Rabobank: Global Recession?

By Jane Foley, head of FX strategy at Rabobank

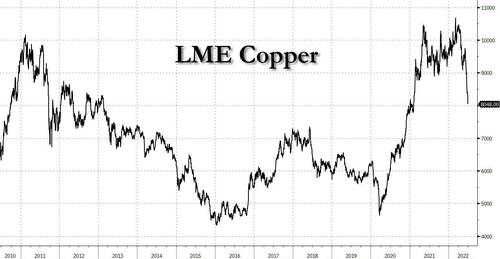

Copper prices plunged to a 17 month low on Friday, demonstrating the rise of recession fears.

The metal, used in electrical circuits in everything from construction, cars and appliances is often traded as a bellwether for growth. Copper is currently trading just above USD8,000 a tonne on the LME. This compares with the year’s high around USD10,600 a tonne. In a quiet Asian session ahead of the UK July 4 holiday, Asian shares crept a little higher this morning and US equities futures gained a little ground. However, this is small comfort given the horrific ride for stocks in the first half of the year.

Friday’s releases of US May construction spending and June ISM manufacturing surveys both missed the mark and accentuated fears of a hard-landing. The latter follows declines in the Chicago PMI, the Richmond Fed, Dallas Fed and Philly Fed. Even ahead of Friday’s data releases estimates of Q2 US GDP growth were already being revised down, with some market estimates even pointing to the risk of technical recession in the US in H1 given the negative print for Q1 US GDP.

As fears of a slowdown tightened their grip, treasury yields dropped with the short-end of the curve leading the way as market priced in a less aggressive trajectory for Fed rate hikes.

In Germany, Bloomberg data indicate that 2 year Bund yields registered their biggest weekly swing on record, in data dating back to 1990. On Friday alone yields dropped as much as 24 bps. A similar move was recorded by 2 year gilts as the market second guessed its assumption that the BoE could hike aggressively in the months ahead in the face of a painful cost of living crisis.

The turmoil in the bond markets also played out in foreign exchange. EUR/USD plunged to 1.0366 on Friday afternoon before finding a little composure. Cable slipped all the way to 1.1976 before finding buyers. Friday’s final June UK manufacturing PMI release recorded a weaker than expected outcome. At 52.8, this was the lowest reading for the index since June 2020. Of particular concern is the drop in the new orders index to 48.3, a level suggestive of contraction.

Despite the recession fears, most stocks US and European stocks indices closed the session in the green. That said higher interest rates, and fears of falling demand clearly point to a rocky road for equity indices. The forthcoming round of earnings report could be a difficult read for many investors. While most commodity prices have dropped back sharply from their highs on the back of recessionary fears, energy security issues remain a huge concern in Europe.

European natural gas prices are on the rise again this morning with around 13% of Norway’s daily gas exports reportedly at risks due to strike action. Over the weekend, the head of Germany’s energy regulator urged residents to conserve energy and to prepare for winter while Chancellor Scholz indicated that the government may be ready to support Uniper, the biggest buyer of Russian gas in Germany. A week ago Germany’s Economy minister Habeck warned of gas shortages and production suspensions for industry on the back of energy security risks. Clearly this has fed recessionary fears in the Eurozone.

Russia has now claimed full control of the Luhansk region after seizing the last Ukrainian stronghold. Putin’s advisor Peskov has stated that Ukraine would have to agree to all of Russia’s conditions for the war to end. The focus of the conflict now shifts to the neighbouring Donetsk region, where Kyiv maintains control of large territories.

Tyler Durden

Mon, 07/04/2022 – 10:50

via ZeroHedge News https://ift.tt/u3OTNMp Tyler Durden