The Retail Market Discovers “Puts” As YOLO Turns To Oh-No

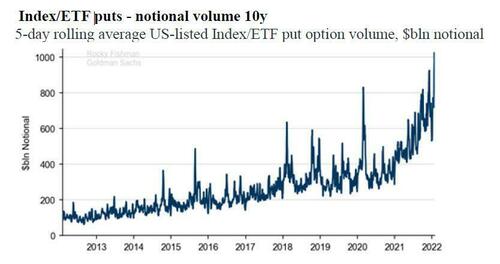

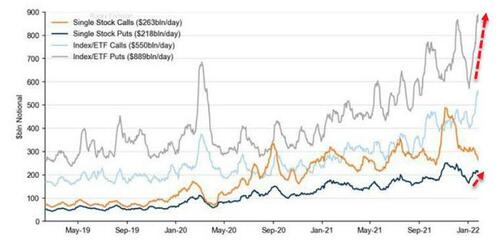

Over the weekend, we reported on the record amount of put-buying that was occurring in US equity markets, with Goldman traders pointing out that we have been averaging $1 Trillion worth of puts per day.

There were several days last week where put notional set records, and Goldman indicates that hedgers tended to be institutional… and mainly focused on the indices:

“Monday for example $2.2 Trillion notional traded in US options market, with 64% puts ($1.4 Trillion) further adding LP hedges and taking the street further short gamma. We have maxed out our index put notional chart.“

But, as Nomura’s Charlie McElligott noted in a report this morning, it appears retail investors have also discovered “puts” after newbie traders took the stock market by storm just a year ago by buying deep OTM calls and sparking ‘gamma squeezes’ in the market’s worst left-for-dead zombie companies.

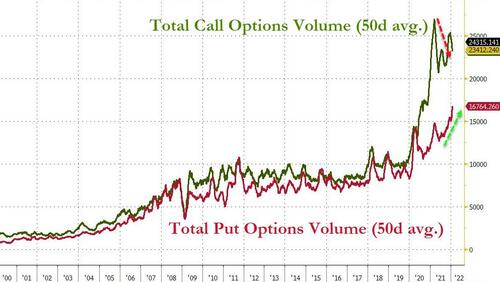

As Bloomberg’s Elena Popina notes, as the S&P 500 spent the week struggling to take a break from a nearly month-long rout, small-lot options traders – those trading 10 contracts or less – spent a record amount of money establishing new bearish positions.

The average daily premium spent on small-lot put contracts also reached the highest level in recent history. The daily average premium that small-lot traders shelled out for protection jumped to $963 million, twice the level seen in October, Options Clearing Corp. data analyzed by Susquehanna’s Jacobson show.

The smallest traders with bite-sized bets spent a record $6.5 billion buying put contracts last week, data compiled by SentimenTrader show.

It’s the latest evidence that the BTFD frenzy – so much of what has fueled the fintwit/tiktok gurus behind the stock market’s gains since the start of the pandemic – is changing. As Popina notes, the newbie crowd is getting less interested in buying dips — a departure from the trend between the summer of 2020 and middle of last year.

The “steady declines in apparent retail participation on the call side alongside incrementally higher participation on the put side” is supportive “of the idea that retail participants on the option side are generally chasing momentum and not aggressively buying dips,” said Christopher Jacobson, a strategist at Susquehanna International Group Inc.

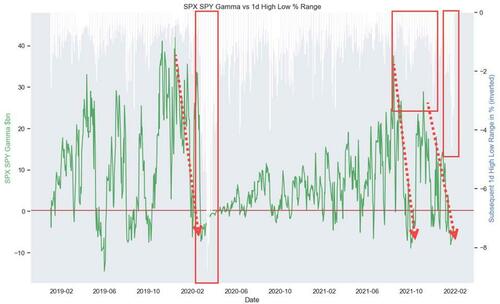

The question is, of course, whether this dramatic ‘hedging’ positioning is enough to spark a meaningful bounce.

SpotGamma notes that there is little signal that traders are about to release the bulk of their protection, much less short volatility with size.

Therefore, there is still plenty of fuel for a short cover rally fueled by put covering.

More tactically looking at equities, where we are push-pulling between the 4400 strike, which is the largest $Gamma line ($2.08B), the 200DMA at 4430, and the stops above the spike-highs from last week’s FOMC day.

If the market holds 4400 we believe implied volatility will trend lower, which adds a tailwind to equities through vanna flows.

On the constructive side, McElligott notes that we are considerably off the worst levels of the Dealer “short Gamma” hedging dynamic felt last week, which contributing to the violent and “chase-y” moves both higher- and lower-; in fact, the SPX (short) Net $Gamma was cut in half into today, while QQQ (short) Net $Gamma was reduced by nearly 30%…so that erratic trading fueled by “accelerant” flows too is greatly reduced and should contribute to a more “stable” dynamic

However, Nomura’s McElligott raises the specter of the clear theme coming out of the largest downside macro drivers for US Equities as determined from the PCA model, where both SPX and NDX now show:

1) (higher / less “easy”) Real Rates and

2) (wider) Corporate Credit as the two largest downside pricing sensitivities for US Equities…

Hence, two factors which Equities managers need to be conscientious of moving-forward.

STFR?

Tyler Durden

Mon, 01/31/2022 – 11:27

via ZeroHedge News https://ift.tt/oVIuMX9rB Tyler Durden