Erdogan Tells Lira To Drop Dead As Currency Collapse Threatens Financial System, Bank Runs, Hyperinflation

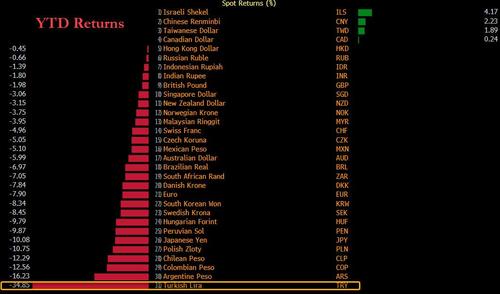

In what should not be confused for a masterclass in FX trading, on Monday Turkey’s President Recep Tayyip Erdogan defended his pursuit of lower interest rates to boost economic growth and job creation, sending the lira cratering to a new record low against the dollar and plummeting to an unprecedented 35% down on the year, surpassing such banana republic currencies as the Argentina, Colombia and Chili Peso.

In his latest validation of the bizarre economic school known as “Erdoganomic” which confuses cause and effect as follows…

- ERDOGAN: INTEREST RATE IS THE REASON, INFLATION IS THE RESULT

… Erdogan said that Turkey has abandoned old policies based on high borrowing costs and a strong currency in the name of slowing inflation, and instead shifted to a new set-up that prioritizes greater investments, exports and strong job creation, while allowing the currency to collapse and no longer engaging in any lira defense.

“We were either going to give up on investments, manufacturing, growth and jobs, or take on a historic challenge to meet our own priorities,” he said after a cabinet meeting in capital Ankara.

While most central banks are talking of tightening policy as the global recovery fuels a surge in prices, Turkey’s decision to slash 4 percentage points off borrowing rates since September even as inflation has soared above 20%, has stunned markets and frustrated investors who complain its monetary policy is becoming increasingly erratic and unpredictable.

Some, such as Swedbank AB strategist Hans Gustafson used the dreaded “H” word: “It is very hard to have a view on a fair value for the lira as long as economic policy is out of sync with fundamentals. The lira will continue to fall until economic policy tighten. Current path will lead to hyperinflation and a balance of payments crisis.”

As everyone knows, Erdogan is a proponent of the insane mantra that high borrowing costs cause inflation rather than curbing it, and he has demanded a so far receptive central bank cut rates even while price gains race along at near 20%.

Erdogan’s pledge to double down on his most recent push for cheaper funding by the nation’s central bank sent the lira tumbling after Turkish markets closed. The currency dropped as much as 2.1% to 11.4767 per dollar and was trading 1.4% lower at 11.4250 at last check.

Below are some of the highlights from Erdogan’s bizarre, paranoid, at time schizophrenic speech, which reveals that Turkey truly is on the verge of a hyperinflationary collapse:

- There is a “game” being played against Turkey by those using interest rates, the currency’s exchange rate and inflation

- “We’re pleased to see that the central bank’s policy rate is being kept low”

- Turkey will crack down on “unfair, inexplicable price increases” by those using a weak lira as an excuse

- “We know quite well what we’re doing with the current policy, why we’re doing it, and the kind of risks it entails and what we’ll achieve at the end”

- The belief that inflation can only slow if the economy contracts has no basis

Erdogan’s ruling AK Party has for decades based its electoral success on rapid levels of economic growth, often driven by reducing borrowing costs to encourage credit expansion. When the economy sank during the pandemic, support for Erdogan and his party also fell to all-time lows, prompting him to redouble efforts to propel growth though rising prices are hurting his traditional working class base the most.

However, in recent months, perhaps having realized that trying to defend the collapsing lira is futile, Erodgan shifted his tone and questioned why business people did not take out loans and instead of investing in the economy, don’t invest in risk assets (i.e., buy stonks) as rates were lowered in the last few months.

“Then they get together (and) talk about high interest rates,” he said last week. “What type of people are you? If you are a businessman you are on the side of investment, so here are you go: loans with low interest,” Erdogan said.

While it remains to be seen if Erdogan’s pivot is accepted by the population, one thing is undpistable: Turkey’s currency crisis is driving up the cost of food, medicine and other essentials for average Turks, and poses a threat to the country’s banks and large companies if the lira’s slide isn’t arrested, economists quoted by the WSJ said.

