Mixed 3Y Auction Prices At Highest Yield Since 2018, Nearly 1% Higher In One Month

We start the holiday-shortened week with a $46BN auction of 3Y paper, which as one would expected, came in mixed at a time when treasury yields are exploding higher virtually every day.

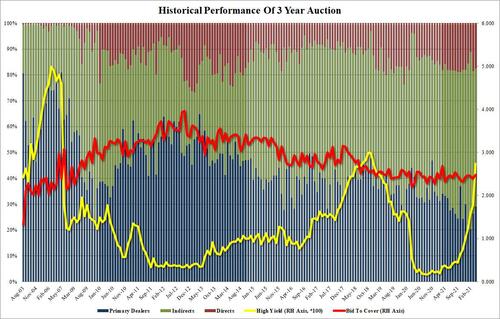

The high yield of 2.738% – the highest since Dec 2018 – was almost 100bps higher than the 1.775% yield printed during last month’s 3Y auction and also stopped through the When Issued 2.729% by 0.1bps.

Surging yield aside, other aspects of the auction came in both hot and cold: on the former, the bid to cover of 2.482 was solid, and above last month’s 2.389 and was the highest since last August (and thus clearly well above the six-auction average).

The internals however were less impressive, with Indirects taking down 53.4%, the lowest since December and below the six-auction average of 56.6. And with Directs dropping modestly from 18.6% to 17.6%, if just above the six-auction average of 16.7, Dealers were left holding 29.0%, or the most since December.

Overall, a non-tailing if mediocre auction, yet despite the blow out in 3Y yields in recent days, the 3s10s has steepened aggressively in the past 24 hours. We doubt this will stick too long, however, as more and more realize that the coming recession will inevitably lead to negative rates.

Tyler Durden

Mon, 04/11/2022 – 13:16

via ZeroHedge News https://ift.tt/u9tVK7y Tyler Durden