Failure To Launch

Submitted by Peter Tchir of Academy Securities

On Friday morning, we switched to being tactically bullish. Does that mean we think the “valuation matters trade” is over? No. The issues discussed in last weekend’s T-Report remain relevant. On some of the issues, we have more clarity now that we had the Fed meeting, all of which support the thesis that valuations will be re-priced.

Failure To Launch – Equities

On Friday, the Nasdaq 100 futures swung by more than 4% from their lows around 8am, until they ripped higher into the close. Not only did we see short covering, but we continue to see little sign of “capitulation”. TQQQ once again had big inflows and has the most shares outstanding again. I focus on this particular bet, because it is essentially a leveraged bet on 10 companies. The ETF is triple leveraged, and just over 50% of the Nasdaq 100 is linked to 10 companies. Trading TQQQ is not for the faint of heart, and for me, for now, it represents the “greed” side of the market that keeps rearing its head. Interestingly, on Friday, we had a “barbell” in terms of flows, with SPY and ARKK having outflows, vs QQQ and TQQQ. There is clearly some serious buying the dip in sector, and while I was happy to participate in it, I will soon be reverting to a bearish stance.

Why will equities fail to launch?

Because Fed speaker after Fed speaker will hammer home how serious they are about rate hikes and balance sheet reduction. If fact, I expect much of the Fedspeak to clarify balance sheet reduction. That balance sheet reduction will start this summer and be of an order of magnitude that is eye-popping (thinking close t $2 trillion by end of 2024).

Basically, the Fed is going to try and jawbone inflation expectations lower, and that will have the side effect of weighing on risky assets.

From the credit side of things, we saw a nice rebound on Friday, though it was modest in comparison to what equities did. Until recently, equities have managed to have a pretty decent sell-off, without the help of a bunch of credit fear mongering, but if we resume trading poorly, credit weakness is a new issue for the equity market to absorb.

On the bright side of things, as earnings come out, we can see discretionary buybacks occur, which could support a lot of these companies.

Failure To Launch – The Fed

I expect that sometime in the next two months, there will be a lot of people wishing they hadn’t jumped on the 5 rate hike bandwagon.

Last week’s data wasn’t a “good news” for the economy story. Personal income and spending were down. Real personal spending was down in December and November. Fed manufacturing indices dropped. Retail and wholesale inventories rose.

My big fear remains that:

- Consumers pulled forward demand to battle the supply chain issues.

- Consumers treated the stimulus as “free money” which it was, which inflated the perception of how strong the consumer is.

- Companies responded to this demand perception and supply chain issues, by aggressively producing goods, that may not be needed as quickly as thought.

Inventory hangover.

Prepare for more bumps ahead for the market. I didn’t even mention Russia and the Ukraine or any of the other geopolitical issues that could have ramifications for the market (see Around the World and Russia on the Warpath Sitrep).

While TQQQ (and I will keep harping on this thing) is down 36% since the middle of November, it is still up 25% from the start of 2021 and a stunning 150% since the start of 2020 (pre-pandemic). I don’t think the pre-pandemic levels are a target, but I think its healthy to think about them in the context of saying how cheap something is or isn’t after the recent selling.

If we get another leg down, I have two concerns that “are different” than the past few weeks:

- Nervousness in the credit markets is real. That is new. I think it is overdone, but the persistence of this weakness is cause for concern if it resumes again, and that will feed into broader risk issues.

- We are seeing the “waterfall” play out, at least a little bit. That is where the selling moves from an area that has been hit hard, to one that seems “expensive” by comparison. The sell what you can, not what you want/should.

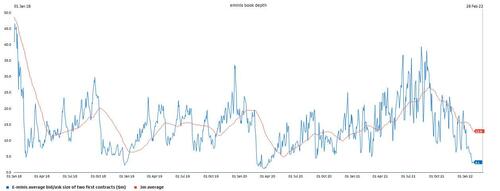

There is no depth to liquidity and every rally feels like there are no sellers and every sell-off feels like there are no buyers – adding to the stress of every decision.

I hope I haven’t already overstayed my welcome on my bullish call , but I don’t think we have seen the lows in stocks. We will see new lows in stocks and wider levels in credit spreads in the coming weeks.

That leaves me comfortable with trading longer dated treasuries and rate products from the long side of the ledger. I think despite (or in fact, because of) the fed rhetoric, the snuffing out growth fear will be real and will materialize in more “risk off” trades.

On those gloomy thoughts, I’m not sure how to end this T-Report on a positive note, other than saying the Nor’easter we had this weekend wasn’t that bad, and apparently some people enjoy the “feels like” temperature of zero! (I told you I was having difficulty finding a cheery sign-off). Once the market starts figuring out that the Fed will fail to launch, we can have a longer, sustained rally, I just think we have some more trouble before that happens.

Good luck, and maybe, at least the insane pace of trading and violent swings will be reduced this week, as I think many of us could use a bit of a breather where we can relax and reassess without being driven by the crazy price action!

Tyler Durden

Sun, 01/30/2022 – 13:20

via ZeroHedge News https://ift.tt/FYiLvNnQg Tyler Durden