Cryptos Jump, Stocks Slump As Bonds & The Dollar Dump

As we transitioned from January to February, stocks soared higher as monthly flows were anticipated and op-ex overhangs were wrung out. But, as the week went on and NFLX and FB were clubbed like a baby seal (only to redeemed minimally by AMZN), dip buyers jumped back in and AMZN’s gains rescued investors from more pain.

Today was a wild day with AMZN’s strength underlying and the good-news-bad-news payrolls data being shrugged off, leaving Nasdaq up 2% and all the majors in the green into the last 30 minutes… then a wave of selling pressure hit all the majors and actually managed to push The Dow into the red for the day…

On the week, The Dow and S&P managed to get back into the green while Small Caps and Big-Tech languished in the red. The late-day puke (ETF redemptions?) actually left all the majors in the red for the week…

S&P and The Dow bounced off their 200DMAs today…

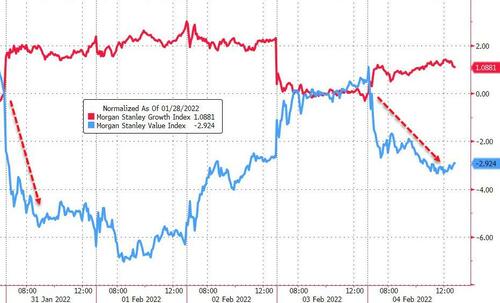

Notably, despite the surge in rates this week, growth outperformed value…

Source: Bloomberg

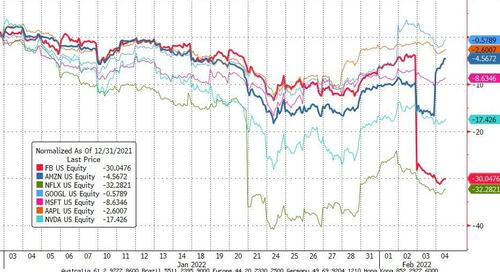

A massive divergence in the FANGMAN group over the last couple of weeks…

Source: Bloomberg

And in case you wondered just how it is that stocks like FB and PYPL can eviscerate market cap like this, here is SpotGamma to explain…

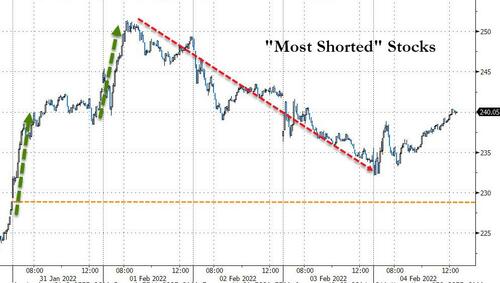

The week was dominated by Monday and Tuesday’s flows enabling a huge short-squeeze…

Source: Bloomberg

While the major indices bounced today (thank you AMZN), the median US stock is hovering back near its lowest levels since Feb 2021…

Source: Bloomberg

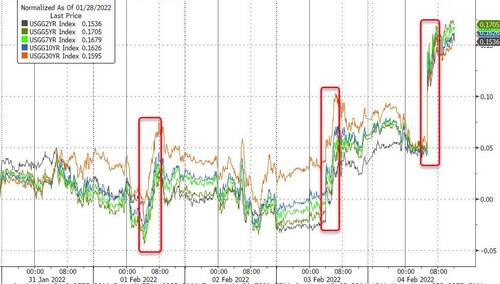

Bonds bloodbath’d this week with the entire curve up between 15 and 17bps…

Source: Bloomberg

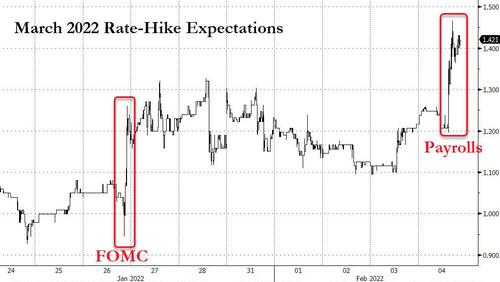

Rate-hike expectations surged again today after the ‘good’ news from BLS on the surprise labor market gains. March is now pricing a 45% chance of a 50bps hike and December is now pricing in a 40% chance of a 6th rate-hike by year-end…

Source: Bloomberg

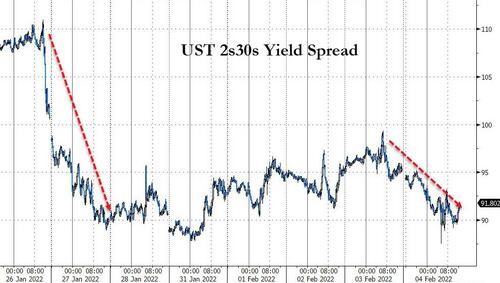

And while STIRs shifted hawkishly, the yield curve shouted at The Fed to stop, flattening significantly and signaling policy error problems right ahead…

