Chinese Homebuilders Soar As Beijing Prompts Prisoner’s Dilemma in Rescue Plan

Just as we predicted last week, bonds and stocks of China’s beleaguered homebuilders surged Wednesday on reports that regulators are considering lifting restrictions on the companies’ access to cash from pre-sold properties tied up in escrow accounts. If implemented successfully, it could ease developers’ cash crunch.

But, as Bloomberg Markets Live analyst Ye Xie writes, it won’t be all smooth sailing, and what needs to be addressed is the “prisoner’s dilemma” confronted by local governments. Those who were first to ease their grip on the local escrow accounts may face the risk that developers divert cash away and leave local projects unfinished. “Such concern may limit the incentives for local regulators to carry out the order from Beijing”, according to Xie.

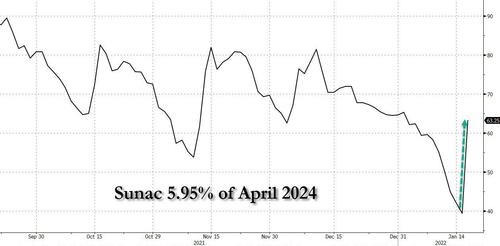

Bloomberg reported that releasing funds from the escrow accounts is part of a policy package regulators are contemplating to prevent the real-estate crisis from worsening. Reuters first reported the news, spurring a rally in struggling developers. Dollar bonds of Sunac China jumped 50% Wednesday.

The discussion marks another step by Beijing toward stabilizing the housing market and keeping cash-strapped developers from failing. Meanwhile, as we noted yesterday, the PBOC’s dovish briefing Tuesday fueled speculation that mortgage rates could be lowered.

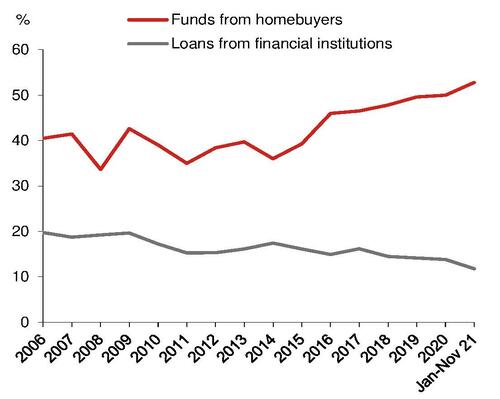

As Xie explains, in China, when real-estate companies sell residential properties before construction is completed, they’re required to deposit the proceeds in supervised bank accounts. Proceeds from pre-sales generally make up more than half of developers’ cash inflows. Relaxation, therefore, opens up a channel for developers to raise funds, just when they have a mountain of bills and debt to pay in coming months.

But Nomura’s economists Lu Ting, Jing Wang and Harrington Zhang are skeptical about how effective the new plan will be. The reason is simple: While the central government can provide the guidance, it’s the local governments that have the actual regulatory control over those escrow accounts. Developers’ financial challenges mean that local governments will be “quite cautious” about loosening their grip on the accounts.

“We believe local governments do not have an incentive to be the first to ease their grip on their local escrow accounts,” wrote Lu in a note. “This is because developers in need of cash will move funds out of the first batch of eased escrow accounts, and those local government officials will have to take responsibility for failed construction projects in their regions as a result.”

Last year, Lu attracted wide attention when he published a report drawing parallel between Beijing’s commitments to reining in the housing market and Paul Volcker’s epic but economically painful campaign to break the back of inflation in the U.S. in the 1970s. The report has so far been correct, and explained quite clearly why Beijing had no choice but to capitulate and ease to avoid an all out collapse of the housing sector.

Tyler Durden

Wed, 01/19/2022 – 20:45

via ZeroHedge News https://ift.tt/3IfDwo4 Tyler Durden