Bonds, Bitcoin, & Big-Tech Puke On Powell Pick; Banks Bid On Brainard Diss

The decision not to appoint progressive-fave Lael Brainard to Fed Chair (and more notably not to pick her fore vice-chair of supervision) triggered selling in STIRs (Powell more hawkish) and buying in bank stocks (no Warren-esque ‘regulator’ running the show).

Dear Lael…

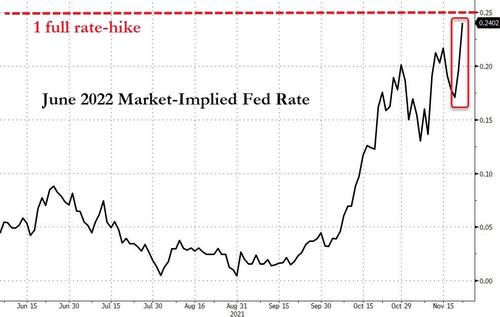

The market is now pricing-in a full rate-hike by June 2022 (that’s before the July end of taper if the current timeline is maintained)…

Source: Bloomberg

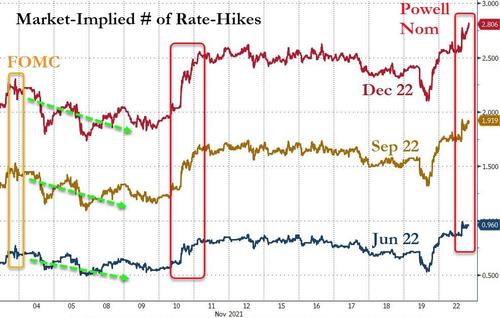

…with almost 3 rate-hikes priced in by Dec 2022…

Source: Bloomberg

Bank stocks jumped on the news (best day in 2 months) that Biden has nominated Powell for another term (and not progressive-friendly Brainard who also was not chosen to head up The Fed’s regulatory division)

Source: Bloomberg

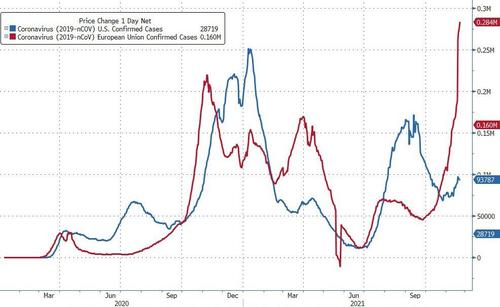

And here’s what’s helping drive risk assets elsewhere!!

Source: Bloomberg

After a chaotic open, Biden’s Powell pick sparked a relief rally in stocks initially but as rates shifted hawkishly, big-tech tumbled (as did the broad market). Once Europe closed, everything went bid as yields soared (and Nasdaq managed to get back to green). But the last 20 minutes of the day saw more violent selling hit the markets again with a big MOC Sell order. Only The Dow managed to cling to some gains (up just 20 points)…

S&P 500 has made 66 new all-time highs this year or 1 new ATH for every 3.37 trading days. This is on pace for the second best year on record, only after 77 ATH in 1995.

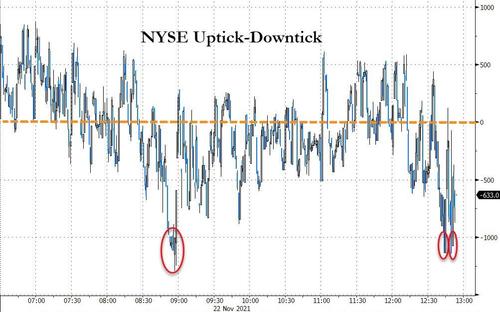

As a reminder, $2.4 trillion in gamma rolled off on Friday, so some chaos was to be expected today as gamma unclenched. Today saw three big sell programs with TICK below -1000…

Source: Bloomberg

Did the recent run in Nasdaq (relative to Small Caps) hit a limit?

As soon as Europe closed, the short-squeeze began…

Source: Bloomberg

The surge in rates sparked a bid in Value stocks as Growth was dumped (before it limped back into the green)…

Source: Bloomberg

Mega-Cap tech was chaos today, gapping open above last week’s highs, puking back below last week’s lows, then ramping back to unch…

Source: Bloomberg

High yield bond prices broke down below the October lows today…

Source: Bloomberg

Treasuries tumbled today with the belly underperforming as two really ugly auctions drove yields higher. The 7Y yield rose over 10bps…

