2s5s Inverts For First Time Since COVID Lockdowns As Fed-Rate-Trajectory Tumbles

With the US away yesterday, the rest of the world decided it was time to buy stocks and sell bonds. But now that Uncle Sam is back – all of that is reversed…

US Treasuries are bid – aggressively – with 10Y Yields down 14bps from overnight highs but the belly is outperforming overall…

And that has inverted the 2s5s spread for the first time since Feb 2020…

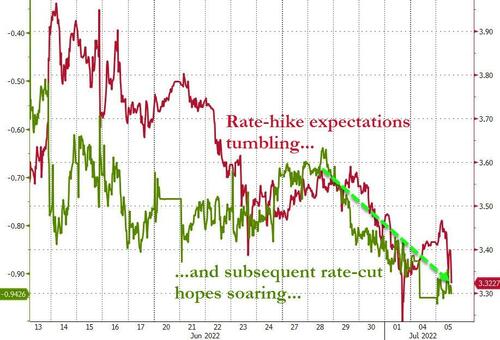

All of which is driving market expectations for The Fed’s rate-trajectory significantly lower (dovish) as rate-hike expectations have plunged and subsequent rate-cut expectations are notably higher (almost 4 x 25bps cuts now priced-in)…

And it appears that recession fears are trumping post-recession-easing hopes as US equity futures tumble from yesterday’s highs…

And for now The Fed refuses to back away from the ‘strong economy can take it’ narrative…

Tyler Durden

Tue, 07/05/2022 – 08:49

via ZeroHedge News https://ift.tt/98edNkA Tyler Durden