“A World At War” : Global Recession Next, And Then QE5

After weeks and weeks of warnings, the worst case scenario envisioned by BofA Chief Investment Strategist Michael Hartnett – worldwide stagflationary and imminent global recession – has finally arrived, and since he has a several month head start on his Wall Street peers, instead of rehashing everything he has said over and over since the summer of 2021, Hartnett digs right into the elephant in the room, which is…

War: According to the BofA strategist, the Russia/Ukraine conflict means bigger “Inflation shock”, smaller “Rates shock”, bigger “Recession shock”; while the Fed and ECB find themselves hopelessly trapped between deflation on Wall Street and inflation on Main St (Euro producer prices up staggering 30.6% YoY pre-invasion). And while the Fed still pretends it will hike rates “six or seven times”, the oil price spike, military-sanctions escalation cycle, and growing financial market accidents (see today’s spike in the FRA-OIS), “threaten global recession” according to Hartnett. With that in mind, the BofA strategist notes that it is still too early to position for Fed/ECB pivot, noting that “QE5 requires minimum SPX <3800-4000, IG CDX >100bps” and so, in the absence de-escalation investors should be maximum defensive.

War is Inflationary: This one is a no brainer: we have seen the strongest start to any year since 1915 for commodity prices

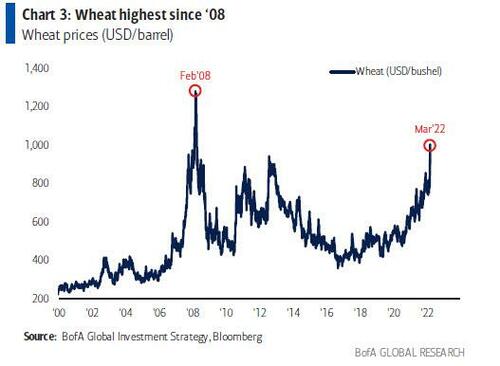

… an all-time high in price of coal/aluminum, oil/wheat highest since ’08…

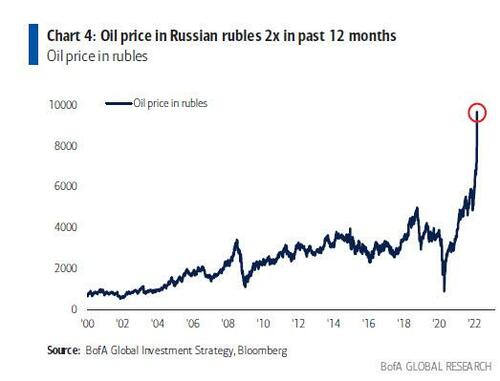

… while the oil price in Russian rubles has doubled in the past 12 months.

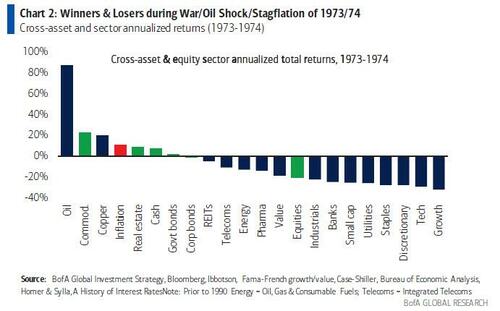

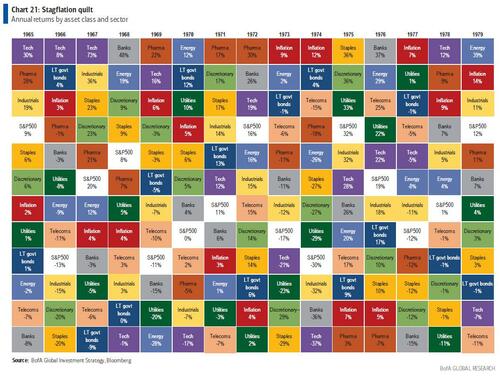

War is Stagflationary: According to Hartnett, the Yom Kippur War and oil shock of 1973 was very Wall St negative as only commodities outperformed inflation, SPX -40% peak-to-trough…

… with tech, consumer, bank, small cap stocks slammed…

… as stagflation crippled the US economy.

