Top 10 Themes For 2022: Part 2

Picking up where we left off with the first five of Deutsche Bank’s Top 10 Themes For 2022, here is Part 2 of what the bank thinks will be the biggest themes of the coming year. Themes covered include i) Antitrust (or competition) renaissance; ii) The end of free money in stock markets; iii) Space: a worrying geopolitical frontier; iv) Central Bank Digital Currencies: Growing into reality and v) ESG bonds go mainstream. (click here for Part 1 which covers the following themes 1) An overheating economy; 2) Covid optimism; 3) A hypersonic labor market and inflation; 4) Corporate focus on asset efficiency; 5). Inventory glut. )

* * *

6. Antitrust (or competition) renaissance, by Luke Templeman

Like it or not, US companies will likely face tougher competition in 2022. The rest of the western world is likely to follow suit. An executive order issued by President Biden in July argued that over the last several decades, “competition has weakened in too many markets”. It blamed this for widening racial, income, and wealth inequalities, as well as suppressing worker power. A “whole-of-government” effort was promised on 72 initiatives. That followed just months after the chair of the Federal Trade Commission was given to Lina Khan who is known for her work on anti-trust and competition issues.

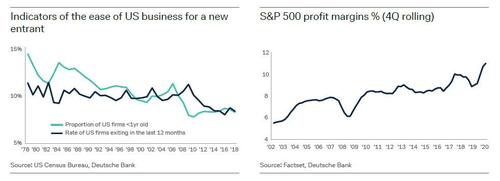

If Biden’s initiatives have teeth, companies may be about to witness a sharp reversal of the trend towards less competition seen over the past few decades. The following charts show just two indicators that life has become more difficult for new companies in the US.

The result of diluted competition is that corporate profit margins have grown. Last quarter’s results showed that profit margins in S&P 500 companies have hit multi-decade highs (despite covid) and have almost doubled to 11.2 per cent (on a four-quarter rolling basis). That has helped corporate earnings comfortably outpace GDP over the last two decades.

Of course, falling costs of labor and capital over the last few decades have helped boost profits. But in a textbook competitive market, these advantages should be competed out and/or passed onto customers.

The tighter competition has been, in part, due to consolidation after rule changes in the 1980s gave corporates the confidence to ramp-up mergers and acquisitions. Hence a lower number of large firms in many markets. For instance, only a handful of mobile carriers and airlines compared with their numbers 20 years ago. Meanwhile, there is an open-ended question of whether some large technology groups stifle or promote competition. Some argue that scale delivers cheap goods to customers; other say it reduces innovation and the incentive to spend on capex and workers.

Regardless of the reason for less competition, Biden appears to have the political will to boost it. And this desire will be undergirded by the will of workers. Post-covid, many workers, particularly low paid staff, have significantly greater bargaining power. As a result, long-standing discontent with wages lagging profits are morphing into action. Large firms, including Amazon, Disney, and McDonald’s, have all given pay rises since covid.

So, with political will at the top supported by worker power at the bottom, the companies stuck in the middle should expect that 2022 will usher in an era of greater competition, an easier time for new entrants, and more hurdles to mega-acquisitions. It could mean that companies come to see high profit margins as an anomaly rather than the norm.

* * *

7. The end of free money in stock markets, Luke Templeman

“Will the stock market crash in 2022 as the Fed tapers and likely raises rates?” While many investors fret over this question, the forgotten theme that may accompany the end of free money is not whether stock markets will crash. Rather, it is how investors may be forced, for the first time in a decade, to consider how the end of free money may reorder equity markets on the inside.

The end of stimulus is certain to slow the money flow into equity markets. And if rising interest rates push bond yields higher, investors will have options elsewhere in bond markets and other rate-sensitive investments that have been ignored in recent years. As investments aside from equities become more appealing, frustrated active asset managers may finally witness the return of fundamental investing.

Equity markets will be shocked by the return of fundamentals. After all, in the era of free money, many frustrated ‘value’ managers have given up. The following charts show that as markets recovered from the financial crisis, traditional ‘value’ investing became very difficult.

The reason for the underperformance of ‘value’ is not simply explained by the outperformance of technology ‘growth’ stocks. It is also because the financial crisis catalyzed the era of super-cheap money. A significant proportion of this poured into equity markets, much through passive funds which bought the index. As a result, all stocks began to move in similar ways regardless of the profitability of the underlying companies. The following chart shows that between the 2008 financial crisis and covid, the dispersion (or spread) of stock returns disconnected from the dispersion of returns on equity. In other words, even though corporate profits were more different, their stock prices remained similar.

