Futures, Oil, Cryptos Soar As Omicron Panic Fades

It appears that Goldman was right again.

As we reported yesterday, the bank’s traders (not the worthless research analysts whose output is evaluated by the pound not P&L) blasted a report to their best clients, claiming that “we can have reasonable degree of confidence that this mutation is unlikely to be more malicious and that the existing vaccines will most likely continue to be effective in preventing hospitalizations and deaths. As such, while we would monitor the situation in Gauteng closely over the next month, we do not think that the new variant is sufficient reason to make major portfolio changes.” That position was bolstered overnight by two of South Africa’s top doctors (not worthless propaganda quacks like Anthony Fauci) including the one who first discovered the so-called “Omicron”, said that the latest strain was “Extremely mild” and speculated that the numerous mutations in the spike protein “destabilize” the virus.

And at least in early Sunday night trading, after suffering their worst post-Thanksgiving plunge since 1941, futures are euphorically ramping higher, unwinding a substantial portion of the Friday puke, with Eminis trading as high as 4630 after trading as low as 4577 on Friday…

… oil surging, with WTI spiking as much as 5.7% even if it clearly still has a ways to go recover its Friday losses when WTI plunged $10 as international travel restrictions were reimposed by many countries and airline stocks plummeted. And yet, as Goldman explained on Friday, even with a worst Omicron case scenario, Brent below $80 is a steal here:

Meanwhile, in FX we are seeing safe havens such as the Yen and Swiss Franc slide more than 0.2%, with epicenter pairs like the ZAR surging.

Peter Tchir, head of macro at Academy Securities Inc., said he’s watching emerging-market currency and bond markets, and Bitcoin, “as leading indicators of potentially more risky asset unwinds to come.” Well, in that case Peter should be happy because in in crypto both bitcoin…

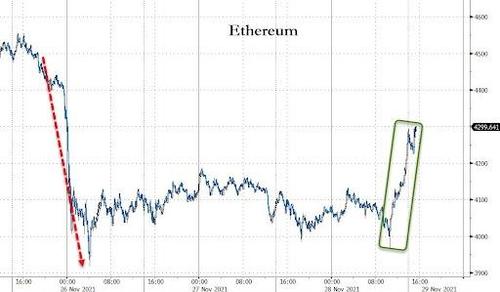

… and ethereum…

… are storming higher, maybe because they are finally realizing that they live in the best of all worlds, one where new Omicron lockdowns would lead to much more money printing (bullish for cryptos which are a hedge to central bank idiocy) while the quick elimination of negative Omicron consequences would just lead to more inflation (also bullish for cryptos which have emerged as inflation hedges).

Still, confusion remained. “We really need some more answers to figure out the impact on growth,” said Priya Misra, global head of rates strategy at TD Securities. “Risk assets are pricing in uncertainty.”

Naturally, Moderna’s chief medical officer – sniffing out an opportunity to buy an even bigger yacht – said a reformulated shot to combat the new strain could be available early in the new year. In other words, everything that has been done so far has been for nothing, because science, and because let’s do more of what hasn’t worked to fight what is coming.

Tyler Durden

Sun, 11/28/2021 – 18:51

via ZeroHedge News https://ift.tt/3cVnq5F Tyler Durden