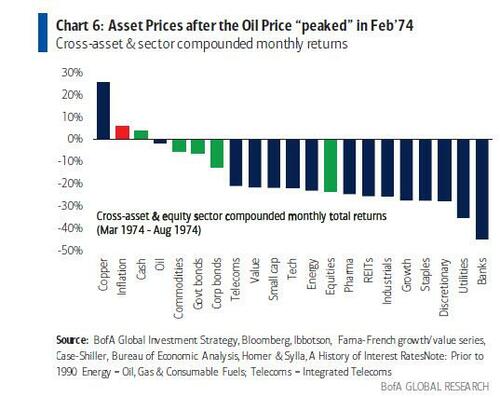

While the Fed initially tightened, oil prices did not reverse in ‘74, and stayed structurally high despite cessation of hostilities. Eventually, the bear market/recession ended but only once Fed reversed course, slashed Fed funds rate from 14% to 3%.

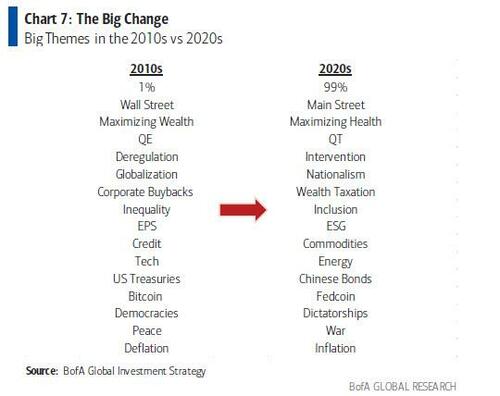

Regime Change: Picking up where he left off last week when he warned of “Crashes, panics and wars”, Hartnett summarizes the present “militant” situation as follows: War on COVID, War on Inequality, War in Ukraine, which leads to a secular regime change from globalization to inflationary isolationism (human, social, regional)…

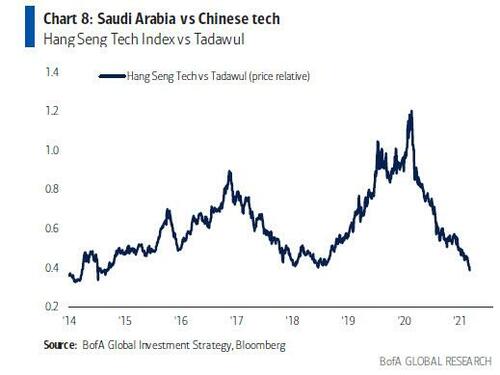

… intervention (sanctions, confiscation, tariffs), insecurity (trust in a “global” financial system) mean new era of inflationary boom-bust cycles seen in secular reversal in inflation vs deflation assets, commodities vs bonds, value vs growth, Saudi Arabia vs Chinese tech.

Taking a step back from his dismal view, Hartnett looks at the latest weekly flow data to see how much of his thesis is shared by the market. There he finds that a whopping $46.3BN went to cash – the largest inflow in 9 weeks- $1.9bn to gold, while $5.0BN was pulled from equities, the 1st outflow in 10 weeks, and $10.6BN from bonds.

