Goldman Calculates How Much Various Markets Will Move Under A Russia-Ukraine War

Yesterday we published an extensive analysis courtesy of Rabobank, looking at all the ways a war between Russia and Ukraine would impact the regional and global economy, how it would affect risk premia and risk assets, what it would do to oil and gas prices (spoiler alert: higher), and much more. Readers can read the full analysis at “How We Would Pay For The War.”

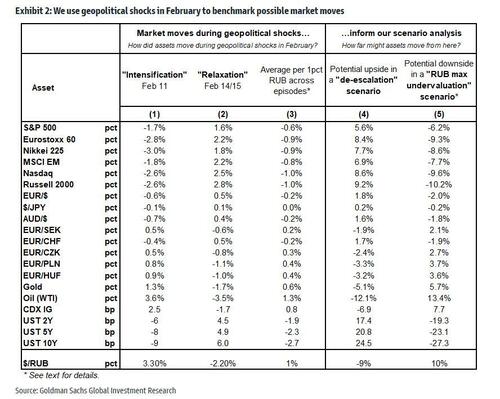

However, for those who are time strapped, or are mostly interested in how a conflict would impact various capital markets, Goldman this morning published a note analyzing how much geopolitical risk is priced into global assets, and finds that – among other things – the S&P could drop 6% in a potential downside case, or jump 5.6% in a “de-escalation scenario”, and also find the following ranges for other asset classes:

- Stoxx 600: down 9.3% in maximum Ruble undervaluation scenario, or up 8.4% in de-escalation;

- Russell 2000: down 10.2%, up 9.2%

- Nikkei 225: down 8.6%, up 7.7%.

- MSCI Emerging Markets: down 7.7%, up 6.9%

And so on, more in the full table below.

As Goldman’s Dominic Wilson writes, in explaining the bank’s approach to the analysis, “we are asked increasingly how much geopolitical risk premium could now be priced in various assets.” And while he concedes that it is always difficult to be precise in these cases, he suggests one way of estimating that issue here.

The bank approaches the answer in two steps: first, Goldman examines how global assets moved during sharp shifts in perceived geopolitical risk in February. Then, it uses these moves, together with estimates of how much risk premium could be either priced out of the Ruble (in a ‘de-escalation’ scenario), or further priced into the Ruble (in a ‘RUB maximum undervaluation’ scenario), to benchmark moves in selected global assets.

Among other results, the bank’s analysis implies a discount of around 5% on SPX, 8% on Eurostoxx, 25bp on US 10s, and close to 2% on EUR/$, with larger discounts in European satellite currencies; it also estimates that gold is trading at around a 5% premium based on the geopolitical risks that have been priced year-to-date.

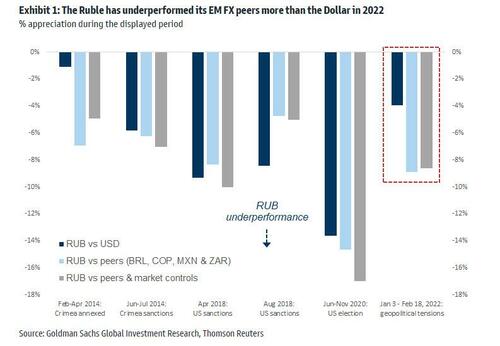

Goldman’s starting point is its previous work looking at the potential risk premium in RUB. At the moment, USD/RUB stands somewhat above its levels in early January, when tensions around Ukraine began to rise sharply. A better measure of the amount of risk premium still priced into the Ruble YTD, however, likely comes from comparing the Ruble to its high-yielding, commodity-exporting EM FX peers, which have seen significant spot gains versus the Dollar in 2022. On that basis, Goldman’s latest estimates would put the risk premium from recent escalation at 9% based on Friday’s closing prices.

The bank’s expectation would be that if geopolitical risks reversed, this undervaluation would compress. Conversely, if risks flare up further, and we shift to an outright conflict scenario coupled with punitive sanctions, the build in political risk premium would very likely extend. While it is difficult to provide benchmarks for such a scenario, one metric the bank’s economists have focused on is the lowest level of undervaluation we measure since 2000. On that basis, the RUB is still more than 10% away from its maximum undervaluation level of the past two decades. This is likely to be a conservative benchmark, however, given that this past undervaluation came in 2014/15 at a time of collapsing oil prices and weak external balances.

Goldman next uses these episodes to come up with some simple estimates of the premium that these geopolitical risks may now be generating in a broader set of global assets. In columns 1 and 2 of the table below, the bank looks at the two episodes of intensification and relaxation of geopolitical risks and record the performance of key assets across those two events. Both were relatively brief periods that were well-identified as driven by geopolitical risk. The basic pattern of movements is intuitive. As risk intensified, equities fell (with European equities underperforming), bond yields fell and European currencies underperformed, while safe havens like CHF, JPY and gold outperformed.

To combine these episodes, in column 3 the bank benchmarks the performance of each asset over these two episodes to the shift in the RUB over the same periods to calculate an estimate of the impact of an underlying “Russia/Ukraine” war that would impact the RUB by 1%.

Finally, Goldman’s Wilson expands on his analysis of geopolitical shocks in columns 1 through 3 to shed light on potential scenarios in columns 4 and 5. In particular, he combines his earlier estimates of the recent increase in Russia risk premium in the RUB to estimate the cumulative risk premium that we think could plausibly be priced into these assets on that basis. These estimates are essentially measures of what various assets could do if this year’s increase in Russia/Ukraine risk disappeared entirely. On that basis, Goldman now sees a discount of around 5% on SPX, 8% on Eurostoxx, 25bp on US 10s, and close to 2% on EUR/$, with larger discounts in European satellite currencies. Gold is estimated to be trading at around a 5% premium.

Alternatively, and more to the point, the bank also applies a similar scaling to the exercises of “maximum risk” which suggest that

“there could be significant further downside volatility if the crisis escalates fully.”

There is more in the full analysis which is available to professional subs in the usual place.

Tyler Durden

Mon, 02/21/2022 – 14:00

via ZeroHedge News https://ift.tt/DSbqQYU Tyler Durden