Oaktree Threatens Rift With China After Seizing Evergrande’s Prized “Versailles” Plot, Derailing Massive Restructuring Plan

While the collapse and default of Evergrande was 2021’s business, the subsequent restructuring – and its potentially absurd fallout – will be with us for a long time.

Take the fluid restructuring plan of China’s most indebted property developer: according to Bloomberg, Chinese authorities are considering a proposal to dismantle China Evergrande Group by selling the bulk of its assets. The restructuring proposal, which was submitted to Beijing by officials in Evergrande’s home province of Guangdong, calls for the developer to sell most assets except for its separately listed property management and electric vehicle units. A group led by China Cinda Asset Management, a state-owned bad debt manager and major Evergrande creditor, would take over any unsold property assets, the Bloomberg sources said.

If approved by Beijing, the plan – which we previewed several weeks ago – would mark the biggest step yet by China’s government to prevent a disorderly collapse of the world’s most indebted developer from roiling China’s financial markets and economy before the closely watched Communist Party leadership transition later this year.

As part of this “Chapter 7-like” liquidation, proceeds from the asset sales would be used to partially repay creditor claims, although according to Bloomberg, it remains unclear to what degree banks and bondholders would be forced to accept haircuts on their claims (judging by the deeply impaired price of the company’s bonds, where Evergrande’s dollar note due in 2025 last traded at about 16 cents on the dollar, one can say that the degree would be “great”). Senior Chinese regulators have repeatedly said in public remarks that debt risks at Evergrande and other distressed property companies should be dealt with in a “market-oriented way.”

If Beijing ultimately signs off on the plan, it would kick off the liquidation and unwind of the country’s formerly biggest property developer that was started 25 years ago by billionaire Chairman Hui Ka Yan, who was not too long ago China’s 2nd richest man. It would also likely set off a lengthy battle over who gets paid from what remains.

For its part, Evergrande – which was officially labeled a defaulter for the first time in December after it missed payments on several offshore bonds – said in a statement on Wednesday that it plans to come up with a preliminary restructuring proposal in the next six months. Amusingly, it earlier urged offshore bondholders not to adopt aggressive legal action over repayments, after an ad-hoc group of holders said the company failed to substantively engage with it over restructuring efforts. Evergrande has started the process of identifying bondholders and plans to hire additional financial and legal advisers.

And this is where the “restructuring” process gets a bizarre twist, because while China is seeking to quietly pursue a straightforward (if lengthy) liquidation, some of the creditors have found creative loopholes to avoid getting pennies on the dollar.

One of them is debt-investing giant, Oaktree Capital, which according to the FT, has “scuppered” a plan to restructure Evergrande’s $20 billion of offshore debts by seizing a vast Hong Kong plot where the property developer’s chair had intended to build a Versailles-like mansion.

The Los Angeles-based Oaktree this week moved to seize control of the asset – known by insiders as “Project Castle” – after Evergrande defaulted on a loan against which the $158bn asset manager had security, the FT reports.

The 2.2 million sq ft project was to be a crucial piece of collateral in a planned restructuring of Evergrande’s giant offshore debt load, but the plan is now in turmoil after Oaktree appointed a receiver in hopes of seizing the real etate. Project Castle was set to form a significant chunk of the assets that would facilitate the restructuring of the company’s offshore debts, an FT source said.

“Evergrande has got the offshore bondholders to stop making noise on the basis there’s a restructuring process coming soon,” said this person. “That land was going to be used to facilitate the restructuring.”

But apparently now that Oaktree has found legal recourse to strip the land, it will do so, in the process derailing the broader restructuring process: indeed, the appointment of the receiver has to be approved by a Hong Kong court, after which the asset “will be removed from the general restructuring of Evergrande.” Of course, without the property, the value of the estate would collapse dramatically.

Pulling a page out of the Elliott Management playbook, Oaktree previously reassured its clients about the ease with which it could seize the “Project Castle” development, according to a copy of a 2021 investor letter seen by the Financial Times. The letter said the firm “structured these transactions with legal protections” that would enable it “to get to the underlying collateral in a smooth fashion should a legal process ensue”.

It remains to be seen how “smooth” this process will be when Oaktree directly and transparently challenges the supremacy of China’s own interests on China territory. Needless to say, an outcome favoring Oaktree, which would be viewed as humiliating for Beijing, would have tremendous consequences for China.