Source: Bloomberg

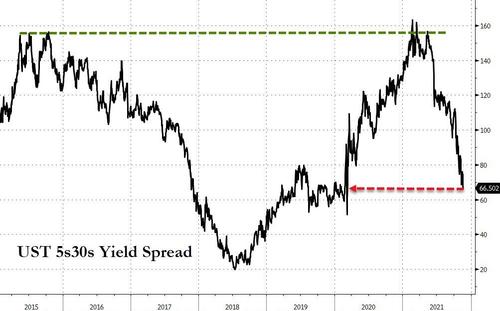

The long-end of the curve refuses to buy into The Fed’s policy plan and is making lower highs (in yield) as the short-end hawkishly rises. 5Y is up 18bps from Friday’s lows, 30Y up just 8bps…

Source: Bloomberg

The yield curve continued to flatten, now at its lowest since March 2020…

Source: Bloomberg

The dollar extended its November gains (now up over 2% this month) spiking to its highest since September 2020…

Source: Bloomberg

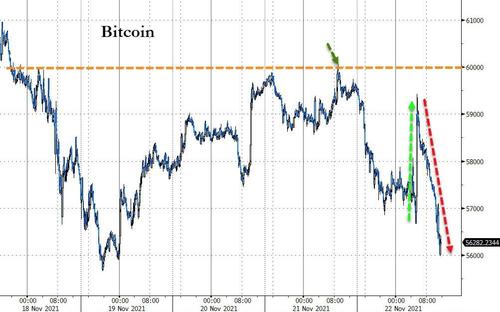

Crypto was a roller-coaster today ended ugly as Bitcoin tagged $60k yesterday, dumped overnight, ripped on the Powell headlines, then tumbled back to last week’s lows around $56,000…

Source: Bloomberg

Gold was clubbed like a baby seal today, plunging back towards $1800…

Oil prices chopped around today as fears over demand (from COVID lockdowns escalating) to supply dynamics (SPR releases vs OPEC+ retaliation), but in the end WTI was higher…

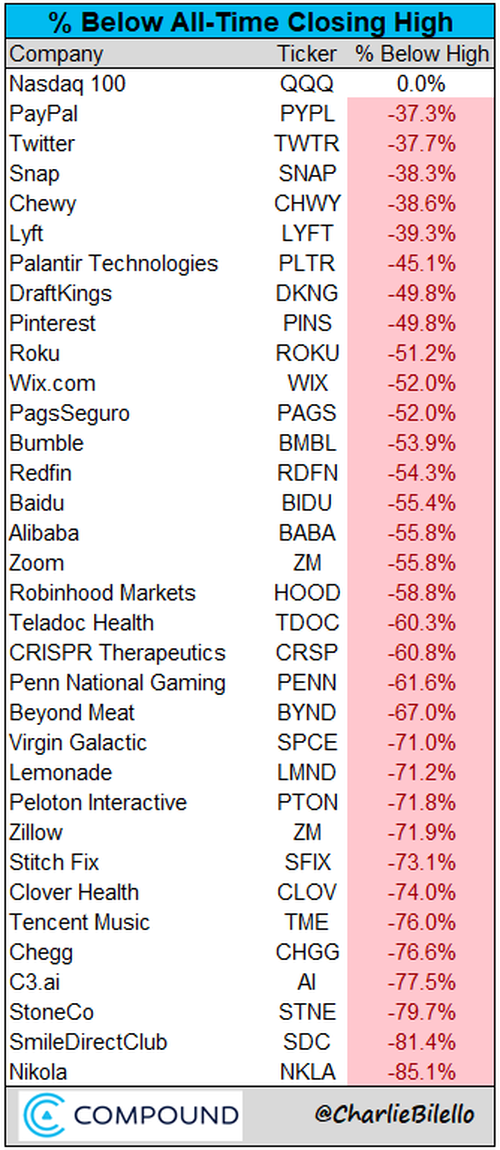

Finally, market breadth stinks….

Source: Bloomberg

And elsewhere, there’s been a bloodbath

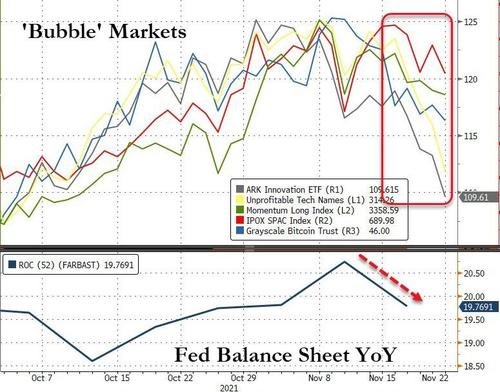

As ‘Bubble’ markets burst as the taper begins…

Source: Bloomberg

Get back to work Mr.Powell!

Tyler Durden

Mon, 11/22/2021 – 16:00

via ZeroHedge News https://ift.tt/3cCTeMj Tyler Durden