“Stay Defensive” – Morgan Stanley’s Mike Wilson Warns Of “Extreme Divergence” Between Stocks & Bonds

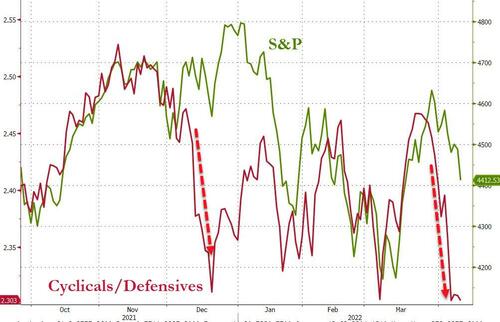

Echoing December’s trading environment (index strength as defensives outperform cyclicals) before January’s index plunge, the last month has seen US equity indices soar (amid an avalanche of hedge unwinds into options expiration) while Defensives drastically outperform Cyclicals as long-duration ‘growthy’ stocks are monkeyhammered by soaring rate expectations (both short- and long-end)…

We are not the only ones to notice this divergence, and a few others, that suggest the equity index, equity internals, and bond/rate markets are definitely not all singing from the same hymn-sheet (nor from The Fed’s hope-fueled expectations).

As Wall Street’s bearish-est bear points out in a note this week, bond markets and the S&P 500 index are too sanguine about the economic outlook.

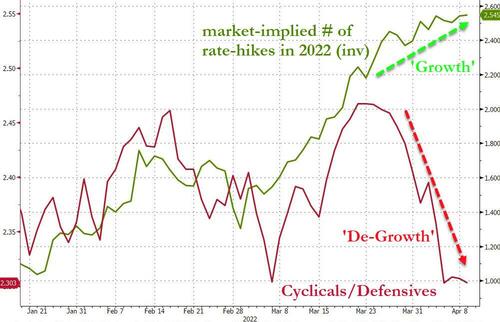

“We have another example of extreme divergence between the internals of the stock market which are strongly indicating a growth scare, while bonds and the S&P 500 are suggesting growth is not only ok, but likely to remain robust in the case of bonds,” Michael Wilson and his team wrote in a note to clients on Monday.

Having spent months reassuring investors that the inflation explosion was ‘transitory’ The Fed finally ‘fessed up as CPI hot 5% and Fed Funds were still at 0!

Indeed, many bearish bond bets got run over last fall by a bond market that remained extremely resilient in the face of what was clearly a Fed that was behind the curve of inflation that was unlikely to be transitory. These mis-priced yields helped the S&P remain resilient which also ignored the growing risk of a more hawkish Fed in the fourth quarter of2021.

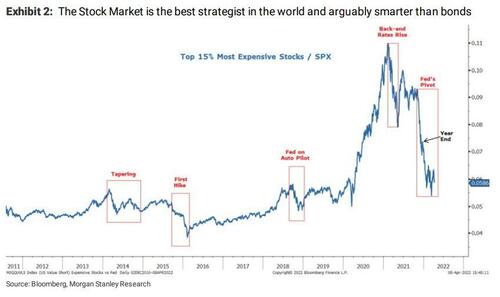

However, Wilson notes that under the surface, as we detailed above, stocks started to figure it out in November (cylicals/defensives diverged from the indices and bonds). This was when expensive stocks began their worst 4 month period of performance in history outside of recessions…

And now, defensive stocks, and in particular the utilities sector, are having one of their best absolute and relative periods of performance on record..

On that score, the internals of the stock market are once again diverging from the message from the bond market. More specifically, back-end rates have had one of it’s largest 1 month moves in history as Fed-Funds futures catch up to reality.

To be clear, Wilson doesn’t have a problem with this move higher in rates – given the state of inflation and The Fed’s persistent attempt to convince the world they are going to do whatever it takes to quash it – but, Morgan Stanley’s chief U.S. equity strategist questions the bond market’s apparent view that The Fed can do this much tightening without impacting the economy in such a way that this path for rate-hikes will be challenging to complete.

