The Geopolitcal Playbook Worked (Nearly) Perfectly

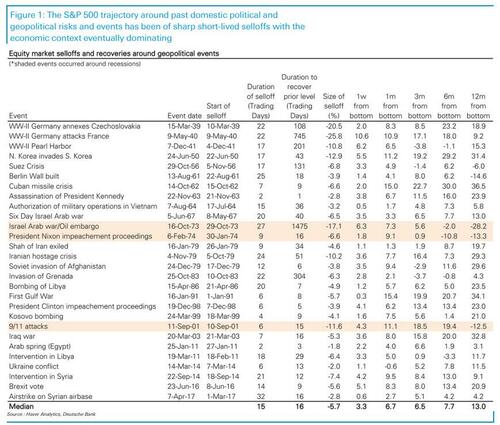

One month ago, Deutsche Bank’s Jim Reid published one of his trademark “Charts of the Day” which showed the historical playbook for how geopolitical events play out in markets, and which Reid says that in retrospect, he “might have retracted” if he could, as he had the lowest confidence in one or two weeks after publishing.

But as it turned out, that playbook worked remarkably well with the S&P 500 now back above levels from the point where the US warned of an imminent Russian invasion of Ukraine late on Friday 11th February.

This marked the start of the escalations and a geopolitical-induced market sell-off.

Basically, as Reid summarizes, the duration and the scale of this sell-off has been almost identical to the median seen through history when we’ve experienced geopolitical or domestic US political events.

And, in keeping with the market’s BTFD Pavlovian response, the bounce back has actually been a few days quicker than normal: while it normally takes three weeks to hit a bottom and 3 weeks to fully recover, this event took around 3 weeks and just over 2 weeks respectively to do the same.

In conclusion, Reid also reminds readers that as he previously showed, what happens after the recovery was complete then “mostly depends on what conditions were like going into the crisis.” Geopolitical events have rarely left a deep scar on markets but even before events escalated around Ukraine, markets were trying to come to terms with inflation and rate hikes. That will continue to be the dominant theme for markets in H1 and beyond.

Tyler Durden

Sat, 03/26/2022 – 11:00

via ZeroHedge News https://ift.tt/Ntg6oDn Tyler Durden