The move by Oaktree represents one of the most significant yet from any international player in the crisis at Evergrande, which last year became a symbol of the sprawling debts underpinning China’s property sector and faces a drawn-out restructuring process.

Oaktree is one of many investors in international bond markets, where Evergrande has borrowed about $20bn of its more than $300bn in total liabilities, who have focused on its offshore assets, including listed subsidiaries in Hong Kong. They warned last week over potential enforcement action against the company, which laughably responded with a blanket statement asking them not to take legal action.

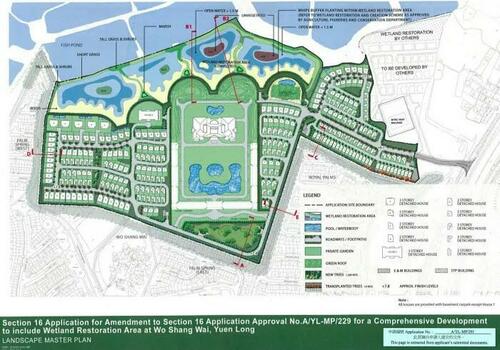

Since “Project Castle” remains one of Evergrande’s most prized possessions, the company naturally had its own plans for the future of the sliver of Hong Kong land, and had been attempting to sell the residential project, in the Yuen Long area of Hong Kong’s New Territories, since last year as part of its plans to offload non-core assets to minimise losses for creditors. It was reported to be valued at about $1bn.

But wait, there’s more…

If the potential Hong Kong scandal wasn’t enough, today the FT also reported that Oaktree also has a secured loan to a sprawling tourism resort on the Yellow Sea coast called “Venice” that would allow it to take control of the land in the event of a default.

Just like with “Project Castle”, a move by Oaktree – whose founder Howard Marks is a former acolyte of “junk bond king” Michael Milken and has a reputation as one of the savviest specialists in distressed investing – to seize “Venice” could have a profound impact on the wider restructuring of Evergrande, and recoveries to creditors.

That said, while a protracted legal fight in Hong Kong is one thing, challenging Evergrande on the ground in mainland China would seems like an impossible task. As the FT notes, if Oaktree moves to seize control over the land “it could face a difficult fight in the mainland Chinese courts over an asset that is strategically important to both Evergrande and Beijing, due to its vast size and because ordinary Chinese citizens have bought homes there.”

The Venice project, which has been in development for more than a decade, embodied the meteoric ambitions of Evergrande, which has racked up more than $300bn of debt to fund its rapid expansion.

The resort has a “platinum seven-star hotel, nine centers (for international conferences, catering, health, sports, badminton, tennis, business, children and entertainment), a bar street and a food street”, according to the local government website for the area. It also has a residential area that covers 66m sq ft, which includes homes and schools.

According to a local government website for the province where the development is located, about two hours drive from Shanghai, 30bn yuan ($4.7bn) has been invested in the project.

Needless to say, lending in mainland China is considered far riskier (or, more accurately, dumber) than in Hong Kong because of the difficulty foreign creditors have in navigating the labyrinthine local court system and claiming security on assets, not to mention facing the incredibly corrupt local legal system. While many US distressed debt funds refuse to lend against assets on the mainland for this reason, others have been coaxed into this riskier form of Chinese lending because of the dearth of opportunities in more mainstream debt markets.

In letters to its investors last year, Oaktree said that the Venice loan was made at “about mid-60s see- through LTVs” — meaning that the size of the debt is just over 60 per cent of the asset’s overall value — and that it benefited from “substantial” protections that included claims on the “underlying properties”. The letter did not disclose the size of the loan, nor what the protections are.

“In addition to structuring our investments with priority claims on the underlying assets, we structured our Venice financing with a guarantee from Evergrande’s listed company,” the 2021 investor letter continued, in an apparent reference to the Hong Kong-listed entity China Evergrande Group.

Evergrande’s closely watched debt restructuring will be the biggest in China’s history and a politically sensitive process for a company whose rapid growth made its chair and founder Hui Ka Yan China’s richest man as recently as 2017. Tens of thousands of ordinary Chinese citizens hold investments in the company and have bought its homes; millions of people could be impacted by the uncontrolled collapse of the company, such as what would happen if an orderly dissolution of Evergrande was prevented.

And if the fund responsible for the ensuing social unrest ends up being a distressed-debt investor operating out of West LA, the diplomatic fallout between China and the US would be unprecedented.

Tyler Durden

Fri, 01/28/2022 – 15:40

via ZeroHedge News https://ift.tt/3AHQOaz Tyler Durden