Introducing The D-Jay Wave; A 35-Year Cycle Of Irrational Exuberance

Authored by Bill Blain via MorningPorridge.com,

“You go back, Jack, do it again, wheels turning round and round…”

I’d like to introduce you to my latest theory on markets: the D-Jay Wave, a 35-year recurring cycle of irrational market exuberance. I have carefully and diligently researched this over a couple of pints… It’s therefore better underpinned than most SPACs or Disruptive Tech funds. (Glossy pitchdeck not available.)

Good luck to my all friends back home in my village of Hamble-le-rice this morning.

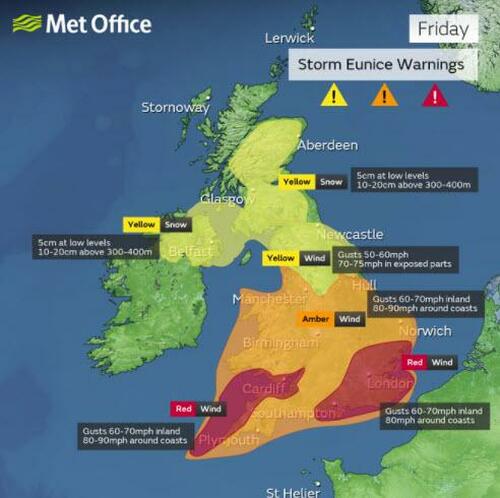

They are being hit by Hurricane Storm Eunice, which is whipping across the South Coast of Blighty. The weathermen are predicting a storm surge and record high tide – which is bad news as my race dinghy is sitting right by the beach in the boat park.. (If anyone spots BatFoux drifting out to sea… I’ll buy the pints if you return it.) She-who-is-Mrs-Blain and our little dog, Dee-Jay (full name: Dinnerjacket Wrigglebottom because he’s black with a white chest, and his bottom wriggles a lot), will have a grandstand view if it’s pushed up the river.

It will apparently be the worst storm, a “spike jet” bomb, since the great 1987 Hurricane the BBC famously said wasn’t going to happen.

Ah… that brings back memories….

That moment of national shock (and very angry letters to the BBC) was immediately followed by the Black Monday Stock Market crash on October 19, 1987. I don’t remember investors jumping off ledges, but I first heard the term ‘Dead Cat Bounce”, and I remember the storm well.. the parks and roads were closed for fallen trees, the trains (unsurprisingly) weren’t running. It was all a bit unreal… adding to the unreality when the stock market crashed 25% the next business day. (Which I remember was bright and sunny!)

1987 was my first real stock crash. At the time I was working as a journalist for Euroweek, part of the Euromoney financial news group. I’d only just joined after a couple of fantastic years learning all about bonds at Morgan Stanley. (I’d always wanted to be a journalist – but a few years on a penurious Fleet Street wage and a very empty wallet persuaded me back into investment banking 2 years later.)

My first experience of market madness had been earlier – the great Perp Crash of 1986.

This occurred when the prices of subordinated callable debt issued by banks suddenly crashed. These notes paid a decent coupon for their first five years when they were callable by the issuer. If, for any reason, they weren’t called then the coupon converted to a floating rate over Libor (the now banned London Inter-bank offered rate). Everyone assumed the bonds would be called, till someone read the small print and figured out there was absolutely no reason why the banks would call a cheap piece of perpetual subordinated debt. The bottom fell out the market in moments. I last traded some of the still outstanding bonds issued by one bank some five-years ago..

Since then…. Market Crashes? Seen it all mate.. Hardly notice anymore.. blasé is my middle name.. Russia? Argentina? Hong Kong? Mexico? Thailand? Dot.coms? 9/11? The GFC? Greece? Taper Tantrums? They were the big ones. The small ones are just as interesting… the companies that proved scams and lies; the Enrons, the Madoffs, the Maxwells, the Guptas, Greensill, We-work, Theranos… so many.. so many more to come..

Markets are carried along on long-term waves of irrational exuberance. That’s the way crowds work. It’s the way we are programmed..

I’m therefore delighted to announced how I’ve uncovered a previously unknown long-term 35-year cycle of market stupidity. I shall name it the D-Jay wave – not because my darling little dog is stupid, but because no matter how many time he’s told not to jump up, his sheer joy of life means he always will. The Wave is long-term because 35-40 years is about how long it takes the market to chew its way through the careers of participants who might remember why it happens.

When we’re done.. all that experience is lost forever.. “like tears in the rain..” (Name the film.) There are only a handful of us around today who remember 1986 and 1987… which is why we are doomed to repeat the past. (They say that about history… but, it’s even more true in markets. A good history book has a decent chance of being interesting. Interesting and financial market history don’t go together… No one ever got rich writing financial history.)

I am very fortunate at work. I am surrounded by very clever and enthusiastic younger fund managers and traders. They do listen, and they are prepared to argue with me. I find myself repeatedly counselling them on exuberance, and the fallacy of the “this time it’s better/different” myth. If you want to be a great investor learn to be sceptical. If you want to be a great trader – learn to read the phycology of the market herd. As I say they individually listen… but… do they collectively learn?

The key lesson of the D-Jay Wave is we will keep making the same mistakes over and over again. It’s entirely predictable. Investors won’t do their due diligence, buyers will get sucked in by extravagant claims and glossy presentations and pitch decks, and savers will let rising prices fill their mind with visions of improbable wealth.

It’s an inevitable tendency of markets – follow the herd, group-think and Do It Again…

Allow me a short interlude as noted behavioural scientists and observers Donald Fagen and Walter Becker sum it up:

Now you swear and kick and beg us that you’re not a gamblin’ man

Then you find you’re back in Vegas with a handle in your hand

Your black cards can make you money so you hide them when you’re able

In the land of milk and honey, you must put them on the tableYou go back, Jack, do it again, wheels turnin’ ’round and ’round

You go back, Jack, do it again

Ah… that takes me back…

This particular D-Jay Wave has peaked. This age of exuberance seems to be grinding to some sort of conclusion:

-

The SPAC market was hailed a cheap and effective way for great firms to swiftly access markets. Now its exposed as a wash that made founders rich and the punters paid. Its dead and buried – most deals have massively unperformed, and they’ve now become a vehicle to park cash in the expectation you can get it back when they don’t make an acquisition or by turning it down. They are just an arbitrage game now.

-

Crypto is increasingly desperate searching for the last few greater fools – which is why they are advertising anywhere and anything. Everything associated with crypto – like Squirrely Squirrel NFTs – are just bunkum trying to catch the last falling penny.

-

The retail revolution last year was the froth as the wave peaked – they are now nursing significant losses and are chastened having learnt the market is not the Willy Wonka’s what they believed it was.

-

Disruptive tech is played out on the basis folk are relearning what profits, margins and competition mean in terms of future dividends and prospects.

-

There is a crescendo of rising corrupt practice approaching as the movers and shakers who’ve been milking the markets try a final monetisation to set off with their bags of loot before it all tumbles.

The market’s focus is back on reality – the D-Jay exuberance Wave is headed towards an inevitable trough.

Yet, all these things will return.. I guarantee it.. I absolutely guarantee it… (although I’ll probably be dead and gone..)

Tyler Durden

Fri, 02/18/2022 – 09:10

via ZeroHedge News https://ift.tt/1qncJE4 Tyler Durden