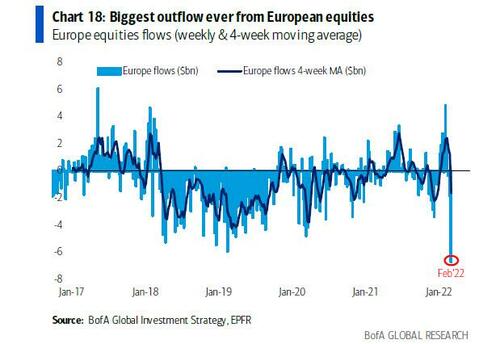

As Hartnett lays it out, the market is finally starting to sniff out the coming stagflation, as indicated by the record outflows from European equities, and the biggest inflows to energy and materials in years. Here is a breakdown:

- Biggest outflow ever from European equities ($6.7bn) as investors dump the one trade that everyone on wall street was consensus bullish on just one month ago.

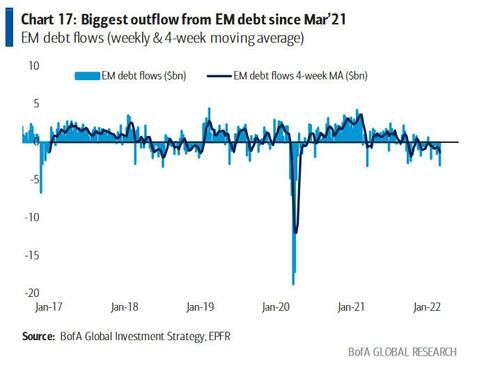

- Biggest outflow from EM debt since Mar’21 ($3.1bn),

- Largest outflow from MBS since Mar’20 ($1.6bn – front-running end of QE),

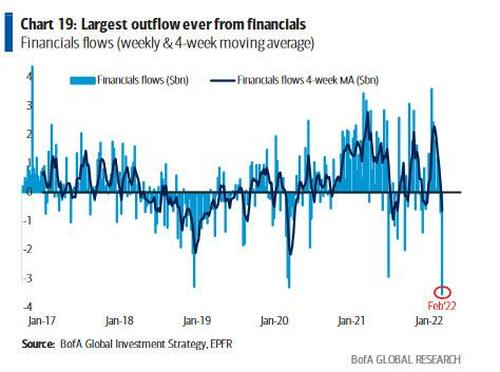

- Biggest outflow ever from financials ($3.5bn)

- Largest outflow from real estate since May’20 ($1.1bn)

- Largest inflow to energy since Mar’21 ($2.4bn),

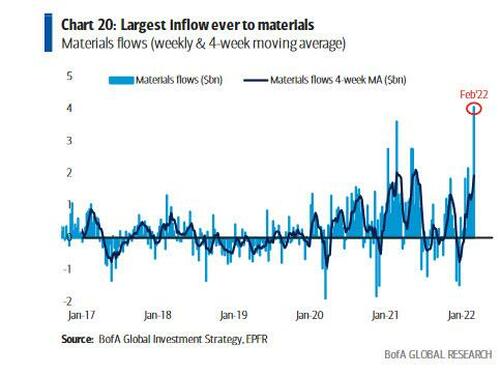

- Largest inflow ever to materials ($4.1bn).

And while we are seeing an early burst of selling, much more is coming, especially since BofA’s ultra high net worth private clients refuse to admit yet that a regime change has arrived. As Hartnett notes, private wealth clients have $3.2tn in AUM, of which 64.2% is in stocks, following 13th consecutive weeks of GWIM private client buying of stocks, as they keep hoping that this is the dip to buy.

It is this stubborn buying and re-buying into every dip that takes us to the next part of Hartnett’s observations, namely his views on the prevailing Zeitgeist: here is what Hartnett is hearing:”Fed will be dovish”, “there’s lots of liquidity”, “stocks oversold”, “tradable rally”, “buy mega-cap tech”, “no recession in US” – investors are recognizing exogenous shocks, but like before the COVID-crash positions rotating (e.g. EU to US, EM bonds to Treasuries, cyclicals to mega-tech) not de-grossing. Only once liquidity turns, will illiquid investors forced to sell what they love, what they own. That will happen in a few weeks, once the Fed actually does tighten, and then begins QT.