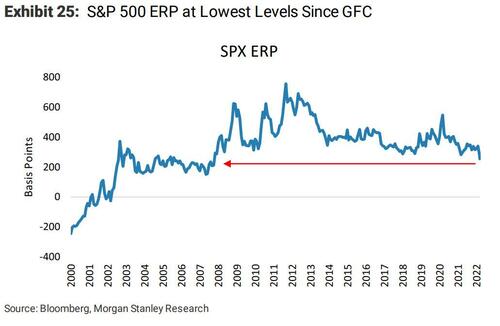

Meanwhile, the internals of the equity market are telling a much different story than bonds or the headline S&P 500 index which continues to trade at valuations we find hard to justify.

Equity risk premiums are historically tight and are at the lowest levels since the GFC for the S&P 500…

As Mike Wilson has noted numerous times in recent weeks, the risk/reward here is poor given the myriad of risks confronting the market.

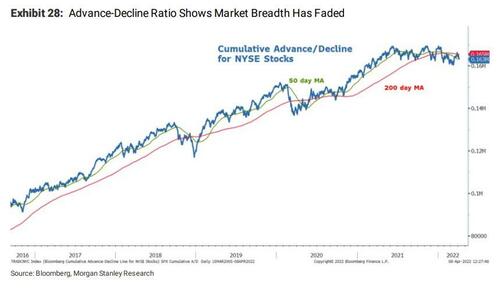

Additionally, the advance-decline ratio shows a distinct pause in market breadth from mid-2021 and has faded in 1Q22.

This marks a clear change in trend from an early/mid cycle environment to a mid/late cycle backdrop.

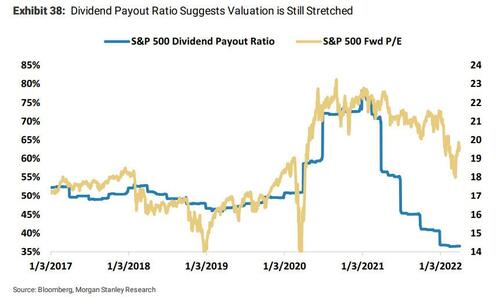

Finally, Wilson and his team see current index valuations as still vulnerable to an earnings slowdown and think P/Es should be lower here.

As the chart above shows, dividends have scaled with current market valuations, which Wilson suggests is because many management teams know that current earnings are extremely strong and perhaps unsustainable.

This deviation – between ‘growth-scare-implying’-internals of the equity market and the bond and equity index markets’ apparent belief in miracles – will prove unsustainable, and cyclical stocks are the most vulnerable when it eventually resolves.

“This divergence between the internals of the stock market and bonds/SPX is unsustainable and we know which one we’re betting with… the best strategist on the street – i.e. stocks.”

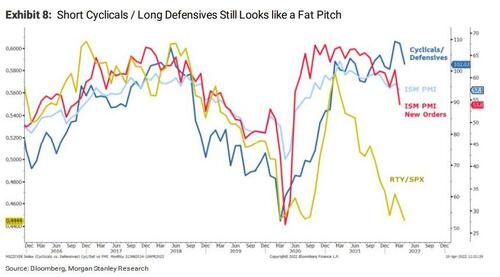

Wilson and his team continue to recommend defensives even though they have already had a great run of performance, and suggests the best expression of this view is the relative trade of defensives versus cyclicals which appears to still have a long way to go if they are right to be worried about growth.

The recent acceleration here is encouraging in that regard as the cyclicals finally start to give it up. It’s also another warning sign that 10 year Treasury yields are potentially in overshoot mode and looking toppy.

Wilson leaves investors with a simple message: Stay Defensively oriented because growth is going to disappoint.

Tyler Durden

Tue, 04/12/2022 – 11:45

via ZeroHedge News https://ift.tt/24fGI80 Tyler Durden