Erdogan Is Secretly Pillaging Billions In Turkish Assets To Prop Up The Lira, And His Rule

Yesterday, we discussed how Erdogan’s shocking “plan” to rescue the Turkieh lira – once it crossed the red line of 18 vs the USD – came into being, and how it will eventually make an already dismal situation even worse, because it really represents a massive stealth “rate hike”, one which will put huge stress on Turkey’s balance sheet and will make the government budget more vulnerable to future currency shocks.

“There has been an epic interest rate hike without calling it one,” according to Refet Gurkaynak, a professor of economics at Bilkent University in Ankara. “There will be a big burden on the budget when there is a sharp increase in the foreign-exchange rate. This kind of burden usually gets monetized, which means even higher foreign-exchange and inflation rates.”

For those who missed our explainers of Erdogan’s cunning plan to stabilize the Turkish lira until the elections, here it is again in a nutshell: the Treasury will underwrite losses in new lira deposits in the case of another run on the currency. That puts a strain on one of the few remaining bright spots in Turkey’s economy — its fiscal position — and highlights a growing trend among policy makers to lean on the public budget to pay for the cost of misguided policies.

“We can say that the budget — the last remaining anchor — has been sacrificed to claim that a rate hike has been avoided,” according to Ibrahim Turhan, a former deputy governor of the Turkish central bank who is now an opposition politician. “In this way, the cost of the lira’s depreciation has been put on the society as a whole.”

The bad news is that Erdogan has taken an already hopeless situation and made it worse. The good news, is that he has managed to kick the can for at least a few weeks (perhaps months) until the big macro funds realize just how much more precarious Turkey’s financial condition has become because for all the posturing, the fundamental driver behind Turkey’s woeful financial condition – Erdogan’s demands to keep rates lower despite soaring inflation – is not going away until Erdogan himself is gone.

Meanwhile, one thing many have ignored, is what was the actual cost now of Erdogan’s panicked intervention.

According to preliminary calculations, the bottom line to keep Turkey’s currency from a terminal collapse this week, is anywhere between $6 and $13.5 billion.

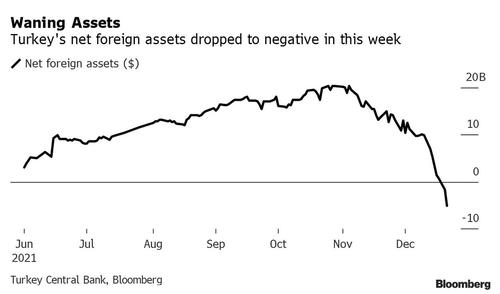

As Bloomberg reports overnight, Turkish net foreign assets fell by nearly $6 billion early this week amid president Erdogan plans to bolster the lira, suggesting Turkey made more unannounced interventions in foreign-exchange markets.

Confirming what many have dreaded for a while – that Erdogan is literally making up healthy economic numbers for international consumption while pillaging the country out of the back door without reporting it, Bloomberg notes that while the government has said it didn’t intervene, it lied and the fall of $5.9 billion probably signals a backdoor intervention similar to operations carried out over two years from October 2018, when state lenders sold dollars – typically those belonging to local private savers – to support the local currency.

What is perhaps even more alarming is that Erdogan actually thinks the international community is so stupid, nobody will notice what is going on.

As Bloomberg shows, net foreign assets dropped by $5,9 billion to minus $5.1 billion on Tuesday compared with $817 million on Friday, a number confirmed independently by the FT.

Others’ estimates are even more stunning. According to Turkey’s Ahval website – which used data provided by a top economist and the main opposition Republican People’s Party (CHP) – the Turkish central bank spent upward of $13.5 billion of its foreign currency reserves to help defend the lira against record losses in December and then to help engineer a rally this week, according to data provided by a top economist and the main opposition Republican People’s Party (CHP).

Uğur Gürses, a former central bank official, said the sales totaled $7 billion on Dec. 20 and Dec. 21. The central bank sold the reserves via a backdoor method involving state-run banks, he said in an article on Wednesday for the T24 news website, citing official data.

The CHP, whose management includes former Treasury Undersecretary Faik Öztrak, who helped Turkey successfully run an IMF program in the early 2000’s, said in a report this week that forex sales between Dec. 1 and Dec. 17 totaled $6.5 billion, including $6 billion of direct interventions in the currency markets, Cumhuriyet newspaper reported on Thursday.

That was before Turkey’s central bank intervened – without any success – in the foreign exchange market on at least four prior occasions, all of which failed to halt the lira’s collapse to a fresh record low of 18.36 per dollar on Monday.

That’s when Erdogan’s “whatever it takes” bazooka came out, and the reason why the lira plunged from 18 to 12 is because Erdogan gave the green light to drain billions in Turkish assets to offset the consequences of his catastrophic Erdoganomics, because while Erdogan’s FX intervention to prop up the lira may have been secret, everyone knows that it is Erdogan’s monetary policy and bizarro economic theories that were behind the collapse in the lira in the first place.

To be sure, blowing all those billions worked – for now: The lira appreciated as much as 25% on Monday after Erdogan spoke, its biggest daily jump since 1983, and has now gained more than 40% against the dollar this week.

However, we now know that this move wasn’t the result of Turkish depositors willingly converting their dollars into lira but was the result of emergency actions taken by state banks, with at least one private lender also involved, said no less than four Bloomberg sources. The sales continued Tuesday, said the people.

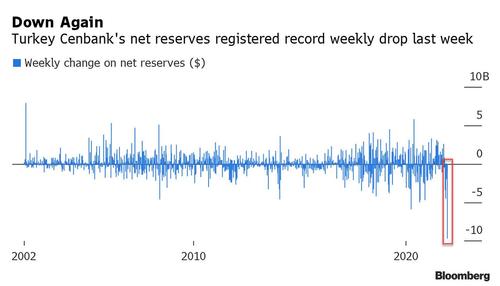

Meanwhile, the best representation of Erdogan’s historic intervention which first and foremost was meant to keep the authoritarian ruler in power and delay a public revolt from an angry population furious at the collapse of Turkey’s economy, is that net Turkish reserves dropped by a record $9 billion to $12.2 billion as of Friday, the biggest weekly drop in data that goes back at least 2002.

But wait, it gets even worse: according to Goldman Sachs, more than $100 billion of central bank reserves were spent to prevent a disorderly depreciation in the lira last year alone, when the currency came under pressure after a series of large rate cuts to support the pandemic-hit economy.

Earlier this year, Erdogan said authorities used $165 billion of central bank foreign-currency reserves to weather developments in 2019 and 2020, and may use them “again when needed.”

In other words, when the true numbers finally emerge, the world will be “shocked” to learn that Erdogan has pillaged every last hard dollar (and ounce of gold)Turkey had, just to keep himself in power for a few extra months.

Tyler Durden

Fri, 12/24/2021 – 06:35

via ZeroHedge News https://ift.tt/32wTlHw Tyler Durden