Death Of Denial: Part 1 (With Apologies To Agatha Christie)

By Russell Clark of Capital Flows and Asset Markets Substack

One of the reasons I left the money management game was that many of the theories that I had used to manage money stopped working. Some of them were original, some I taken from others, and some I had modified. I knew I need to take time off and have a think. I also knew that I needed to read different books to get my mind thinking differently. As it happens, I have just finished reading Agatha Christies “Death on the Nile” (excellent book), and I particularly enjoyed how he looked at all the clues, organized them, and then slowly but surely eliminate suspects until only the murderer, however unlikely, was left.

For me, recent market action has eliminated the final suspect for what has caused the extremely long lived bull market in US equities. I had speculated that robustness of the US stock market was a feature of extremely loose credit conditions. These loose credit conditions were only possible due to a long drawn out commodity bear market, and hence if we had a spike in commodity prices which led to rising bond yields, then were likely to see a much weaker equity market.

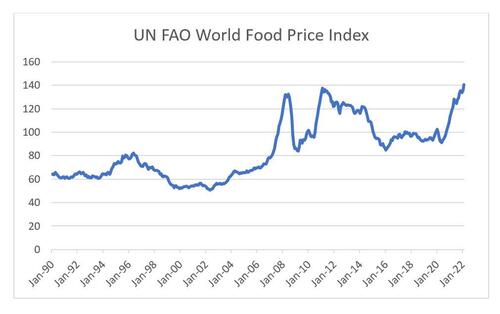

Commodity prices, and particularly food prices have spiked. Food prices had spiked in 1996 before the Asian Financial Crisis, again in 2007 before the GFC and in 2011 during the Eurocrisis. My working assumption was that another spike would also signal problems. But with the exception of Chinese equities, major equity market returns over last 12 months have been robust. MSCI World is barely 5% from highs. I have used food, but energy price spikes have also led to weaker equity markets historically too.

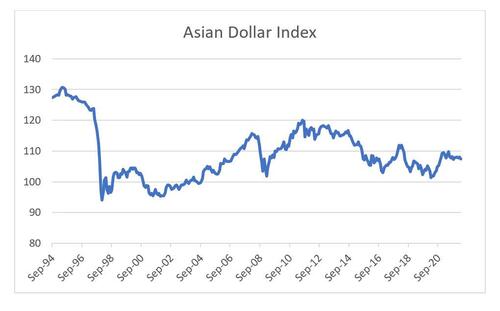

I have also learnt to be cautious on equities when the Asian Dollar Index is going sideways or falling. Even after the Asian Financial Crisis, Asian currencies strengthened during the dot com bubble. Since a beak in 2010, they have been generally poor, even as U S equities have powered on.

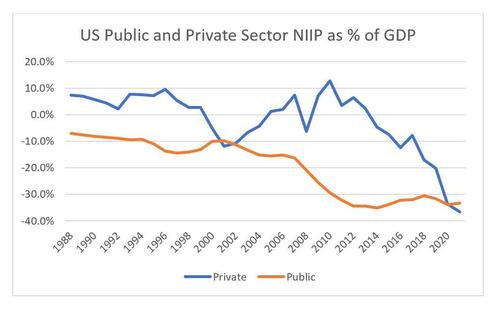

I have also used net international investment position data to inform whether to be bearish on a currency or equity market. This worked well on pointing out danger in the dot-com bubble, and the top in the US dollar in the early 2000s. It also worked well for the Japanese bubble economy, the Asian Financial Crisis and the Eurocrisis. But this model has had me bearish on the US dollar and US equities since 2016, so very wrong indeed (see Spotting Property Bubbles in East Asia in my Archive for more details).

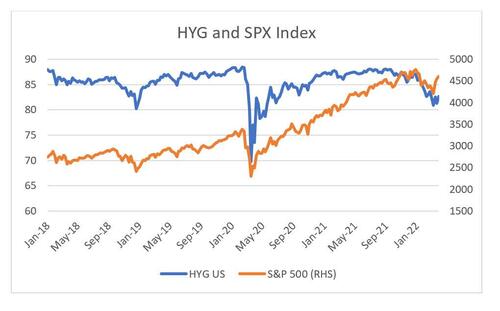

On a much shorter term basis, the S&P 500 has seemingly broken out of its relationship with HYG US (High Yield ETF). A similar chart can be drawn using mortgage rates, which have spiked. I would include – but Substack says I am at the limit already in this post!

I realized that I needed to look at all this clues again, and have a think about why they worked before, but did not work this time. And, by eliminating suspects, and having a long think, I think I have the answer. The murderer of all possible bear markets in the US dollar and US equity is….. (to be continued).

Tyler Durden

Thu, 03/31/2022 – 19:40

via ZeroHedge News https://ift.tt/uBKdDQ5 Tyler Durden