The steep drop in the lira – which as noted above has lost more than a third of its value to the dollar in eight months – is shaking a Turkish society that had long prided itself as an ascendant economy that rivaled its European neighbors. Ordinary people are now struggling with a decline in their living conditions, with rampant inflation putting pressure on wages and eating into savings.

“My life is completely changed,” said Kemal Ince, an Istanbul shopkeeper who hails from Rize, the conservative Black Sea stronghold of President Recep Tayyip Erdogan. Ince says that he is ashamed to have to increase the prices of coffee, olives and cheese, and that even as he charges his customers more, he still feels squeezed.

“I don’t have the luxury of spending money on anything,” he said.

Turkey’s current crisis is the worst the country has faced since 2018, when the lira also dropped precipitously amid a crisis in relations with the U.S. Worries over potential loan defaults and stress on banks were so high in 2018, the country’s banking regulator allowed lenders to extend loan maturities and facilitate debt restructuring.

Turkey’s major banks and companies—many crippled by big foreign-currency loans—now face longer-term risks of instability if Erdogan continues down the path of cutting interest rates further, economists and businesspeople here said.

“These kind of imbalances might end up with a run on banks,” said Omer Gencal, a former executive at several Turkish and international banks and now an official with an opposition party. “The current situation isn’t sustainable.”

According to the Turkish central bank, nonfinancial companies had about $160 billion in foreign-exchange assets and $280 billion in liabilities as of August. The gap has narrowed since 2018, though it is still wide. Banks’ lending in foreign currency ranged from 24% to 45% of their total loans in the first half of the year, according to Fitch Ratings.

While banks have kept their nonperforming loans in check, including through the pandemic, Fitch warned in a report last month that “risks remain high given exposure to the volatile Turkish operating environment, risky segments and sectors, significant foreign-currency lending and the high lira interest-rate environment.”

Jason Tuvey, senior emerging-markets economist at Capital Economics, however, told the WSJ that the greatest threat for Turkish banks is their ability to rollover their external debts if investors get increasingly spooked.

Short-term external debt of banks stood at $84 billion, or close to 10% of the country’s gross domestic product. Mr. Tuvey said April next year will be a key month for banks, given some of that debt will be due then. Tuvey said that back in 2018 banks were able to draw down their foreign-exchange assets held at the central bank to meet external debt repayments.

“The upshot is that banks would be able to muddle through for a short period as in 2018, but they may struggle to cope if access to international capital markets were to be restricted for a considerable amount of time,” Tuvey said.

Turkey’s large companies may be able to cope with the crisis for the moment because of foreign-currency reserves that he said might be even larger than official figures show, an ability to pass costs onto consumers, and government assistance including loans, according to Hakan Kara, a former chief economist at the central bank.

But as with every case of soaring inflation, the crisis has fallen hardest on ordinary Turks, many of whom are swapping their earnings into foreign currency and cryptos, or looking for ways to flee the country.

“I have no confidence left in the Turkish lira because we cannot see what lies ahead for us in this country anymore,” said a woman in her 60s who walked into an exchange office in Istanbul to change 50,000 lira into dollars. The woman, who owns a pharmacy, asked to have her name withheld because of fear of government reprisal.

The government imposed a new rule this week requiring customers to present identification cards any time they exchange more than $100 worth of currency.

Alas, as noted above, Erdogan doesn’t appear likely to change course, despite the political risks of soaring inflation. He has intensified his calls for low interest rates and the central bank this week used language that suggested it would cut rates again in December.

Having ruled Turkey for nearly two decades as both prime minister and president, winning elections in part by vastly expanding the country’s economy, Erdogan’s time in power is at risk of coming to an end as the plummeting lira erodes the standard of living for millions of Turks, driving away potential voters.

“Erdogan runs everything. He doesn’t allow either the finance minister, or the central bank governor, or anyone else to do their jobs,” said the owner of an exchange office in Istanbul.

Tyler Durden

Mon, 11/22/2021 – 14:07

via ZeroHedge News https://ift.tt/3cAYmjZ Tyler Durden