, with two more slots that can be filled by January.

After all, what would better signal “continuity” than sticking with the guy who’s already in there?

Tyler Durden

Mon, 11/22/2021 – 08:22

via ZeroHedge News https://ift.tt/3DGqgXH Tyler Durden