Stellar 20Y Auction Stops Through, Sees 2nd Highest Foreign Bid On Record

After a furious rout in bonds, rates traders were carefully looking at today’s 20Y auction to see if the recent blowout in yields meant less demand for US paper at auction, or inversely, if the drop in prices had sparked a hunt for bargains. And if the 20 year reopening auction which just closed with the sale of $20BN in 19-year 10-month cusip TC2 is any indication, the answer is resoundingly the latter.

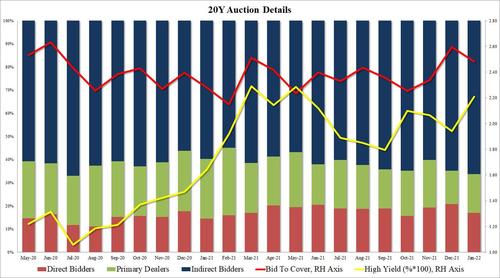

While yields had dropped sharply on the day (granted after yesterday’s surge), some were worried that the lack of a concession would lead to a tail in today’s sale. However, not only did that not happen, but the auction – which priced at a high yield of 2.210% – stopped through the When Issued 2.225% by 1.5bps, the second biggest stop through since June 2021. That said, with a yield some 27bps above the December auction, today’s auction cleared at the highest yield since June.

The bid to cover was solid, and while it was below last month’s stellar 2.59, at 2.48 it was well above the six-auction average of 2.39%.

The internals were even more impressive, with Indirects taking down 66.2% which was the second highest in the history of the series, with just July 2020 higher. In other words, foreigners have no concerns about bidding up a storm in the primary market as of right now. And with Directs taking 17.0% (below the recent average of 18.7%), Dealers were left holding 16.8% of the auction, also just below the six-auction average of 18.5%.

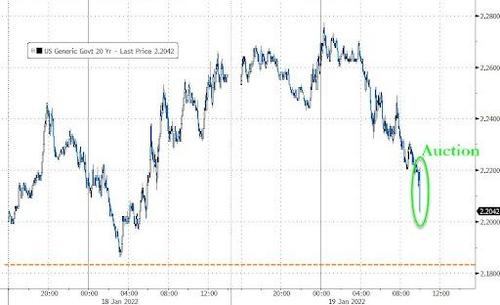

Overall, this was a stellar auction, and one which despite a concession did not tail. It’s also why after briefly touching 1.90% earlier in the session, the yield on the 10Y TSY has collapsed as low as 1.8253% after the news of the 20Y auction broke.

Tyler Durden

Wed, 01/19/2022 – 13:17

via ZeroHedge News https://ift.tt/34UP1my Tyler Durden