Fed’s Reuters Mouthpiece: No 50bps Rate Hike In March

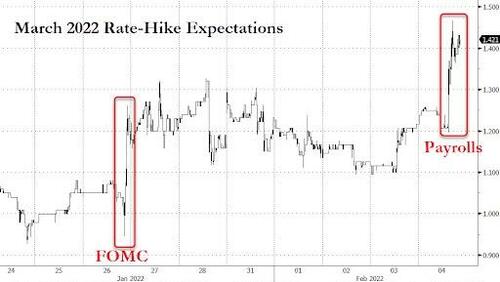

With rate hike odds soaring today after the shocking payrolls report (which was driven entirely by seasonal and other “tap on the shoulder by the Biden admin” adjustments), the market is freaking out that the Fed may be the next to shock markets by delivering not one 25 bps rate hike in March but two. Indeed, as shown below, the fed fund market is now pricing almost even odds (45% to be precise, up from 20% pre payrolls) of a 50bps rate hike next month.

And while we await for guidance from the WSJ – the Fed’s favorite media mouthpiece to confirm or deny this speculation – the B-team of Fed mouthpieces, Reuters, is out with a note today saying that a 50bps hike in March is not coming.

As Reuters Fed whisperer Ann Saphir writes, “that’s likely a bridge too far, given what Fed policymakers have said, where the jobs market is now, and what history suggests. But they do cement expectations that the Fed will raise rates at most of its remaining seven meetings this year as it moves to battle high inflation without undermining the labor market recovery.”

As for a double-rate hike, Saphir writes that “since the 1990s, when the Fed is considered to have largely tamed inflation, 50 basis-point hikes have been the exception and have never been used to start a tightening cycle.“

Next, Reuters give us a clue who the “unnamed source” of the report is:

To St. Louis Federal Reserve President James Bullard, one of the Fed’s most strident supporters of earlier and faster policy tightening, it wasn’t clear what starting with a bigger bang would accomplish.

At this point “It is not clear what you are buying with a 50 basis point move,” Bullard told Reuters Tuesday. “In a way we have done a lot of the work already and I am not sure it behooves us to do a dramatic funds rate increase” in March.

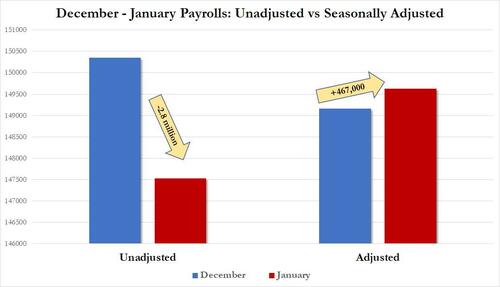

And while Reuters concedes that the January data might cause the Fed to reassess somewhat, we doubt it, especially since even the Fed isn’t so clueless as to grasp that the entire surge in the January jobs data was due to statistical and seasonal adjustments. The real labor market tumbled, as it always does in January, and this time it lost a whopping 2.8 million jobs on an unadjusted basis.

Of course, should the market believe that a 50bps rate hike isn’t coming, and surge then the “Fed shorting Calls” scenario we laid out earlier may come in play again, as the risk surge becomes defeating effectively putting a larger than expected rate hike in play. And so, the Fed and equities are caught in a game of chicken, where stocks can’t crash too much or the Fed put is triggered (less the contagion spill over into credit), nor can they rise too high or then the Fed call is activated and Powell will push the hiking jawboning into overdrive…

Tyler Durden

Fri, 02/04/2022 – 14:48

via ZeroHedge News https://ift.tt/tQshqog Tyler Durden