Beijing Capitulates: Urges Local Govts To Unleash Debt Flood As Cities Begin Backstopping Property Developers

Despite the best efforts by South African doctors to temper the panic sparked by the emergence of the Omicron strain, it appears that western politicians and their media and “science” lackeys won’t let go so fast, and one of the potential casualties is China, which will either be forced to engage in more lockdowns, depressing the economy, or find itself engaged in far less trade with a world that is about to undergo another wave of restrictions.

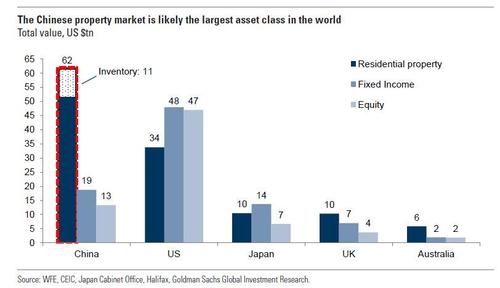

All this, of course, is happening as the recent deep freeze of China’s property market – the largest asses in the world according to Goldman Sachs…

… and sparked by the repeated near-death experiences of Evergrande – has unleashed a bone-crushing shockwave across China’s economy, which takes place as Beijing continues to maintain its deleveraging stance amid Xi’s “shared prosperity” drive, which has meant far less nearly created credit is available to mask the current weakness in the economy.

And yet, cracks are finally starting to show in Beijing’s deleveraging resolve and last week China’s State Council called on local governments to sell more special bonds this year in order to boost investment amid a slowdown in the economy.

According to Bloomberg, Premier Li Keqiang chaired a meeting of the State Council (i.e., China’s cabinet) on Wednesday, urging local governments to have more ongoing construction of projects at the beginning of next year, the official Xinhua News Agency reported. And since they need money to fund these projects, the meeting also called on them to make better use of proceeds from special bonds to expand domestic demand.

Said otherwise, China is once again quietly restarting the re-leveraging process, only this time instead of consumer loans, corporate bonds, or shadow debt (in the form of trusts), Beijing is targeting local government special debt issuance as the focal point of the next debt bubble.

Xinhua confirmed as much, reporting that “regional governments should step up project preparation, facilitate the launch of projects that are mature, and make reasonable requests for special bond quotas next year.” And to assist this upcoming debt burst, “the authorities will study the possibility of granting some bond quotas in advance of next year, according to the report, as they did in the recent two years.”

Meanwhile, echoing what he said at the start of the month, premier Li reiterated the economy is facing “new downward pressure” and cross-cyclical policy needs to be strengthened. This comes as economists have pared back their growth forecasts for the fourth quarter to a median of just 3.1%, while some say the economy’s pace next year could be slowest since 1990 (excluding last year’s pandemic impact), as low as 5% or even less according to some skeptics.

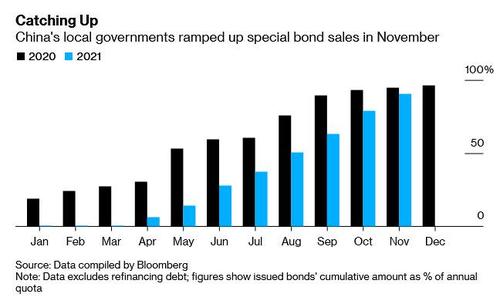

Alas, there is an unexpected problem with Beijing’s plan: lack of demand for the debt. As Bloomberg notes, sales of local government special bonds have been particularly slow in the first ten months of this year, partly due to a lack of quality projects. Previously, the Ministry of Finance urged local authorities to finish issuing all the bonds within this year’s quota by November. Alas, the collapse in Evergrande, and the broader property market has taken all the wind out of China’s construction sails in 2021.

Needless to say Beijing had to spin this unpleasant outcome, and instead the State Council meeting said that the Local governments have achieved positive results in managing debt and reducing so-called hidden debt in recent years, with the government’s overall debt-to-gross domestic product ratio trending lower.

And while the meeting added that authorities need to step up auditing and monitoring of proceeds raised from the bond sales, China Securities Journal reported on Thursday that fiscal policy will play a bigger role in ensuring the economy has a stable start in 2022. And where will funding for said “fiscal policy” stimulus come from? Well, as Citic Securities economist Zhu Jianfeng said, while local governments’ income from land sales might fall, they should issue more special bonds to help fund investment projects.