Since covid, stock markets have flirted with the idea of once again discriminating between companies with strong and weak profitability. But the stimulus-fuelled rally has largely ended that. Investors are, once again, simply throwing their money at the entire stock market, particularly in passive funds.

In 2022, as equity markets lose the flood of money that has propped up all stocks over the last decade, investors may be forced to become more discerning. There are signs this is beginning to happen. Postcovid, the dispersion of returns is higher than it has been in almost a decade.

Accelerating the return of fundamentalism could be a tightening in business conditions. Wage pressure, exposure to ESG issues, and the Biden administration’s desire to increase competition, will likely have a disproportionate effect on poor quality companies that investors have hitherto propped up. That will further highlight the gap to market values and widen the differences between companies.

None of this means overall equity markets will crash. Rather, it may lead to a reordering within equity markets as we witness the return of fundamental value investing. Finally, active managers may be back in vogue.

* * *

8. Space: a worrying geopolitical frontier, Galina Pozdnyakova

Against the backdrop of rising geo-political tensions between several countries, 2022 is shaping up to be the year when tensions over the potential for the militarization of space become a top geo-political negotiation topic.

The problem is that most parties have an incentive to avoid agreeing on new rules. Many would rather keep space as a ‘wild west’. Of course, several countries have national space laws, and international treaties such as the Outer Space Treaty of 1967 are in place. Yet they do not adequately govern modern weaponisation of space technologies. And with no consensus over boundaries and control over space objects, and blurred lines between defence and weapons systems, the risk of conflict is rising.

The reality of the military threat in space will be amplified in 2022 as politicians digest recent high-profile events. The Russian ASAT test in November showed that the country can take down satellites – an ability also demonstrated by the US (2008), China (2007) and India (2019). Meanwhile, France recently became the fourth country to launch electromagnetic-monitoring military satellites, following the US, China, and Russia.

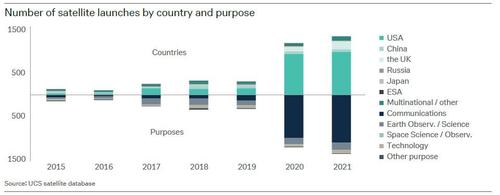

The importance of space has surged in the past few years as falling launch costs have led to an increased number of satellites in orbit and, thus, and increased dependence upon them. Aside from military uses, future conflicts will certainly target communications, GPS, and finance applications that all rely on satellites.

Countries have quickly taken the military risks of space more seriously. Over autumn, QUAD leaders agreed to finalize “Space Situational Awareness Memorandum of Understanding” this year. Separately, the UK pushed a resolution on “threatening and irresponsible space behaviours” which passed the first stage at the UN and will be reviewed in December.

Responding to the threats, new military space divisions have popped up over the last two years. Japan’s Space Operations Squadron and the UK’s Space Command were both created since 2020. They follow the creation of China’s Strategic Support Force in 2015, and the US Space Force in 2019. The latter will receive a 13 per cent budget increase in 2022.

The 2022 completion of the Chinese space station, Tiangong, will also mark a shift in soft space power. It will increase China’s scientific research capabilities and its collaboration with other countries. The station’s advanced technologies and equipment, as well as modular design, will allow for multiple use cases. Meanwhile, the International Space Station is only approved to operate until 2024.

So 2022 will likely be the year where space becomes the next frontier of an arms race between key global powers. Layering these issues on top of existing geopolitical tensions will create an unusual situation for world leaders. Everyone wants everyone else to play by the rules. Yet the rules of space are antiquated and there is a heavy incentive for most powers to avoid cementing new ones. The tensions above the Earth appear set to amplify tensions on it. Space threats are already becoming a topic of geo-political negotiation and, in 2022, they will likely become front-and-center.

* * *

9. Central Bank Digital Currencies: Growing into reality, Marion Laboure

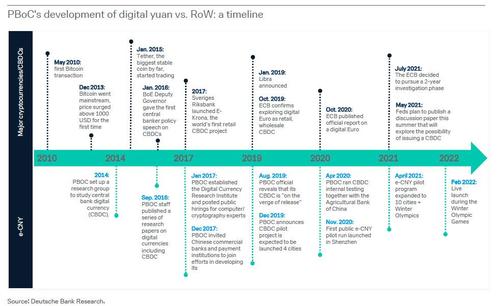

There is a clear move towards a cashless society (as a mean of payment) and CBDCs is set to progressively replace cash. The question is no longer « if » but « when » and « how ». Today, 86 per cent of central banks are developing a CBDC; 60 per cent are experimenting at the proof-of-concept stage. Central banks representing about a fifth of the world’s population are likely to issue a general purpose CBDC in the next two years. We believe that a large majority of countries will have a CBDC live in the next five to six years.

