Bitcoin Jumps On News Google Is Entering Crypto Space

Cryptos are spiking on news of what appears the most significant institutional adoption of crypto in quite some time.

According to Bloomberg, as part of Google’s pivot to a “broader strategy” to team up with a wider range of financial services, including cryptocurrencies, the search giant has hired former PayPal Holdings executive Arnold Goldberg to run its payments division and set a new course for the business after it scrapped a push into banking. And to make up for lost time, Google has partnered with companies, including Coinbase and BitPay to store crypto assets in digital cards, while still having users pay in traditional currencies.

The business, known for the Google Pay system and mobile wallet, has largely avoided the crypto industry, but that is about to change and where Goldman goes, everyone else in TradFi follows.

According to the report, the changes follow a major turnabout in October: Google had spent years planning a digital checking and savings service, lining up 11 banking partners for the launch. But that month the company nixed the proposed offering, called Plex. Instead, Google wants to become the connective tissue for the entire consumer finance industry, not just certain partners, according to Bill Ready, Google’s president of commerce.

“We’re not a bank — we have no intention of being a bank,” Ready said in an interview. “Some past efforts, at times, would unwittingly wade into those spaces.”

So if it can’t be a traditional bank, Google will instead focus on the far less regulated field of cryptocurrencies, and it is here that Google plans on picking up market share ignored by its peers:

Given Google’s dominance in search and other online services, it was long expected to shake up the world of finance. But it has little to show for its efforts so far. Google Pay has gained some traction in India, but struggled elsewhere. It lags well behind Apple Inc.’s payment platform, and Google hasn’t created its own credit card or financial products the way Apple has.

But what Google lacks in results, it more than makes up in potential: the company has enormous consumer reach and a huge balance sheet. The technology giant takes no fees on transactions with its mobile wallet, and Ready said there are no plans to change that. Google is also working to add more payment features within search and its shopping service. That will help show users “the entire array of financial services out there,” Ready said.

“Our aim is to help create connections,” he said. “We’re not a conflicted party.”

According to Bloomberg, Ready, who is PayPal’s former chief operating officer, joined Google in 2019 and began overseeing its payments division last year after an executive departure. He recruited Goldberg, who ran PayPal’s merchant business, to become the vice president and general manager for the payments and emerging market efforts — an initiative Google calls Next Billion Users, or NBU.

To be sure, Google has a long way to go: Tom Noyes, an industry analyst, estimated in 2020 that Google accounted for 4% of contactless payments in the U.S., calling the service “largely a failure.”

And this is the part that crypto fans will be interested in: as part of the overhaul, Google will focus more on being a “comprehensive digital wallet” that includes digital tickets, airline passes and vaccine passports, Ready said.

Tiptoeing into crypto also could help Google entice users. Google has partnered with companies, including Coinbase Global Inc. and BitPay Inc., to store crypto assets in digital cards, while still having users pay in traditional currencies. Ready said Google is looking to do more of these partnership, though the company still isn’t accepting crypto for transactions.

“Crypto is something we pay a lot of attention to,” he said. “As user demand and merchant demand evolves, we’ll evolve with it.”

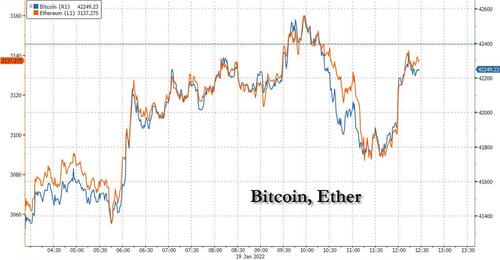

And now, the market will also be paying a lot of attention to what Google is doing, because as the race to become the dominant market player in crypto wallets heats up, so will the next leg of institutional adoption. Not surprisingly, the price of bitcoin and ether – both of which have been beaten up in recent weeks – jumped on the news.

Tyler Durden

Wed, 01/19/2022 – 12:31

via ZeroHedge News https://ift.tt/3KnwzTX Tyler Durden