Correlation Doesn’t Imply Causation, But…

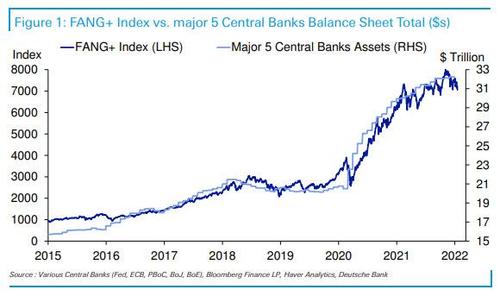

In his “chart of the day”, DB’s Jim Reid writes this morning that “correlation does not imply causation but unless you are an incredibly strong advocate of a completely new earnings paradigm for the largest technology companies, that coincidently have tracked unconventional monetary policy, then it is hard to argue against the notion that central bank policies have been a big contributor to an incredible run for the sector over the last 6-7 years.”

Indeed, as the chart below shows, the only notable setback for the gigatech space was when global QT arrived in 2018, however briefly. Just don’t show this to the handful of remaining macrotourists who are still so clueless they actually argue the Fed doesn’t dominate every aspect of the market, while bizarrely still claiming to be “finance experts.”

2022 has been a perfect negative storm for tech with higher nominal and more importantly real yields, as markets price in a Fed that seems strongly committed to starting QT later this year.

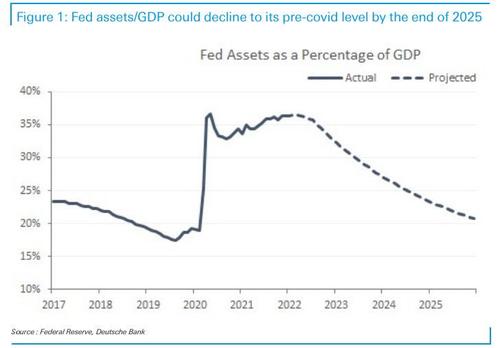

Meanwhile, as we noted last week, DB economists predict that the Fed balance sheet will fall by $1.5tn by end 2023 and around $3tn by 2025. Needless to say, this would be devastating to the tech sector.

It’s not just the Fed: according to the DB strategist, the second biggest contributor to the graph, namely the ECB, will likely see its balance sheet fall by several hundred billion dollars this year due to maturity TLTROs outweighing continued QE. So it is especially likely that 2022 will see the local balance sheet peak, with dire correlated consequences for the FAAMGs.

As Reid concludes, “clearly it’s impossible that such a correlation will stay as tight as this indefinitely but it’s a useful graph to understand the possible big picture trends.”

Tyler Durden

Wed, 01/19/2022 – 15:21

via ZeroHedge News https://ift.tt/3FDNjCJ Tyler Durden