Source: Bloomberg

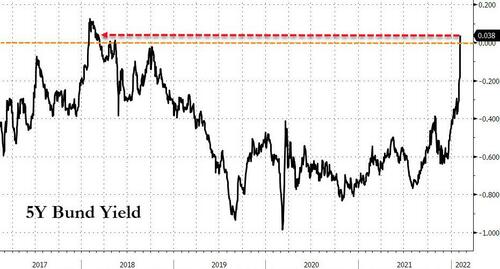

It wasn’t just US bonds that bloodbath’d – as the rest of the world scrambled to catch up as they realize that Central Bankers are serious this time…

5Y Bund yields went positive…

Source: Bloomberg

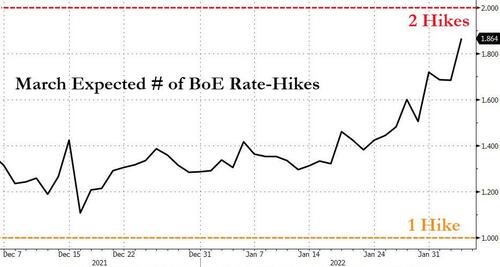

UK STIRs shifted very hawkishly…

Source: Bloomberg

And JGBs touched the top of their yield curve control corridor…

Source: Bloomberg

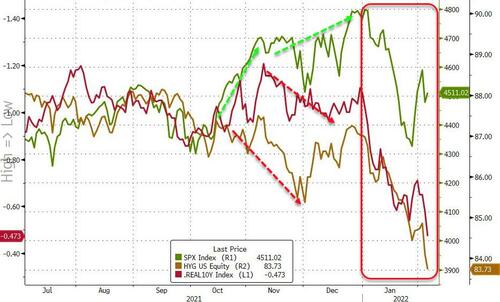

Real yields continued to surge higher this week with 30Y real yield is back above 0…

Source: Bloomberg

And if real yields are right, then stocks have a long way to go before reality is met…

Source: Bloomberg

This was the worst week for the USDollar (against its fiat peers) since Nov 2020 (the election week), erasing all of last week’s post-FOMC spike gains and more…

Source: Bloomberg

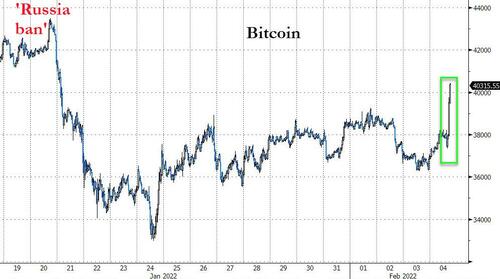

Cryptos had a big week with Ethereum leading the way…

Source: Bloomberg

Bitcoin bounced back above $40k today (and Ether pushed up to almost $3,000)…

Source: Bloomberg

Will it or won’t Ethereum manage closing above the negative trend channel? Key for further upside is to close above the 3k for starters. The 50 day is still way up at 3300. Interesting to note is the pick up in ETH skew, especially the short maturity. People starting to believe in some ETH bull again?

Source: Bloomberg

Commodities were higher this week led by Crude (and copper)…

Source: Bloomberg

Every time gold was hammered back below $1800, a bid appeared…

WTI rallied above $93 today, its highest since Oct 2014…

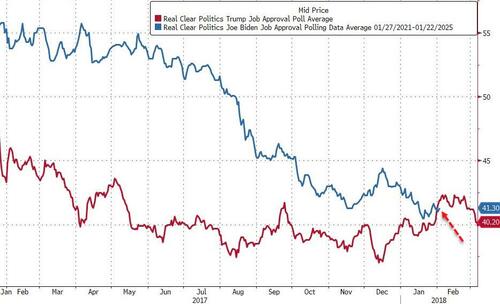

Soaring oil prices mean that President Biden is in trouble as gas prices are about to explode…

Source: Bloomberg

But then again, President Biden just suffered the ‘death cross’, dropping below Trump’s approval rating for the same time in his term…

Source: Bloomberg

Finally, judging by credit markets and real yields, there’s a lot further to go in this downswing…

Source: Bloomberg

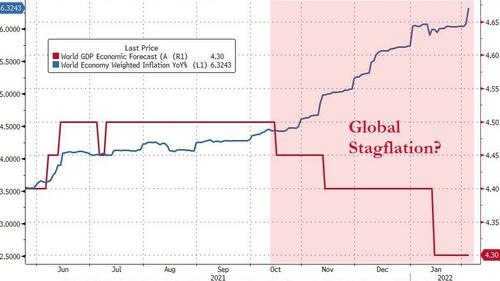

And right as the central bankers’ nemesis strikes the world – Stagflation…

Source: Bloomberg

Get back to work Mr.Powell, Bailey, Kuroda and Ms. Lagarde! We leave you with one remark (from Nomura’s Charlie McElligott) that all should reflect on as the equity market bounces…

“…there is an overhead “lid” on Equities, where the Fed is effectively shorting Calls / upside because anytime US Equities rally higher substantially higher, US FCI eases… and that’s exactly when we have to anticipate them to “up” their “hawkish” messaging.”

Trade accordingly.

Tyler Durden

Fri, 02/04/2022 – 16:01

via ZeroHedge News https://ift.tt/wsVDUTN Tyler Durden