JPMorgan Warns S&P Fair Value Is 2,500 If Inflation Shocks Do Not Fade Away

Last week, when discussing the latest Bank of America Fund Manager Survey, we pointed out that yet another paradox had emerged: on one hand, Wall Street professionals were the most overweight stocks since 2013, while on the other virtually nobody was expecting a stronger global economy in the future, an unprecedented divergence between these two data sets the likes of which has never once been seen in survey history.

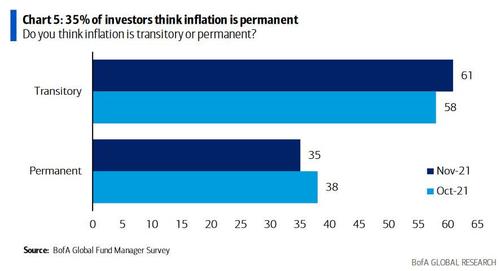

How does one make sense of this historic gap? Well, one doesn’t – this is just Wall Street goalseeking any and all scenarios to make it seems that being all in risk is the only possible trade, and the only way this particular goalseek does not blow up is if the finance bros also “believe” that inflation is transitory (something not even the Fed is doing anymore), as a persistent inflation would lead to a painful repricing of all asset classes sharply lower. That’s why despite sharply higher than expected October inflation data, a majority of FMS investors acknowledge that inflation is a risk but only 35% think it is permanent while 61% think it is transitory…

…while a net 14% of investors now expect global inflation will be lower, the lowest level since the onslaught of COVID-19 in Mar’20. In other words, 51% of investors expect lower inflation while 37% expect higher inflation.

Setting aside how laughable Wall Street’s delusion with “transitory” inflation has become when it is by now painfully obvious that prices will not revert to previous levels and at best will see the pace of galloping increase moderate somewhat, although in light of persistent wage growth one can just as easily argue that inflation will keep surging for years, the bigger question is what happens when the day of reckoning comes and Wall Street’s conviction of transitory inflation comes crashing down – say we get another 2-3 outlier CPI prints; forcing Wall Street to stop ignoring the imminent threat posed by surging inflation.

Trying to answer this question is JPMorgan quant Nick Panigirtzoglou, who in his latest Flows and Liquidity note titled “What if the rise in inflation volatility persists?” note (available to pro subs in the usual place) looks at what would happen to stocks if inflation volatility surges.

The reason why is because as the Greek strategist explains, in his longer-term fair value framework for 10y real yields and the S&P 500, “inflation volatility is an important input as a proxy for term premia in the former and for risk premia in the latter.” And with upside inflation shocks in the US and UK in the last week, JPMorgan notes that “the question of the persistence of inflation has again featured heavily in our discussions with clients” while the steep rise in inflation readings “has also raised questions over inflation volatility.”

In other words, what does a rise in inflation vol imply for real rates and equities? To answer this question JPM updates its long-term fair value model for 10y UST yields and the S&P 500.

First, some background: Turning first to the former, the JPM model values the 10y real yield as a function of the real Fed funds rate, inflation volatility as a proxy for term premia, and three major components of net demand for dollar capital: from government, corporate and emerging market issuers. The bank measures these as the government deficit, the corporate financing gap (the difference between capex and corporate cash flow), and the EM current account balance, all as a % of US GDP.

In theory, higher deficits by governments and corporates (ought to) exert upward pressure on yields as overall demand for capital rises, while external surpluses of EM countries ought to push US yields lower due to repayments of dollar-denominated debt and/or dollar asset accumulation by their central banks.

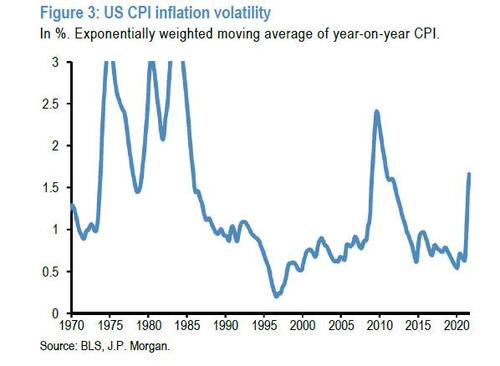

In the JPM model, inflation volatility has a significant influence given a coefficient of 0.75. In other words, a 100bp increase in inflation volatility would put 75bp of upward pressure on 10y real yields. The next chart shows the 5y moving average of US CPI volatility over time, which shows that inflation volatility has already risen markedly, from around 0.6% in 1Q21 to 1.6% after the October CPI release. According to JPM, this metric looks likely to rise further, potentially to around 2.2% during 1H22 based on the bank’s economists’ inflation forecasts before starting to drift lower.