Emerging economies will lead the race. They will move quicker and with higher adoption than advanced economies. The Bahamas and the Eastern Caribbean are live; China will be live in February 2022. In five years, many emerging economies will have moved; including many Asian countries. The ECB/Fed will soon start piloting projects and, if successful, are expected to be live around 2025-26. The main barriers for advanced economies are: cultural/privacy; low interest rates; older demography, heavily reliance on cards.

A CBDC itself is not going to rebalance the international order between the US and China. But this is the Chinese global, 360 strategy with very advanced payments technologies which is creating an advantage to pay in their currencies and will continue to gain market share. China benefits from advanced payments systems (especially settlement technologies) that could change the deal and attract merchants and vendors to use this new, more efficient currency. The Chinese government has made tremendous efforts to internationalize the renminbi, like the US intervention in the early twentieth century. China aims to become a world leader in science and innovation by 2050. China is also massively investing in advanced technologies and is currently the second largest investor in artificial intelligence enterprises after the US. Indeed, China appears on track to have an “AI ecosystem” built by 2030.

* * *

10. ESG bonds go mainstream, Luke Templeman

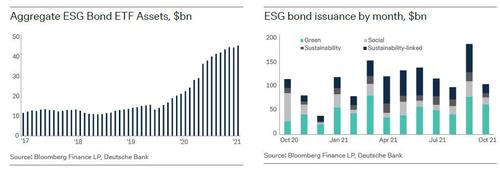

Amongst the many themes turbocharged by the covid catalyst, ESG bond issuance is one of the most prominent. In 2022, ESG bond issuance is set to go mainstream. Investors have taken notice. In fact, the holdings of ESG bond exchange-traded funds have tripled to over $45bn since the covid outbreak. As the chart below shows, that surge of interest follows years of very little growth.

The growth of ESG bonds appears to have breached a tipping point. Not just because investors are keen to hold ESG debt, but also because corporates see that ESG issues now affect their business and investment risk. Indeed, in our recent survey, 19 per cent of corporate debt issuers say that over the last 12 months, environmental factors have impacted their rating. A smaller, but still material proportion, report that social and governance factors have had an impact.

Now that there is a firm nexus between ESG issues and business risk, ESG instruments (primarily bonds) have become a gateway through which corporates begin to address their impact on problems like climate change. Since early last year, over half of corporates have either offered their first ESG instrument or are currently preparing to do so.

Some of the strongest issuance in 2022 will likely be of sustainability-linked bonds. These bonds, which have quickly become very popular, generally offer corporates an interest rate discount if they hit certain ESG targets. From a base of close to zero two years ago, sustainability-linked bonds have comprised up to half the ESG bond issuance in the second half of 2021.

Investors have quickly fallen in love with sustainability-linked bonds. Just over half of investors say these types of bonds are the most promising instrument out of a pool of ESG assets. That is over double the next highest response, which is European green bonds, with 21 per cent.

Driving sustainability-linked bonds is the sudden growth in the number of businesses that publish quantifiable ESG performance targets. Indeed, a third of corporate debt issuers have already started to do so since 2020. A further 21 per cent will begin publishing in the next 12 months and that will leave only 6 per cent without any plans to do so.

Aside from investor demand and published corporate targets that have laid the platform for the growth of sustainability-linked bonds in 2022, corporates have discovered the ‘signalling’ benefits. Just over 60 per cent of companies in our survey said the main benefit of their company’s ESG instrument was that it “enables us to convey our sustainability strategy”. A further 22 per cent say these instruments expand their investor base. Meanwhile, half say there are pricing benefits.

Definitions on how to do ESG investing ‘well’ differ given the breath-taking pace at which it is evolving. Regardless, corporates and investors have now created the market for ESG bonds. With companies starting to publish specific ESG targets, it seems inevitable that in 2022 there will be a surge in issuance from corporates and strong appetite from investors.

Tyler Durden

Thu, 12/23/2021 – 16:50

via ZeroHedge News https://ift.tt/3pnWe6B Tyler Durden