Yield Spike Gets Even Uglier After Dismal 5Y Auction Has Biggest Tail In 18 Months

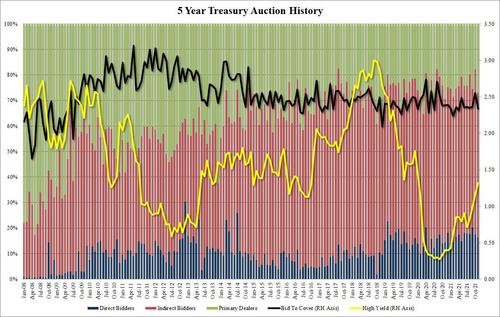

In a day when risk markets have turned uniformly ugly since the start of cash trading, moments ago the day’s second coupon auction (due to the holiday-truncated weekly schedule) was just as ugly as the first one from 90 minutes ago, when just after 1pm ET, the Treasury sold $59BN in 5Year paper in another ugly, tailing auction.

The high yield of 1.319% was more than 16bps above October’s 1.157% and the highest since Jan 2020; it also tailed the When Issued 1.309% by 1 basis point, the biggest tail since May 2020.

The Bid to Cover of 2.34 was, just like during today’s prior 2Y auction, a big drop from last month, sliding to 2.34 from 2.55, and below the six auction average of 2.41.

Finally, the internals were quite ugly as well, with Indirects awarded 56.9%, down from 64.8% last month and below the recent average of 60.3%. And with Directs also stepping back and only taking down 16.2% or the lowest since May 2021, Dealers had to step in aggressively and take some 26.9% of the final award, the most since February.

Overall, another very ugly auction which – without the benefit of a short squeeze to balance out deeply negative repo rates – and together with today’s dismal 2Y auction revealed just how little demand there is for the short end at prevailing prices especially with the Fed now tapering and set to end tapering in 6-7 months.

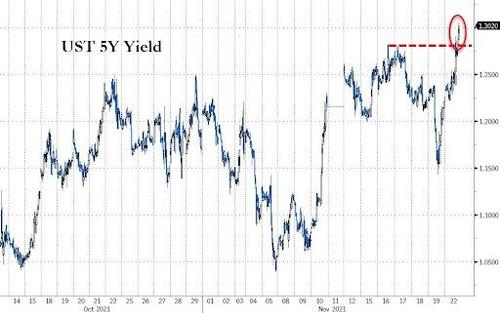

Not surprisingly, the 5Y yield spiked to session highs…

…. as did the 10Y…

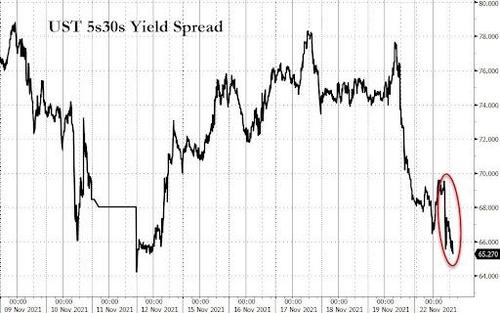

… while the 5s30s curve continues its pre-recessionary collapse.

Tyler Durden

Mon, 11/22/2021 – 13:17

via ZeroHedge News https://ift.tt/3HFMQm1 Tyler Durden