Based on JPM calculations, the increase in inflation volatility that has already taken place would push up 10y real rates by 75bp. And if inflation vol drifts further to 2.2% it could put an additional 40bp of upward pressure on real rates. In this risk scenario where inflation vol proves persistent and is fully incorporated into term premia in rate markets, it would suggest a fair value for the 10y UST real yield of +40bp.

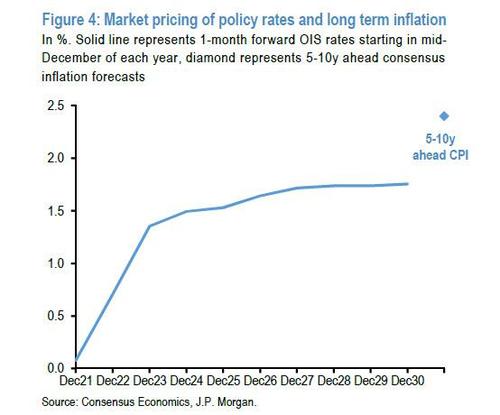

As a quick aside, JPM here asks why do real yields remain so low, which as a reminder is the market’s $64 trillion question as we discussed in “The Most Important Question For The Market Is Identifying The Driver Behind Record Low Negative Real Rates”? JPMorgan’s response is that this is partly because markets price in negative real policy rates even a decade out. This is shown in the next chart which depicts 1m forward USD OIS rates starting in mid-December of each year and the 5-10y ahead inflation forecast from Consensus expectations.

This pricing also stands in contrast with JPM economists’ own revised Fed forecast of a start of the hiking cycle in September 2022 and quarterly 25bp hikes thereafter at least until real policy rates reach zero (2022 US economic outlook, Feroli et al, Nov 17th). This would

suggest policy rates reaching 2% by mid-2024 and potentially 2.5% by end-2024.

Meanwhile, the broader bond market has – similar to the BofA Fund Manager Survey respondents – looked through the rise in inflation volatility thus far, “treating it as a transitory shock.” However, as Panigirtzoglou warns, “if inflation volatility remains elevated, say fluctuating around 1.5-2% for a prolonged period, this could start to put more meaningful upward pressure on term premia.” This could further be compounded by the Fed’s taper, given that one of the channels that QE operates through is via suppressing term premia.

Bonds aside, what about the implications of a rise in inflation vol for equities, the one asset class which seems impervious to absolutely all negative newsflow and is only dependent on how much liquidity central banks will inject at any one moment?

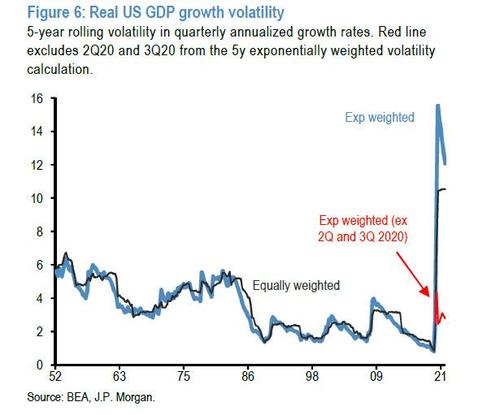

Well, as the JPM strategist notes, he had argued previously that equity markets have effectively looked through not only the surge in inflation vol but also the the rise in real GDP volatility, given the significant policy support from fiscal and monetary authorities. Effectively,

following policy measures to smooth the impact of the pandemic on incomes and avoid a situation where disorderly markets, particularly credit markets, amplify the shock, equity markets focused more on the eventual recovery in earnings than on the near term vol shock. Indeed, after the Q2 2020 real GDP contraction in excess of 30% and the Q3 2020 expansion of a similar magnitude, the volatility of GDP readings has been markedly more modest – this is shown in Figure 6 with the red line, which excludes 2Q20 and 3Q20 from the exponentially weighted real GDP volatility calculation. In other words, the run rate of real GDP volatility, while still above pre-pandemic levels, has already shown signs of normalizing.

