Morning Wood: Hours After ARK Founder Says Innovation Stocks Are “Deep Value”, Two Major Holdings Plunge

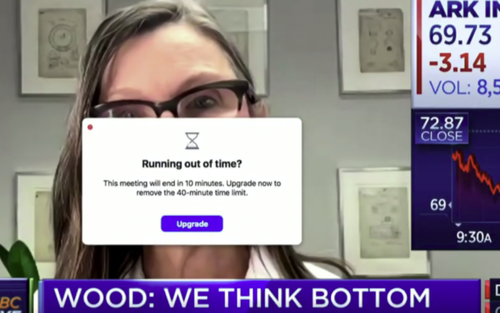

For those that missed it on Thursday, Cathie Wood spent the better part of an hour on CNBC’s Halftime Report, defending her stock picking style and running through a rolodex of financial-speak to try and justify what has been an ugly drawdown, now over 50%, for her flagship ARKK fund.

“We do believe innovation is in the bargain basement territory. … Our technology stocks are way undervalued relative to their potential. … Give us five years, we’re running a deep value portfolio,” Wood said on CNBC Thursday.

“Our biggest concern is that our investors turn what we believe are temporary losses into permanent losses,” she continued.

It was just hours after her appearance where she claimed that her stocks were not in bubbles that Roku, one of Wood’s holdings in several funds, was plummeting 25% on an earnings report that failed to get the rest of the market as excited as Wood clearly is about the name.

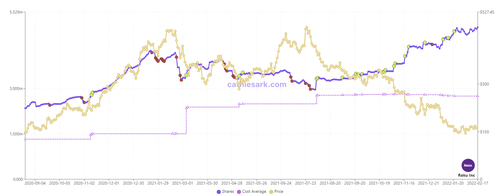

Roku is currently the #3 weighting in Wood’s flagship ARK Innovation Fund (ARKK) and Ark owns 4.24% of the company, per analysis at Cathie’s Ark. Roku is also in Wood’s CTRU and ARKW exchange traded funds.

As you can see, the delta between the equity’s price (in gold) and the number of shares held by Wood’s ARKK fund is at its widest delta (in the wrong direction) in the last year.

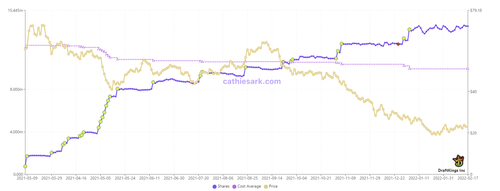

On Friday morning, Wood took another gut punch when DraftKings, which Wood has been buying “the dip” in since about $48 per share, fell 15% pre-market to $18.75 per share, on poor earnings.

Cathie bought the $DKNG dip at ~$48/sh after our @HindenburgRes report.

It’s currently at about $19 premarket. https://t.co/LDaq8DpYJf https://t.co/dPb3SUxNGX

— Nate Anderson (@ClarityToast) February 18, 2022

DraftKings is the #15 weighting in Wood’s flagship ARK Innovation Fund (ARKK), per analysis at Cathie’s Ark. Like with Roku, the delta between DKNG’s price (in gold) and the number of shares held by Wood’s ARKK fund is at its widest delta (in the wrong direction) in the last year.

Jim Cramer said of Wood on Thursday afternoon that she “buys stocks like someone who just started yesterday”.

Despite her recent plunge, Wood pointed out on CNBC Thursday that her fund was still seeing inflows that that one “value investor” who manages a major pension fund (God help its investors) was still bullish on her strategies.

Wood also complained on air that ETFs set up to short her fund were “ridiculous”. CNBC’s Scott Wapner then deftly noted that these funds weren’t shorting innovation, they were shorting her.

Probably the greatest thing I’ve ever heard @ScottWapnerCNBC say https://t.co/3MPSSwYrfc

— Quoth the Raven (@QTRResearch) February 17, 2022

Wood said numerous times during the interview that she wants to be judged on a 5 year rolling timeline. We’re assuming this is a tactic to buy herself time and try and convince investors it’ll all work out in the wash. Wood also continued to emphasize 40% annualized returns during her interview with CNBC.

Which reminds us that Wood faced scrutiny for how she presented the performance of her hallmark fund this year. Last month, Zero Hedge contributor Quoth the Raven wrote that Wood had changed how ARK’s website was displaying its returns for ARKK, from a YTD return period to a 5 year return period.

He also wrote back on December 21 that Wood had backtracked on estimates of returning 40% per year, for the next 5 years. She said in mid December that “innovation stocks” were in “deep value territory” and she estimated specifically that her “flagship strategy” could deliver “a 40% compound annual rate of return during the next five years”.

Then, she changed the language in her blog post and realigned her expectations from “40%” to “30-40%” and added a lot of qualifier language, not the least of which was directing the return expectation away from their “flagship strategy” and onto a vague benchmark of ARK Invest, in general.

“If the luster wears out for ARKK names or we see a tech wreck, as I have predicted might happen, there’s no doubt that Wood’s “Innovation Fund” will wind up facing more volatility, possibly disproportionately,” we wrote in December.

Tyler Durden

Fri, 02/18/2022 – 09:27

via ZeroHedge News https://ift.tt/ARj7ZYQ Tyler Durden