Then on Wednesday, the Securities Times reported that according to another Citi analyst, Cheng Qiang, regional government may issue more than 4 trillion yuan ($630 billion) worth of special bonds next year, up from the 3.65 trillion yuan budgeted for this year. Expect the final number to be much higher, especially if Omicron is indeed as dangerous as Fauci & Co. are trying to make it seem.

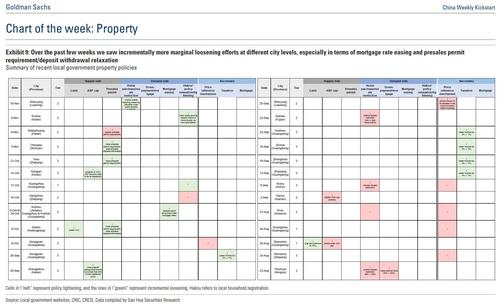

Finally, a look at the latest Chinese property regulatory actions compiled by Goldman shows that over the past few weeks there have been incrementally more marginal loosening efforts at different city levels, especially in terms of mortgage rate easing and presales permit requirement/deposit withdrawal relaxation. Said otherwise, while China is not yet panicking it realizes that the deleveraging campaign is now effectively finished, and so expect much more debt creation in China next year.

In short, China is about to restart its debt machine, and while all Chinese debt is of course fungible – since the state owns and controls all – this time around it will be the “local government” silo that will serve the the global growth dynamo for the coming year.

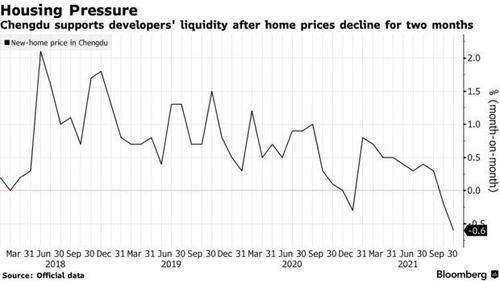

Meanwhile, as China targets property stabilization at the macro level via local government bond sales, it is also expanding its “micro” focus and also last week, a Chinese city rolled out a series of easing measures to boost liquidity at property developers, becoming the first major local government to address a cash crunch engulfing the real estate industry.

Chengdu, the capital of the southwestern province of Sichuan with a population of about 21 million, will accelerate approvals for home sales and property loans as well as ease restrictions on using proceeds from pre-sales, according to a statement posted by the local housing authority last week, Bloomberg reported.

“Chengdu is the first city authority to call for faster property-related loans in a clear official statement,” said Yan Yuejin, research director at Shanghai-based E-house China Research and Development Institute. “We may see other initiatives to press banks on faster mortgages soon.”

The capitulation by Chengdu comes as new-home values in the city dropped 0.6% in October from a month earlier, the biggest slump in four and a half years.

Here are some of Chengdu’s key measures allowing developers to boost cash:

- The housing authority vowed to shorten the time for compulsory pre-sales procedures by at least a third

- Developers will be able to use proceeds from pre-sales if they meet certain construction progress

- Chengdu will work with financial institutions to increase credit quotas for developers and accelerate loan approvals

- The city said it will coordinate with banks to extend property development loans for key developers

The move to boost liquidity in the beleaguered building sector comes as China’s home slump deepens, adding pressure on authorities to stabilize an industry that’s estimated to account for almost a quarter of economic output.

Separately, last week some cities relaxed rules for land sales – a key revenue source for municipalities – after cash-strapped developers became reluctant to bid, prompting the abovementioned appeal on local governments by China’s State Council to sell more special bonds to boost investment amid a slowdown in the economy.

The bottom line is that as many had expected, regulators are finally fine-tuning their long-running crackdown on the property sector after the near implosion at Evergrande and other junk-rated developers began spreading to higher-rated peers. In late September, the central bank urged financial institutions to help local governments stabilize the rapidly cooling housing market and ease mortgages for some homebuyers. Official media reported in recent weeks that faster mortgages are already on the way.

“It shows how the city government cares about developers’ liquidity risks,” said Pan Hao, a property analyst at KE Holdings, adding that Chengdu is looking at different measures to prevent developers’ cash risk from blowing up. And now that one city has adopted a proprety bailout strategy, expect every single other Chinese city to follow suit, the result of which will be another major can-kicking for China’s property sector at the expense of trillions in new debt, this time at the local government level.

Tyler Durden

Sun, 11/28/2021 – 20:00

via ZeroHedge News https://ift.tt/3FPptEC Tyler Durden