Needless to say, Hartnett – like Michael Wilson with whom he is competing for the title of biggest Wall Street bear – disagrees with such a cheerful take, and lays out what he is seeing instead: “sinister ongoing weakness in all lead indicators of the end- of-QE bear market past 12-months: EM debt, China credit, China tech, biotech, none can catch bid despite lower yields, indicates early liquidiation, anticipation of next geopolitical dislocation to financial, FX reserves.”

Meanwhile credit spreads are leaking wider, and volatility is gapping higher as conviction in the “longs of 2022” e.g. the banks vanishes (at intraday low this week JPM had given up almost entire gain of past two years).

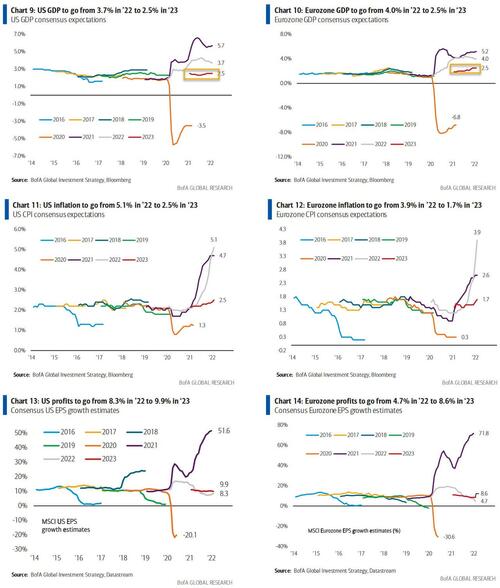

Where will investors see the coming recession next? In the collapse of consensus: As Hartnett notes, “next move in consensus GDP/EPS estimates to be lower; ’22 consensus estimates for GDP the US 3.7%, for EU 4.0%, estimates for EPS 8.3% in US, 4.7% in Europe (Charts 9-14).”

How to trade all of this, or “the Long & Short of It”: Hartnet believes cash, volatility, commodities, EM to outperform credit, stocks & private equity in 2022: “we are short tech, credit, private equity as era of excess QE over; we are long volatility, high quality, defensives on recession risk; we are long oil, energy, real assets on inflation; dislocation to financial plumbing delays entry to postponed reopening China/Asia/EM credit on (very) distressed yields.”

And while a recession – most likely in the second half – is now inevitable, that doesn’t mean an immediate collapse in risk, and here’s why according to Hartnett:

- markets are oversold,

- have discounted end of QE,

- partially discounted slowdown;

- EU stagflation looks highly likely;

- key fundamental that prevents >20% decline in S&P500 is US GDP/EPS estimates remain positive;

- but US consumer will pressure numbers lower

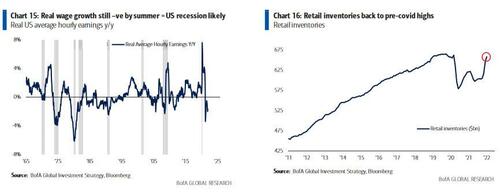

Meanwhile, the US economy is literally tearing itself in two, with US retail sales >24% still above pre-Covid levels, even as the savings rate is to 2019 levels, and real earnings are tumbling…

… as inflation soars. Getting to the punchline, Hartnett predicts that if US real wage growth still negative by summer US recession likely, and since it is impossible that wage growth will continue growing at the recent torrid pace especially after today’s unexpected flatlining in hourly earnings, one can be certain that a recession is now on deck.

To be sure, stocks won’t go straight down, and any news of a de-escalation in the Russia-Ukraine conflict will cause a big bear rally in risk assets but Hartnett says “sell-the-rip as Fed/ECB now hopelessly trapped between Wall St deflation & Main St inflation.”

As usual, the full Hartnett report is available to pro subscribers in the usual place.

Tyler Durden

Fri, 03/04/2022 – 16:42

via ZeroHedge News https://ift.tt/PUQSA9t Tyler Durden