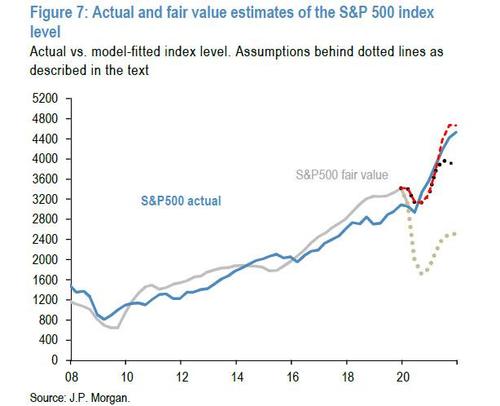

So how have equity markets processed the other vol shock, that of inflation? The next chart shows how JPM’s fair value model would look like with three different scenarios applying after 1Q20.

- The first, shown in as the grey dotted line, mechanically applies the headline increase in both real GDP and inflation vol.

- The second scenario looks through the shock in real GDP vol but incorporates the headline increase in inflation vol, shown as the black dotted line.

- The third and final scenario (red dotted line) assumes markets look through both the real GDP vol shock as well as the rise in inflation vol.

Since the blue line – which is the actual S&P500- has been tracking the red dotted line, it suggests that equity markets have looked through both volatility shocks, effectively assuming both will prove to be temporary.

As noted above, the run-rate of real GDP vol excluding the 2Q20 and 3Q20 swings around the trough of the pandemic-induced recession has already shown signs of normalizing, which suggests that markets looking through the real GDP vol shock has been a reasonable approach.

And while it is clear that consensus is, as in the case of the FMS, that any kind of economic shock will be transitory, is it equally reasonable for both equity and bond markets to look through the inflation volatility shock?

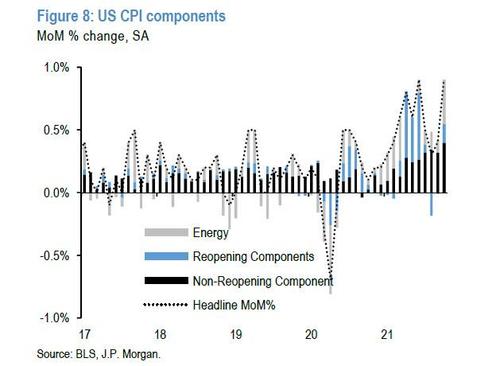

According to JPM, this ultimately depends on the nature of the current inflation shock. As the bank recent argued in last week’s J.P. Morgan View last week, a big reason behind the inflation vol has come from energy prices and re-opening components, such as used and rental cars, vehicle insurance, lodging, airfares and food away from home, undoubtedly more affected by the Delta variant waves, and the fading of these drags has generated a rebound in services activity that is sparking a normalization in prices (at least until the current spike in cases leads to another round of lockdowns as we have already seen in Austria).

According to Panigirtzoglou, who like his quant colleague Marko Kolanovic has traditionally been extremely bullish on stocks and bearish on cryptos – because any agent of the establishment system can not possibly support both fiat-driven and digital gold-based assets – these volatile components “should ultimately stabilize and the accompanying volatility they have induced should fade.” Of course, this is almost completely wrong, just as wrong as Goldman’s monthly inflation forecasts for all of 2021, and JPM does in fact admit that it could be wrong conceding that “there has been some upward pressure on inflation readings beyond these components, pointing to some persistence in inflation risks.” Then again, in keeping with the bank’s bullish mandate, Panigirtzoglou concldues that “provided these persistent pressures do not also become more volatile, or provided market participants have confidence that central banks will respond to contain these pressures, markets can still look through inflation volatility.”

However, in a surprising reversal from the bank’s uniform and stbborn bullishness, the JPM quant acknowledges there is risk that inflation volatility could stay elevated for a longer period, which could eventually feed through to markets pricing in higher term premia and risk premia that would put upward pressure on real yields and downward pressure on equities.

The outcome for stocks? An S&P500 which collapses to its “fair value” of 2,500 as all those inflation and GDP shocks that the market has so eagerly ignored so far, turn out to be persistent, and crush risk assets.

However, before anyone goes and accuses JPMorgan of being bearish, Panigirtzoglou emphasizes “that this is a risk scenario, not a baseline view.” Translation: “this is what will happen, we just don’t want to tell our bullish clients just yet.”

Tyler Durden

Sun, 11/21/2021 – 21:00

via ZeroHedge News https://ift.tt/3oO2OBV Tyler Durden