Ugly 2Y Auction With Biggest Tail Since Covid Crash; Sends Yields To Session Highs

In a bizarre day for risk assets, one where stocks surged to a new all-time high promptly after the start of trading only to fade all gains and push the Nasdaq into the red, moments ago the Treasury sold $58BN in 2 year paper in a very poor, tailing auction, which was a mirror image of last month’s stellar 2Y sale which only saw tremendous interest due to the buying frenzy by shorts who needed physical paper to offset their futures shorts.

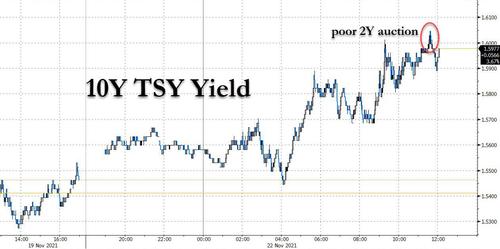

In any case, today’s 2Y auction priced at a high yield of 0.623%, was well above last month’s 0.481% and tailing the When Issued 0.612% by 1.1bps. This was the biggest tail since Feb 2020 when the economy was about to implode.

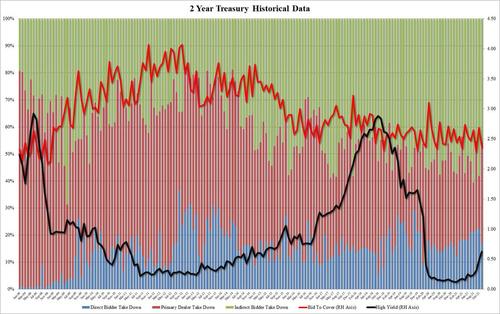

The Bid to Cover was also ugly, sliding sharply from last month’s 2.686 to just 2.358% and far below the 6-auction average of 2.56.

The internals were also very ugly, with Indirects taking down just 45.62%, the lowest since September and far below both October’s 58.14% and the recent average 54.08%. And with Directs taking down just 17.2%, the lowest since March 2021, Dealers were left holding a whopping 37.2%, the highest since April.

Overall, a very poor auction, one which could have been better if only more traders were short the cash and needed to cover into today’s action similar to last month. In any case, absent continued squeezes it’s hard to see why the short-end will do better for the foreseeable future especially now that rates markets expect the first rate hike to hit in June of next year apparently hinting at a shorter than expected tapering cycle.

The auction was so ugly it pushed the 10Y yield to the highs of the day, and even though stocks are now puking yields remain higher on the day.

Tyler Durden

Mon, 11/22/2021 – 12:08

via ZeroHedge News https://ift.tt/3lkv9yT Tyler Durden